Dogecoin miners ease selling pressure – What this means for DOGE

- Dogecoin miners holding their coins for extended periods.

- DOGE looks primed for long-term gains.

Dogecoin [DOGE] continues to show strength, much like other cryptocurrencies, as traders anticipate the historic bullish Q4 since the integration of blockchain technology into the financial markets.

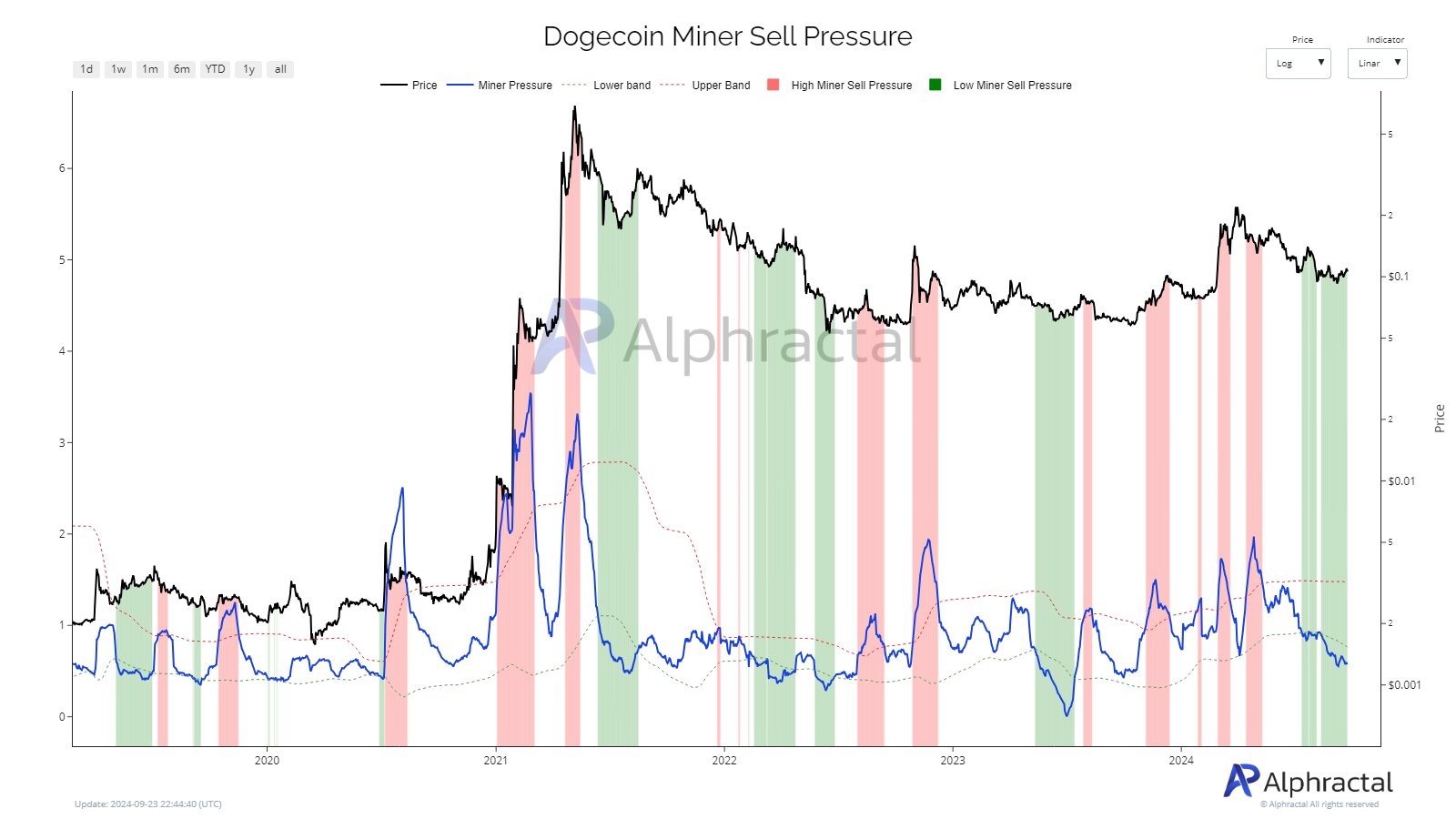

Dogecoin miners, in particular, seem to be playing the market intelligently, taking advantage of price spikes to sell their mined coins.

Sell signals have been slow to emerge, indicating that miners are holding onto their DOGE for extended periods before selling.

