Dogecoin prices gain 8.2% in a day – Are new predictions on the way?

- DOGE has a short-term bearish bias on the price charts.

- The recovery from the $0.086 zone was encouraging as it showed bulls were still in the fight.

Dogecoin [DOGE] saw its momentum shift bearishly after the recent selling pressure forced prices to dip to the $0.086 support zone. Yet, Bitcoin [BTC] recovered overnight and there was a market-wide bounce in asset prices.

AMBCrypto reported on the performance of the meme coins in 2023 and noted that DOGE showed signs of short-term bearish sentiment in the futures market. Could the bulls reverse this development soon?

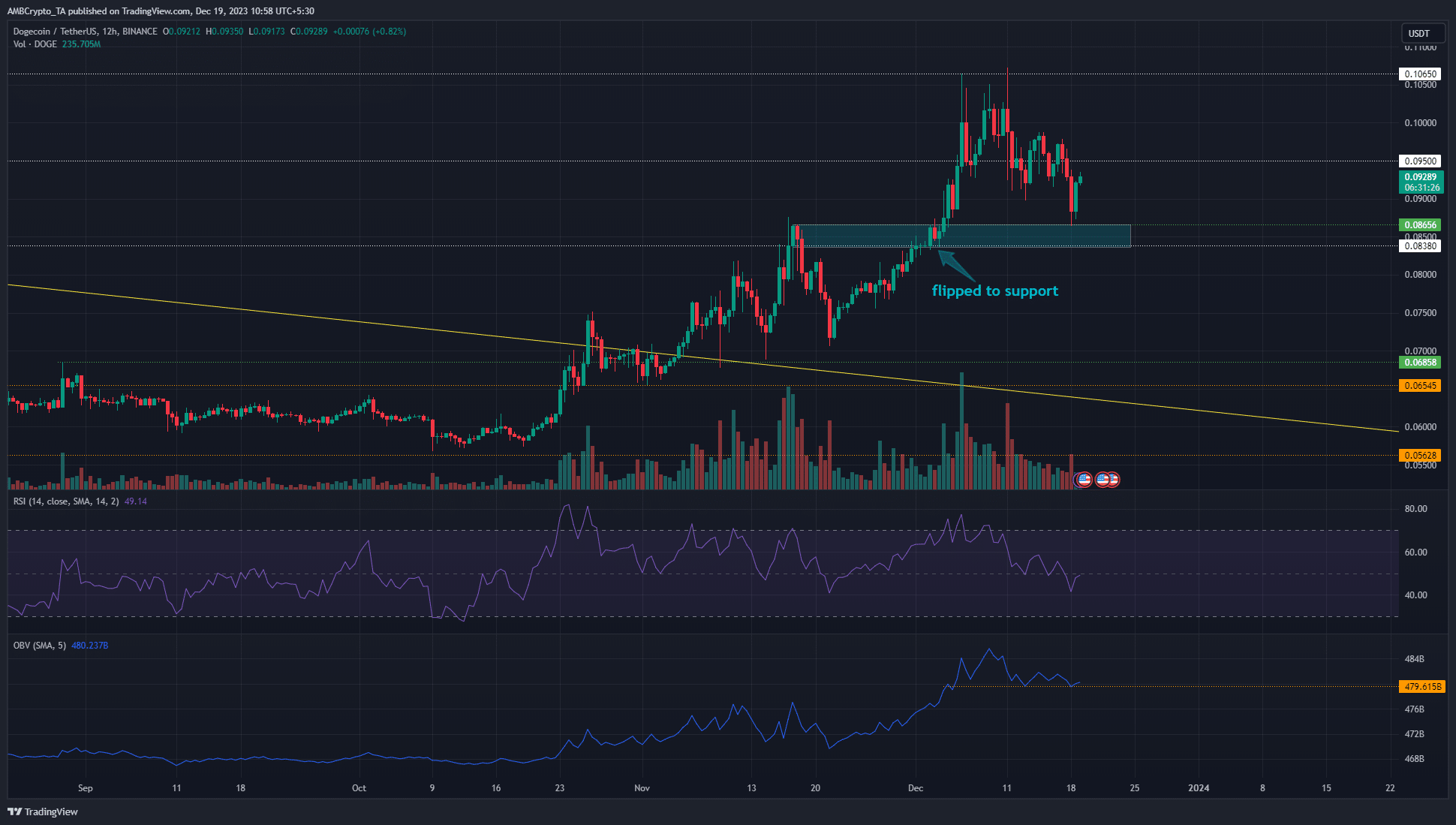

The November high was revisited as support

The 12-hour price chart showed a bearish market structure had developed. This was followed by the RSI dipping to the 41.5 mark to indicate a shift in momentum.

