Dogecoin mirrors Bitcoin: This high correlation means DOGE will now…

- Dogecoin is the altcoin with the highest correlation with Bitcoin in the last 30 days.

- DOGE found its bottom around its 2023 highs but there is potential to reach 2021 highs.

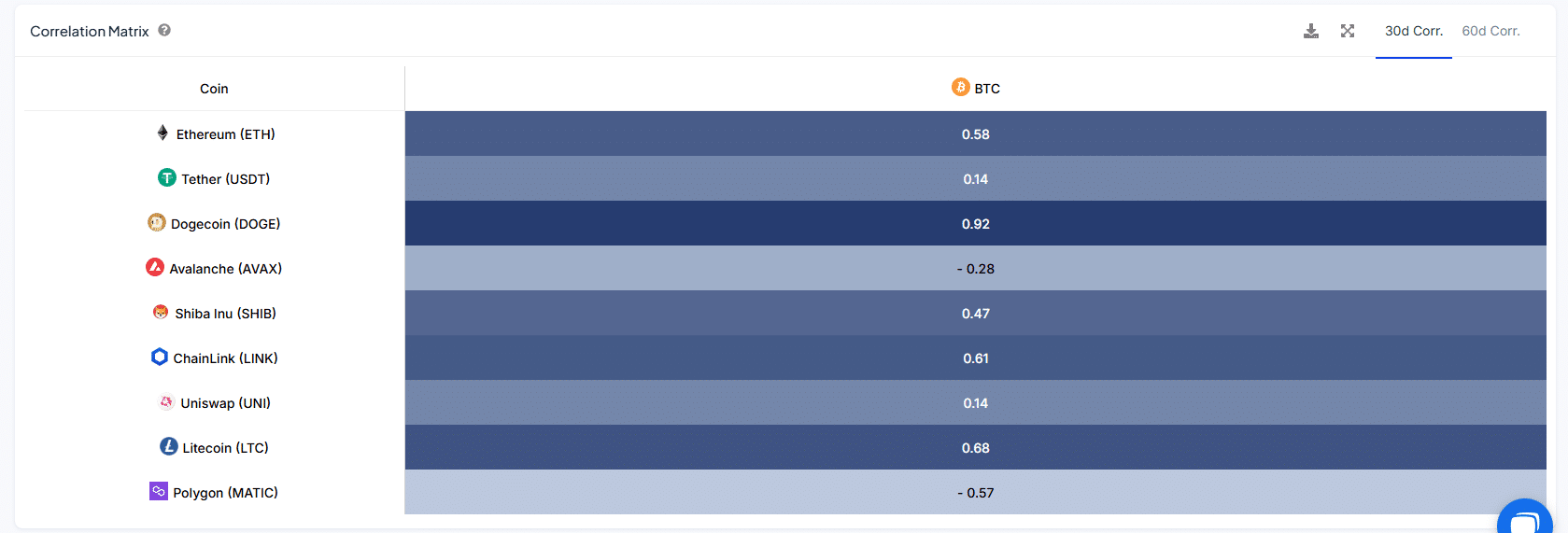

Dogecoin [DOGE] maintained a significantly high correlation with Bitcoin [BTC] at 0.92, indicating that movements in its price often mirrored those in BTC as the correlation matrix from IntoTheBlock highlighted.

The relationship suggested that as the price of Bitcoin increased, DOGE typically followed suit, something traders don’t want to see continue if BTC turns bearish.

Analyst Cryptollica noted on a recent broadcast that Dogecoin has been notably effective in drawing new investors into the cryptocurrency market.

This attraction was supported by on-chain data, which showed a growing interest from retail investors.

Despite varied opinions about Dogecoin’s influence, it undeniably played a positive role in the broader crypto adoption, likely contributing to its upward movement when Bitcoin rallied.

Dogecoin price prediction

DOGE/USDT on the weekly time frame chart revealed that it found its bottom around its 2023 highs, signaling the end of its previous bull run.

The positioning suggested a significant recovery, as DOGE showed signs of retracing towards its peak levels of 2021.

With the recent upward trend, Dogecoin mirrored a similar pattern observed in early bull runs, indicating that it might just be initiating a new memecoin supercycle as we head into 2025.

The current price movement positioned above significant Fibonacci retracement levels from the previous highs implies that Dogecoin could see considerable gains.

If this momentum sustains, Dogecoin could potentially revisit its all-time highs, leading the memecoin rally.

Impact of BTC.D peaking on DOGE

Further analyzing Dogecoin’s next move in the context of its correlation with Bitcoin and the broader crypto market dynamics, DOGE has shown resilience by establishing a base around its 2023 highs.

Despite Bitcoin’s dominance reaching 60%, and subsequent fluctuations following the Federal Reserve’s rate cuts, Dogecoin did not mirror Bitcoin’s new highs in 2024.

However, historical patterns suggested an upcoming memecoin season in 2025, potentially propelling Dogecoin to new heights.

Is your portfolio green? Check out the Dogecoin Profit Calculator

After the recent rate cuts, Bitcoin’s dominance briefly declined, which historically benefits altcoin-to-Bitcoin pairs. If this pattern holds, Dogecoin might rally as the market adjusts to these macroeconomic shifts.

As the year ends and quantitative tightening possibly concludes, DOGE could capitalize on market liquidity and investor sentiment. It might robustly revisit its 2021 highs and participate in the next memecoin cycle.

![Ethereum [ETH] targets $1,810 – Will THIS crucial level ignite a breakout?](https://ambcrypto.com/wp-content/uploads/2025/04/Gladys-59-400x240.jpg)