Dogecoin prepares for lift-off: Historical patterns hint at a 12,000% rally

- Dogecoin address activity surged 111%, signaling strong interest ahead of a potentially massive rally.

- Historical patterns suggested that Dogecoin could see a 12,000% rally as whales ramp up transactions.

Dogecoin [DOGE] has shown a recurring trend of sharp price increases followed by corrections. In 2017, DOGE climbed 212%, retraced 40%, and then gained 5,000%. Similarly, in 2021, it rose 476%, corrected by 56%, and later surged 12,000%.

In 2024, Dogecoin followed a comparable trajectory, increasing by 440% from $0.065 to $0.39547 before retracing 46%.

According to crypto analyst Ali, this pattern suggests the potential for another significant rally if the trend continues as it has in previous cycles.

Current price action and critical levels

Dogecoin was trading at $0.3167, at press time, reflecting a 1.43% decline over the last 24 hours and a 21.23% drop in the past week. The cryptocurrency has a market capitalization of $46.66 billion and a 24-hour trading volume of $4.37 billion.

Price data shows DOGE holding within its long-term logarithmic price channel. Support levels are identified at $0.065 and $0.19-$0.20, while resistance is at $0.39547 and $0.73665, the record high set in 2021.

Analysts project a potential upper boundary of $17.94 if Dogecoin maintains its historical upward trend within this channel.

On-chain activity shows increased interest

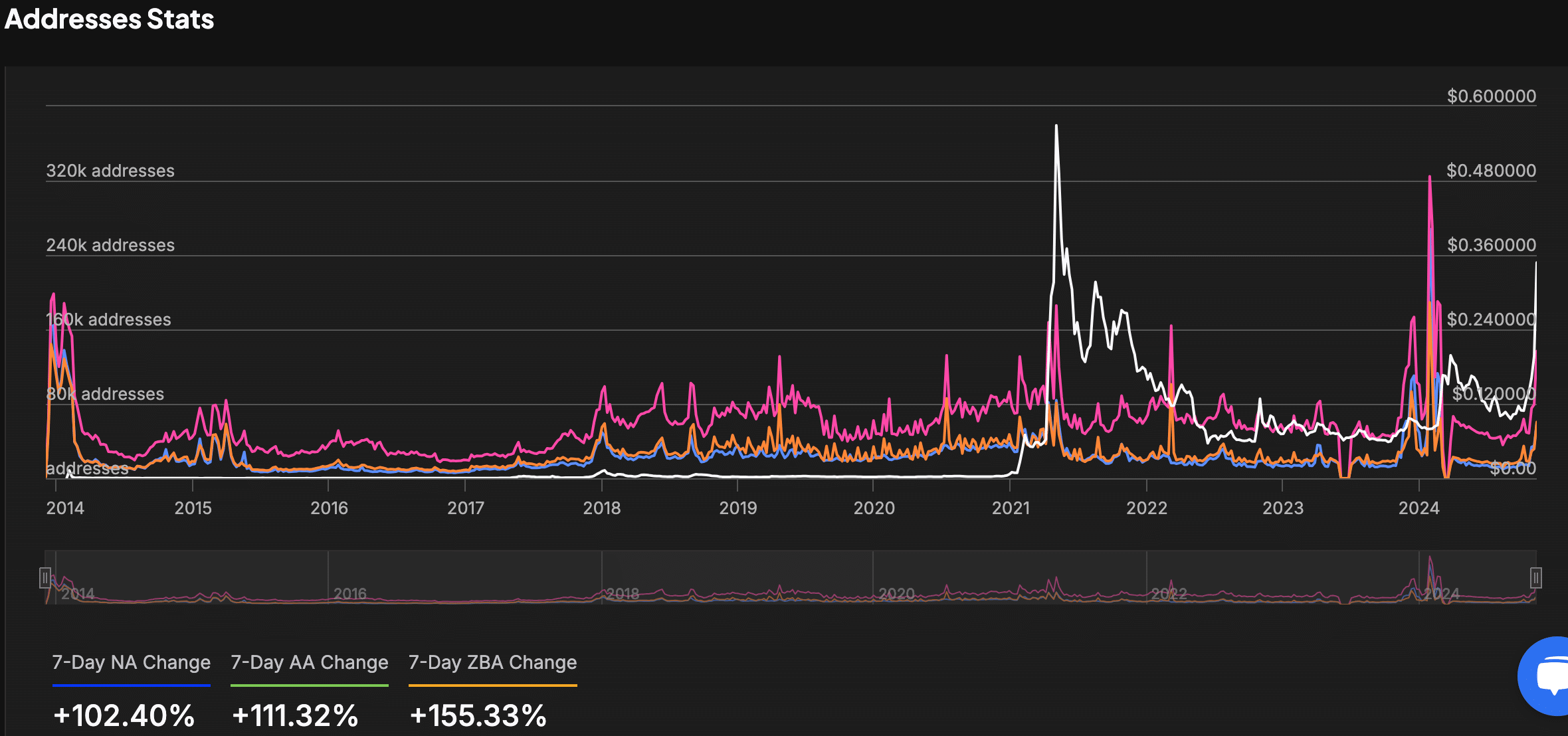

Data from IntoTheBlock indicates a rise in network activity. As of the 11th of November, active addresses totaled 136,850, with 58,990 new addresses created.

