Dogecoin price prediction – Here’s how long the $0.12 support will hold on

- DOGE’s pullback hit the $0.12 support level after losing 47% of its value.

- Weak derivatives market and on-chain readings could complicate matters for bulls

Dogecoin’s [DOGE] price has hit a key support level after shedding over 47% of its value in its most recent pullback. The memecoin dropped from its peak Q1 levels of $0.22, but the plunge eased near the $0.12 support level.

Since March, the $0.12-support has been a key rebound for bulls. Will it hold again for a bullish reversal?

Dogecoin price prediction: Can $0.12 stop the dump?

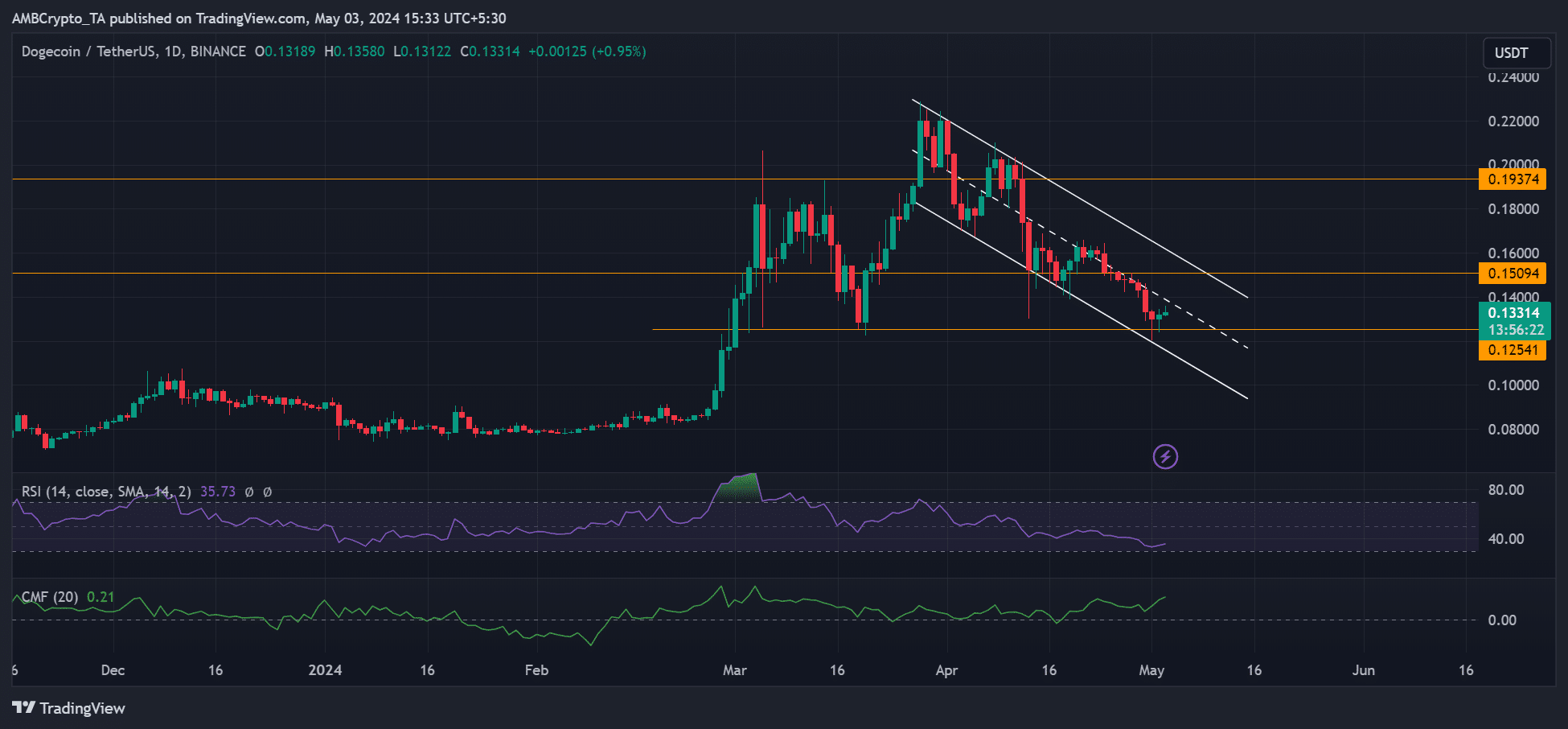

The daily chart flashed weak bullish reversal signs based on the RSI (Relative Strength Index) and Chaikin Money Flow (CMF). Notably, the CMF has remained above average since mid-February and edged higher at press time. This underscored increasing capital inflows into DOGE markets.

Additionally, the RSI chalked a U-turn in the lower end, denoting a dampening sell pressure. However, the price faced resistance at the mid-level of the descending channel (white) and $0.15.

So, bulls must push above $0.16 to gain market leverage before attempting to reverse the rest of its previous losses. In fact, according to crypto-analyst Ali Martinez, DOGE’s 47% pullback could position it for a mega bull run based on historical price patterns.

However, a crack below the multi-month $0.12 support could complicate matters for DOGE bulls.

