Dogecoin price prediction – How DOGE can register another 18% gains

- DOGE rebounded by +30% and could tap an extra 18%

- Investors have de-risked from DOGE, exposing price to more pressure

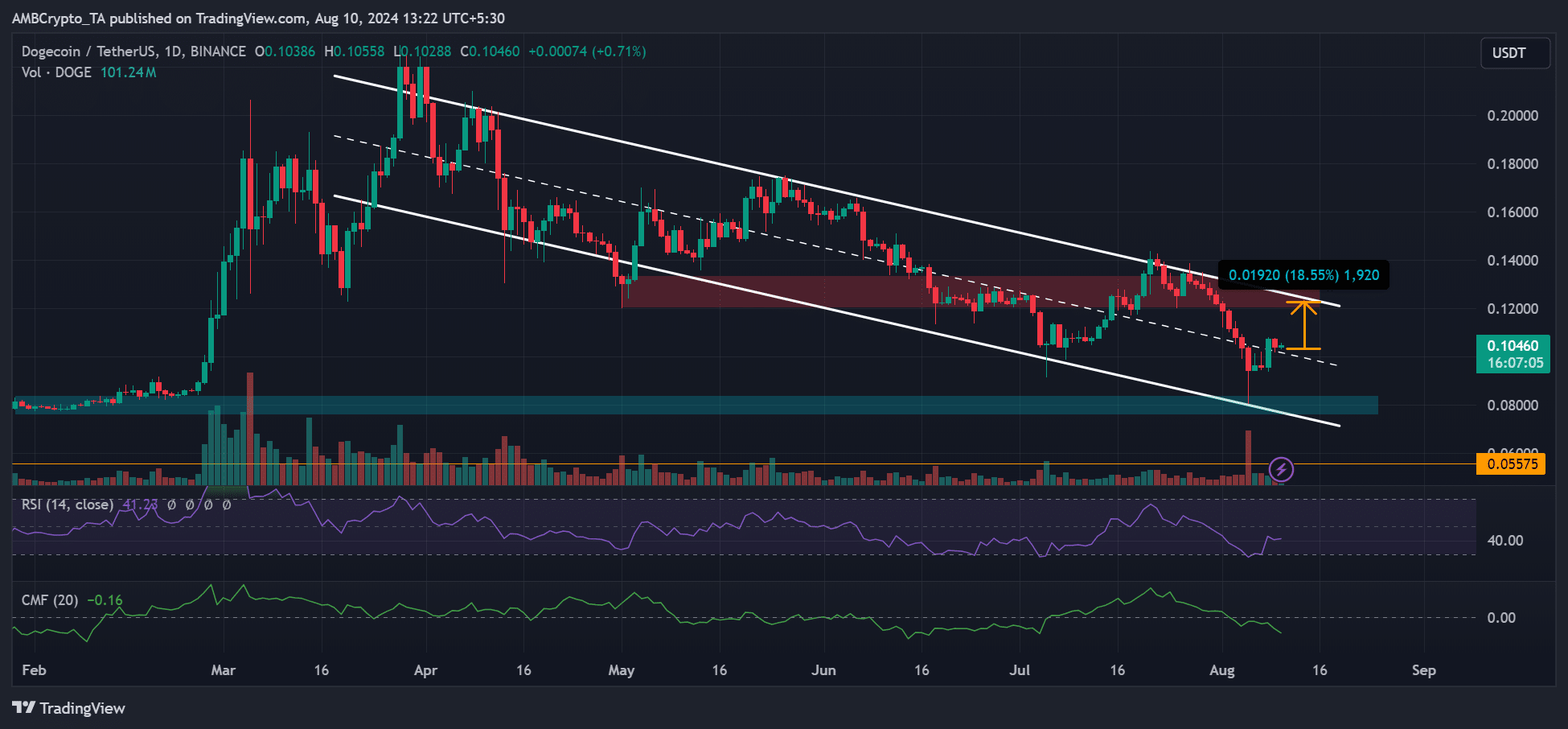

Dogecoin’s [DOGE] price has faced significant pressure after hitting its yearly high of $0.22 in March. In fact, the recent market dump dragged it lower to its early 2024 lows of $0.8, shedding an extra 40% on the charts.

However, like the rest of the market, DOGE’s recovery has been worth over 30%. It reclaimed a crucial resistance and a mid-range level of its declining channel pattern. Hence, the question – Are bulls set for extra recovery gains?

Can DOGE’s upswing continue?

DOGE bulls strongly defended the channel’s range-low at $0.8, as shown by the long candlestick wick. However, the key market edge, at the time of writing, for an extended recovery was flipping and defending the mid-range as a support.

As of press time, the mid-range had been reclaimed and defended. This could set DOGE to eye the next bullish target and the range-high at $0.12. Such a move could add 18% gains to the recovery.

However, key price chart indicators didn’t support the aforementioned bullish thesis, at least not at press time.

Historically, whenever DOGE has climbed above the mid-range, demand, as denoted by RSI (Relative Strength Index), and inflows, as highlighted by CMF (Chaikin Money Flow), were above or near average.

An extra pump would only be feasible if demand and inflows surged too.