This low selling pressure hints that a price spike may be on the horizon, as historical trends suggest that such calm periods often precede a significant rise in DOGE price.

Could DOGE be gearing up for a price spike?

Dogecoin’s long-term outlook

A closer look at Dogecoin’s weekly chart shows it may enter a growth phase. This phase historically recurs in each crypto cycle. It typically lasts around 90 days and could see DOGE reaching significant new highs.

The chart indicates three consecutive weeks of green candles, supporting the idea of DOGE price growth. If this trend continues, a conservative estimate suggests DOGE could reach $0.15 by the end of 2024.

In a more optimistic scenario, if history repeats, DOGE might reach $0.5 by March 2025. It could even hit $0.75 by the end of that year.

For long-term holders, this may be a favorable entry point, as DOGE price is currently resting above a strong support level on higher timeframes.

This upward-trending support further reinforces the idea that the low selling pressure from Dogecoin miners could be the calm before the storm, indicating that a price spike may be imminent.

Balance by holdings looking good for whales

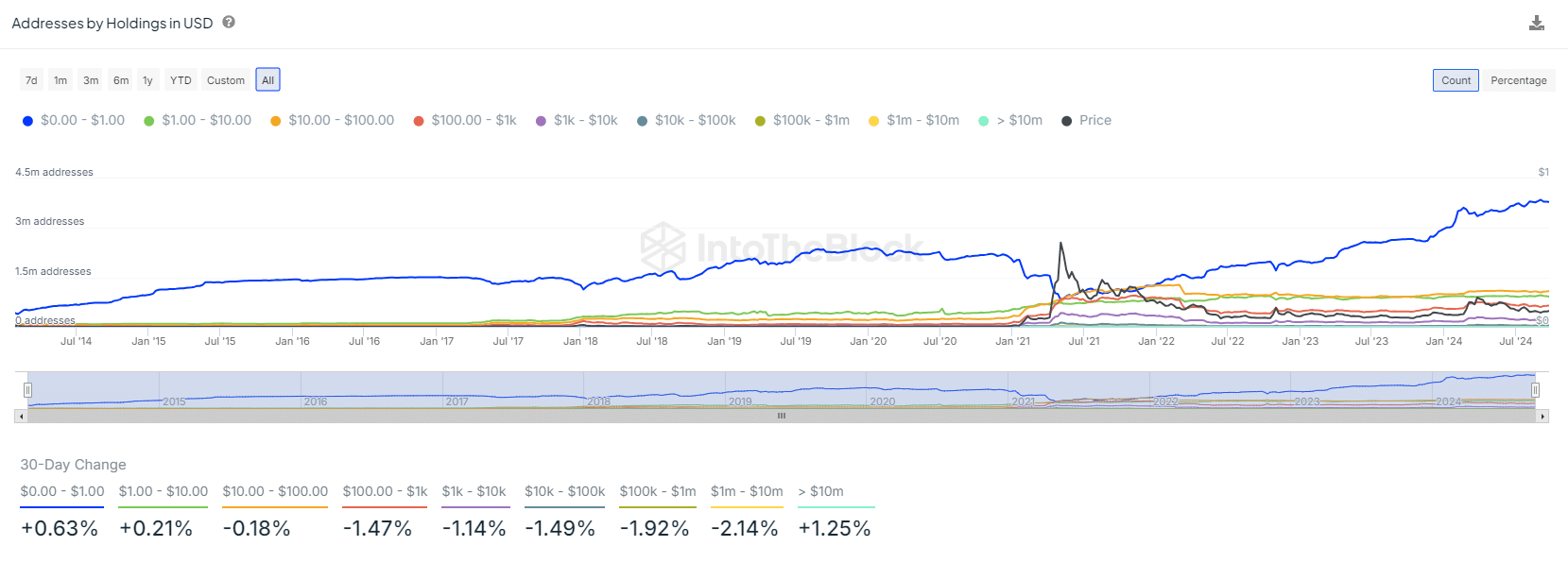

Dogecoin whales, holding over $10 million in DOGE, have increased their holdings by 1.25%. This rise in whale activity strengthens the bullish outlook for Dogecoin.

It suggests significant players are preparing for a potential price surge.

Although other categories of DOGE holders have experienced slight declines, this impact is minimal. Whales constitute the majority of the circulating DOGE, reducing the overall market weight of these declines.

However, traders should still approach DOGE cautiously, ensuring they have a clear strategy in mind before jumping into trades.