DOGE volume compressed as sentiment weakens

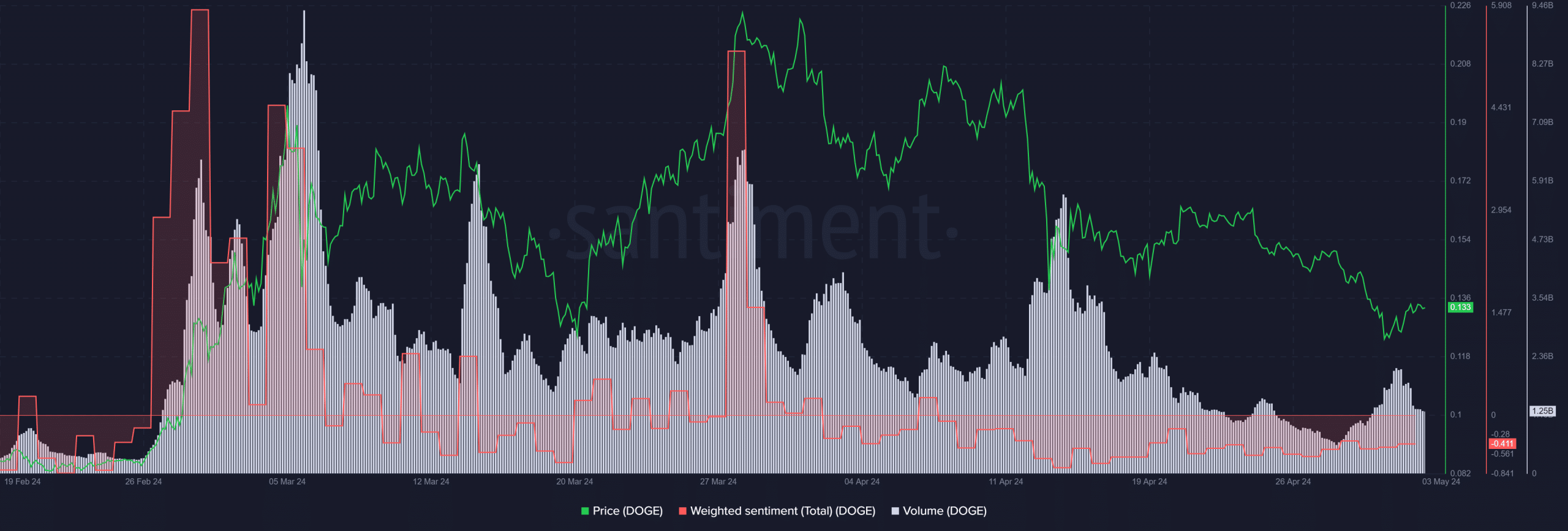

Despite the remarkable defense of the $0.12-support at the time of writing, market participants seemed overwhelmingly negative on the memecoin. As shown by Santiment’s data, DOGE’s negative sentiment in April has extended into May now.

Additionally, DOGE’s trading volume has remained compressed, which has added to the sell pressure seen over the past few days.

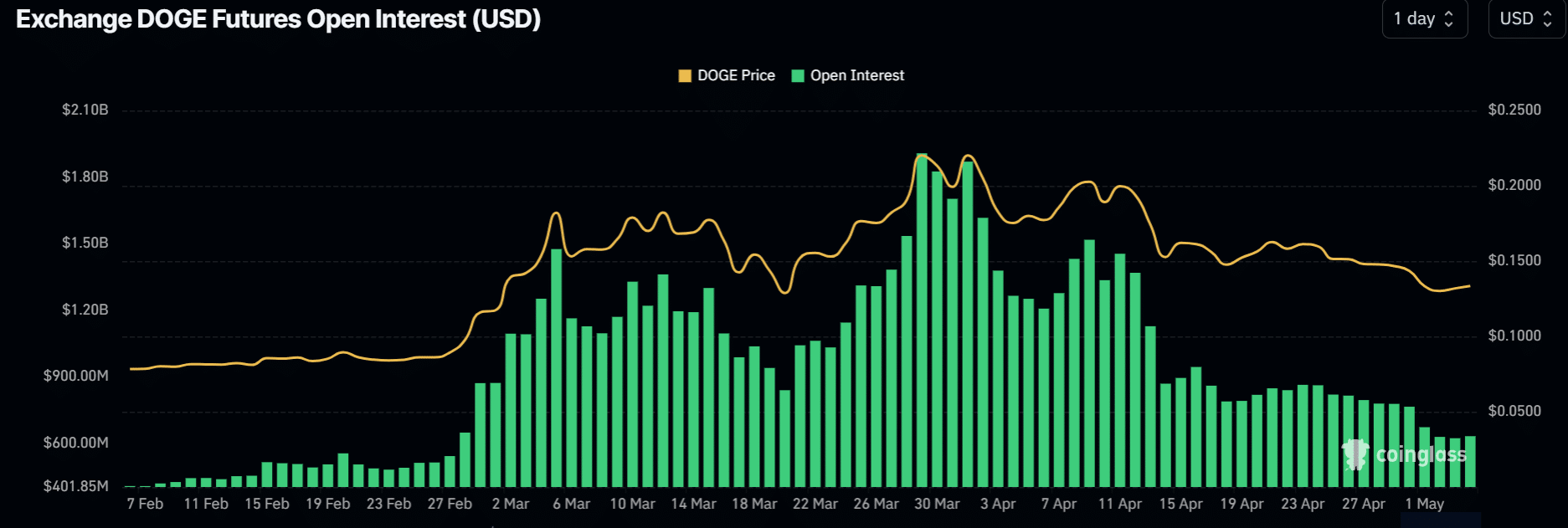

These bearish readings are not exclusive to on-chain metrics alone, however. Futures market data revealed that DOGE markets had weakened too.

According to Coinglass data, DOGE’s OI (Open Interest) rates were slashed by half, dropping from over $1.8 billion in March to below $900 million in May. Open Interest tracks the amount of money invested in the Futures market and, by extension, market sentiment.

The 50% drop underscored bearish sentiment in DOGE’s derivatives market.

That said, DOGE’s capacity to defend the $0.12-support is not guaranteed, given the overwhelmingly bearish readings from the on-chain and derivatives markets. On the contrary, the defense of the support depends on Bitcoin [BTC] reversing its recent losses.