However, the OBV clung stubbornly to a level of support it has defended throughout December.

In mid-November, DOGE prices reached the $0.085 region. It was a strong resistance level at that time and caused a sharp pullback to $0.07. Since then, the buyers have breached it and also retested it as a support zone, highlighted in cyan.

On 18th December, the price fell to this region once again but immediately bounced higher. This showed buyers were strong, but the price was now at a lower timeframe resistance at $0.0928.

The rising active addresses were encouraging

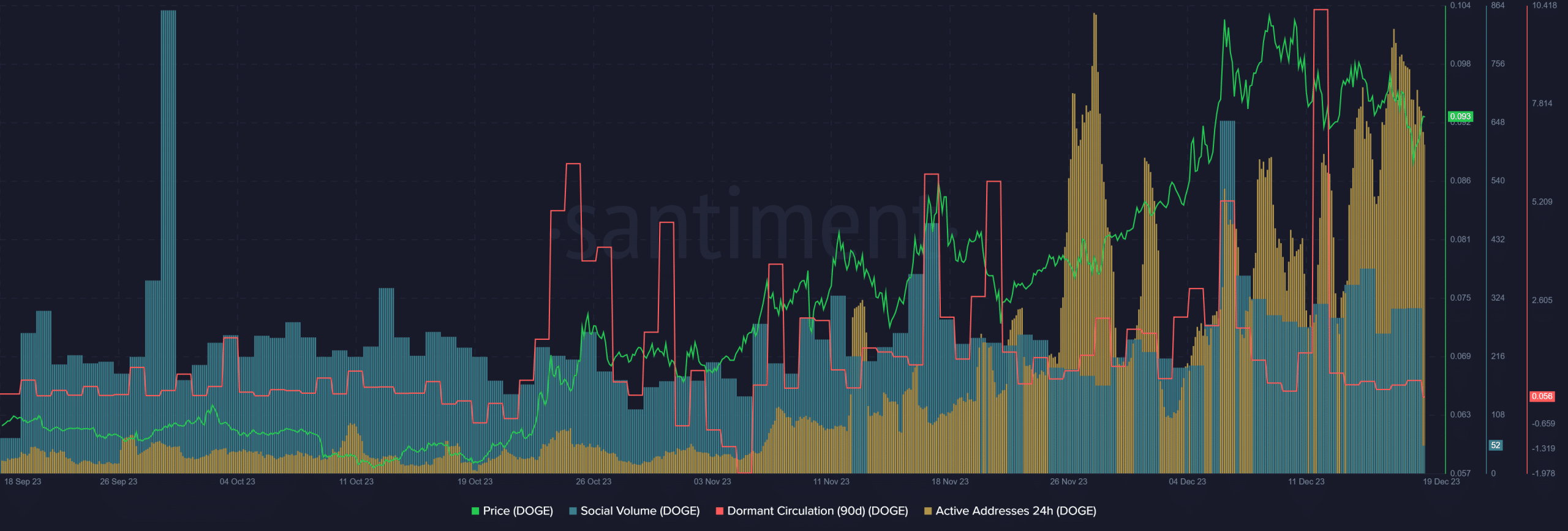

Source: Santiment

The active addresses count has been trending higher since mid-November. This showcased increased participation from users and pointed toward increased demand for DOGE as well. The metric was near its three-month high at press time.

Is your portfolio green? Check the DOGE Profit Calculator

The social volume was strong in early December but has receded since then. Yet, it was higher than what it was in October and the first half of November.

The dormant circulation saw a large spike when prices were at $0.097 on 12th December. This suggested increased token movement and was a sign of a spike in selling activity, and was followed by a descent in prices to reinforce this idea.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.