Key liquidation levels and price targets

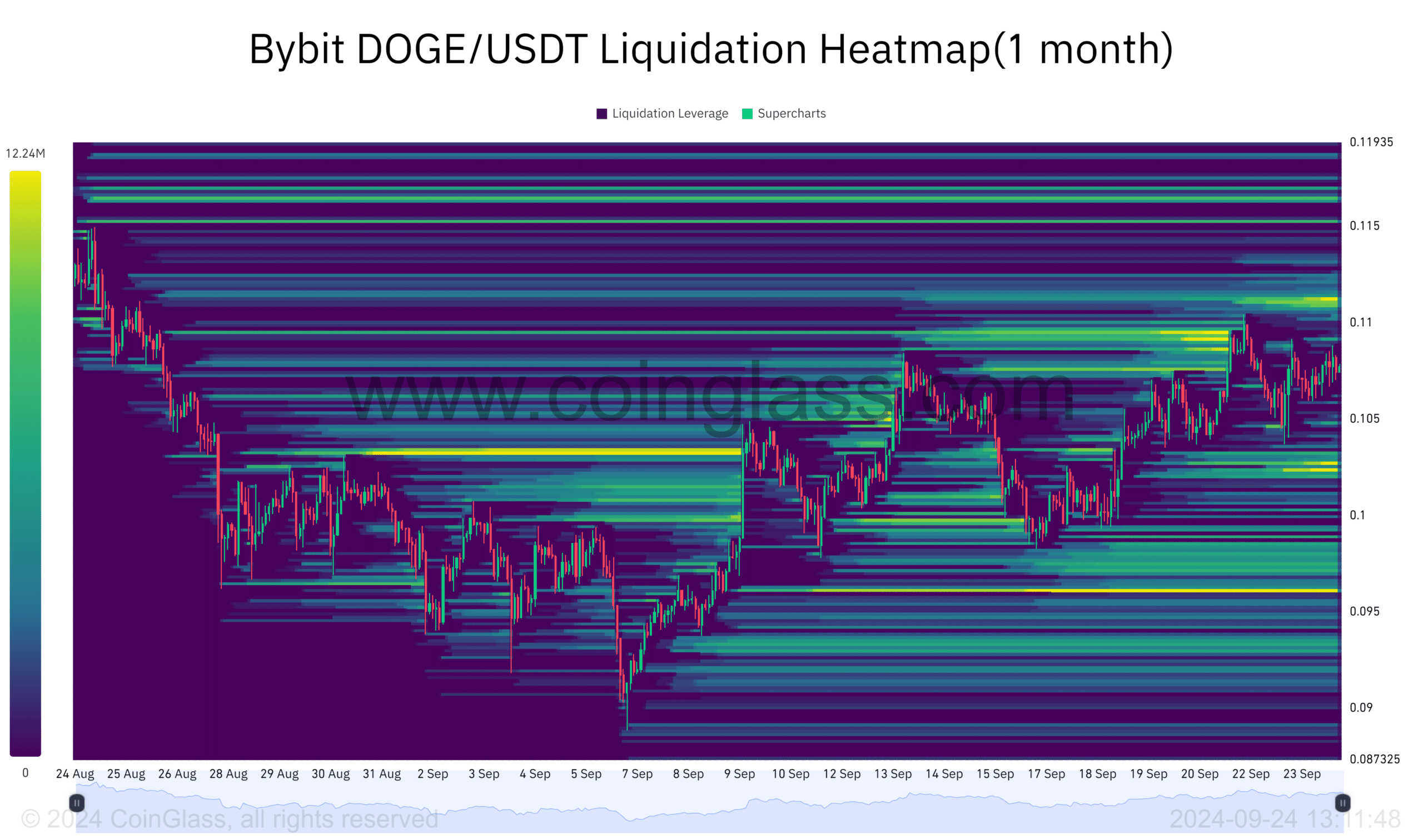

Another factor to fuel DOGE’s upward movement is the significant concentration of liquidation levels above the $0.11 mark.

Some whales have placed around 30.93B DOGE in short positions in this zone, as an earlier AMBCrypto analysis stated.

The easier these liquidation levels are breached, the higher DOGE price could climb as more short positions get liquidated.

As DOGE approaches these levels, traders may see increased volatility, but if DOGE can break through, it could trigger a sharp move higher.

Read Dogecoin’s [DOGE] Price Prediction 2024–2025

Dogecoin’s price looks set to rise as selling pressure remains low and whales continue to accumulate DOGE.

With proper timing and strategy, DOGE may be on the verge of a new price spike, driven by increasing whale activity and favorable market conditions.