Over the past week, new addresses rose by 102.40%, active addresses by 111.32%, and zero-balance addresses increased by 155.33%.

The growth in address activity coincided with Dogecoin’s recent price move to $0.40. The increased participation suggests a resurgence in interest from both retail and institutional investors.

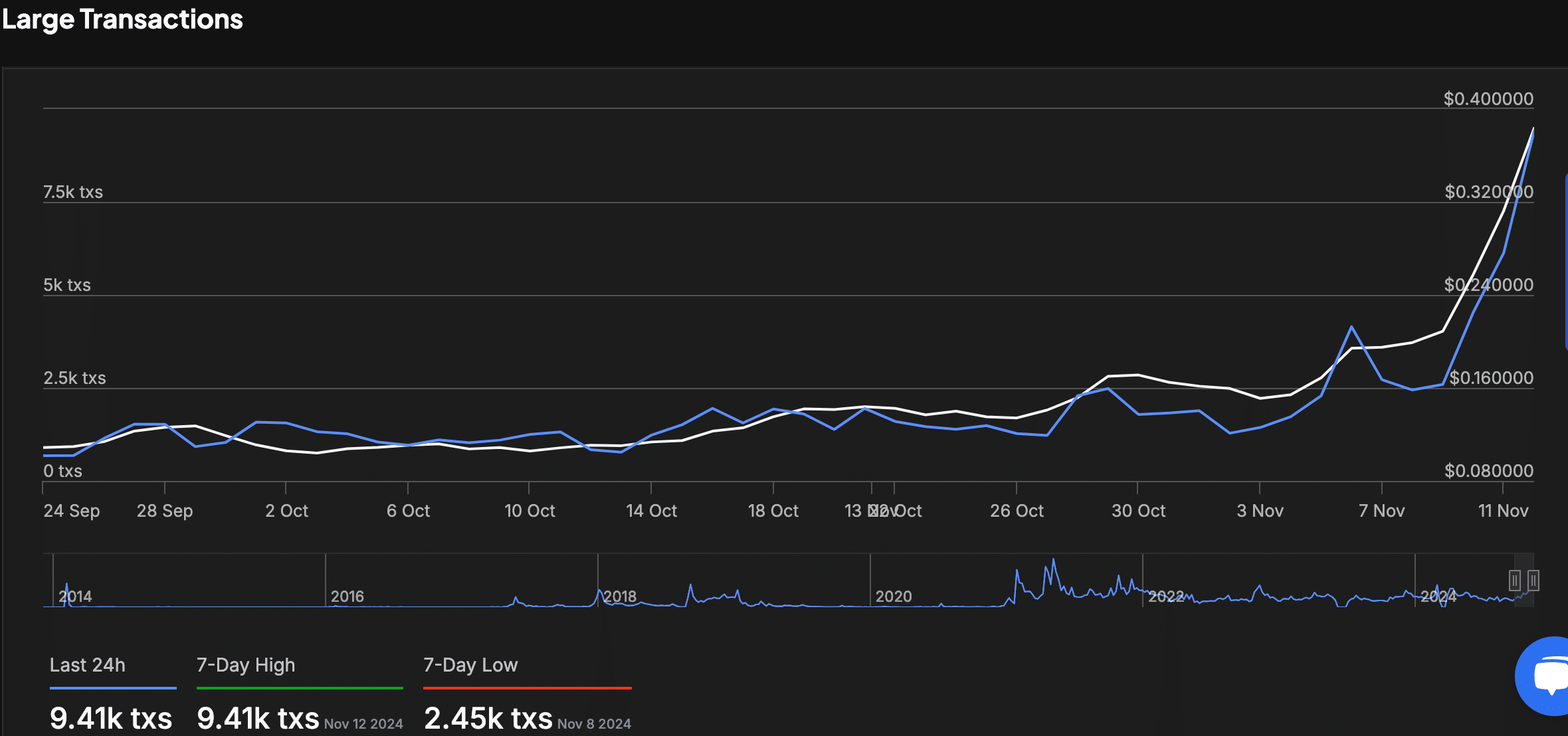

Large transactions involving Dogecoin have also seen an uptick. Over the past week, whale transactions peaked at 9,410, aligning with the recent price surge.

This marks a sharp increase from the weekly low of 2,450 transactions observed on the 8th of November.

Market data from Coinglass shows trading volume down by 24.83% to $7.42 billion, while Open Interest(OI) in Futures contracts declined by 4.71% to $1.95 billion.

Read Dogecoin [DOGE] Price Prediction 2024-2025

Options trading volumes dropped 58.52% to $427.08 million, with OI in options contracts at $1.18 million.

With historical trends, increasing address activity, and large transactions aligning, the data suggests that Dogecoin may be positioning itself for another significant price movement.