DOGE: Investors de-risk as outflows surge

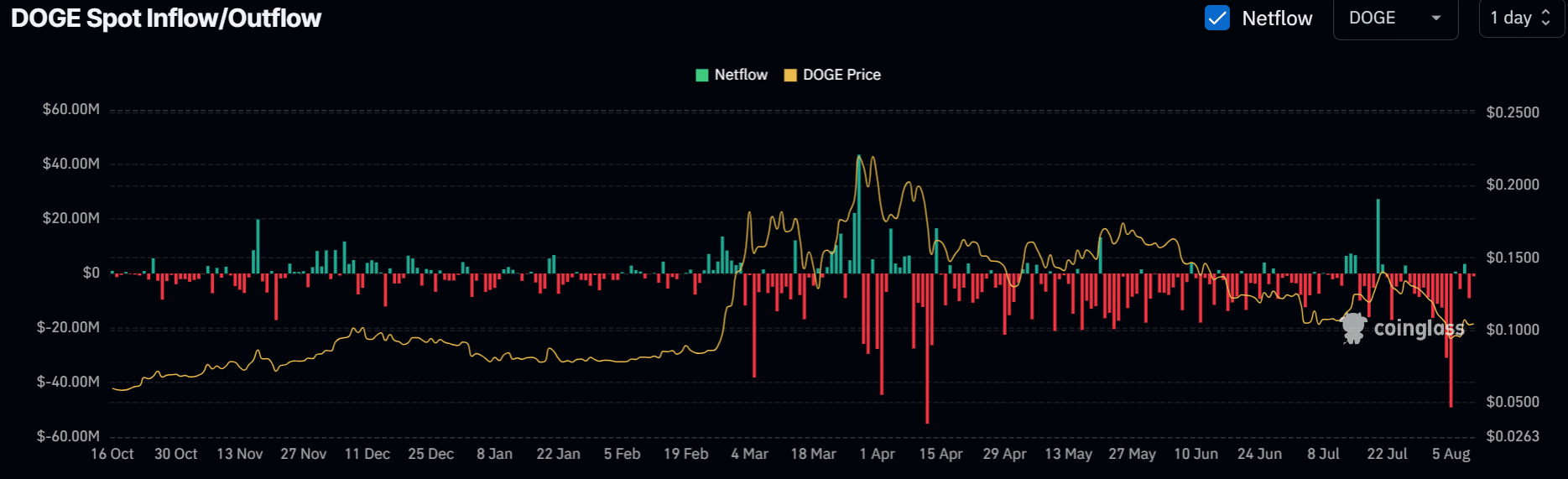

So far, as per Coinglass data, DOGE has seen $60 million in outflows this week following investors’ risk-off approach during the recent carnage. However, the outflows eased towards the end of the week, suggesting that a trend reversal was likely.

However, a stronger price uptrend that could tip DOGE to break above its overall downtrend could take a little longer.

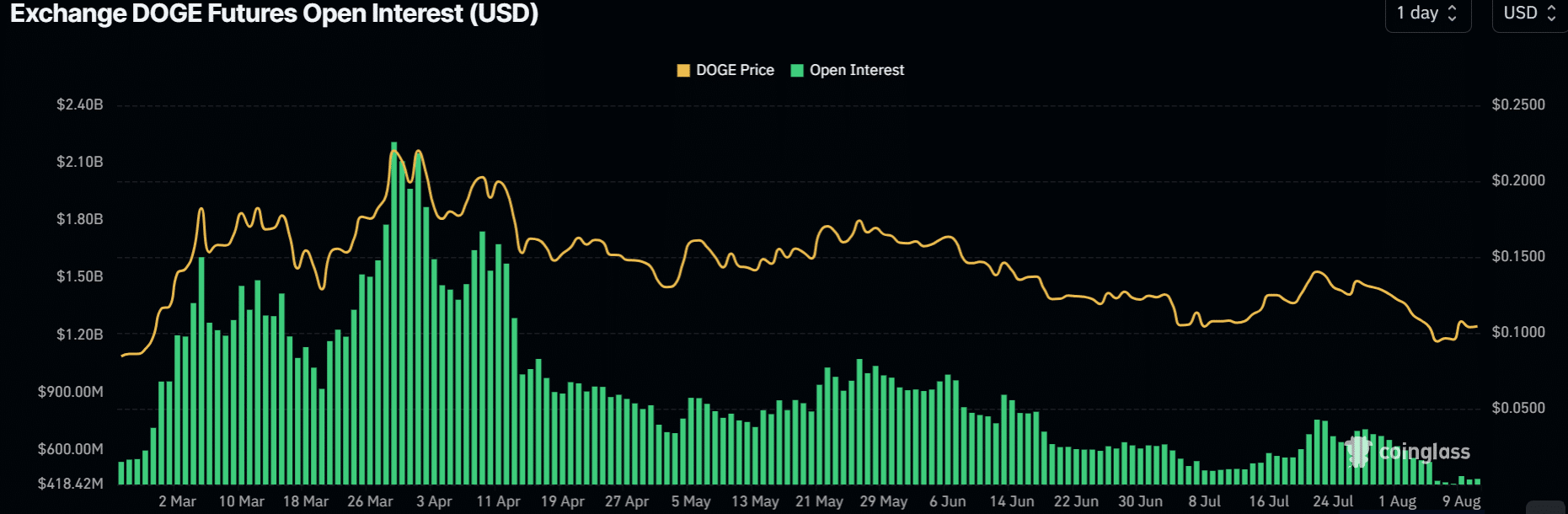

The weak momentum was likely because of the declining Open Interest (OI) rates.

Read Dogecoin Price Prediction 2024-2025

DOGE’s OI dropped from its March peak of over $2 billion to below $500 million, at press time. This illustrated a lack of liquidity injection on the derivatives front to fuel the memecoin and help reverse its downtrend.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion