Here’s the pain point of Dogecoin’s recovery

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- DOGE reversed 5 June’s losses.

- Funding rates and OI improved, but BTC hasn’t reversed its downtrend momentum.

So far, this week has been full of crazy price swings, thanks to the US SEC – Binance lawsuit. On Monday, 5 June, Dogecoin [DOGE] plunged and retested March swing low of $0.0632 after news of the lawsuit.

DOGE reversed almost all the Monday losses on Tuesday. The upside move followed Bitcoin’s [BTC] sharp rebound from $25.4k to $27.4k before easing to $26.8k at press time.

Is your portfolio green? Check out the DOGE Profit Calculator

But BTC is still in a short-term downtrend momentum unless it climbs above $27.5k or $28.5k. If BTC fails to reverse the downtrend, it could expose DOGE to another bull trap.

What’s next for DOGE?

A Fibonacci retracement tool (yellow) was placed between a lower high in late April ($0.0837) and a recent lower low in June at ($0.0632). Based on the Fib tool, the 50% ($0.0734) and 38.2% ($0.0710) Fib levels are immediate key resistances.

As such, bulls must clear the above two roadblocks of $0.0710 and $0.0734 to gain leverage. A session close and bullish breaker above the 50% Fib level will flip the market structure bullish.

But before that happens, sellers could still control the market. The price rejection at 38.2% Fib level ($0.0710), seen at press time, could drag DOGE lower to $0.0680 or March swing low of $0.0632. The downswing could be accelerated if BTC drops below $26k again.

At press time, the RSI eased at the median level and had a downtick, showing selling pressure is imminent at the 38.2% Fib level. Similarly, the OBV’s recent uptick made a U-turn, confirming the limited demand in the past few hours.

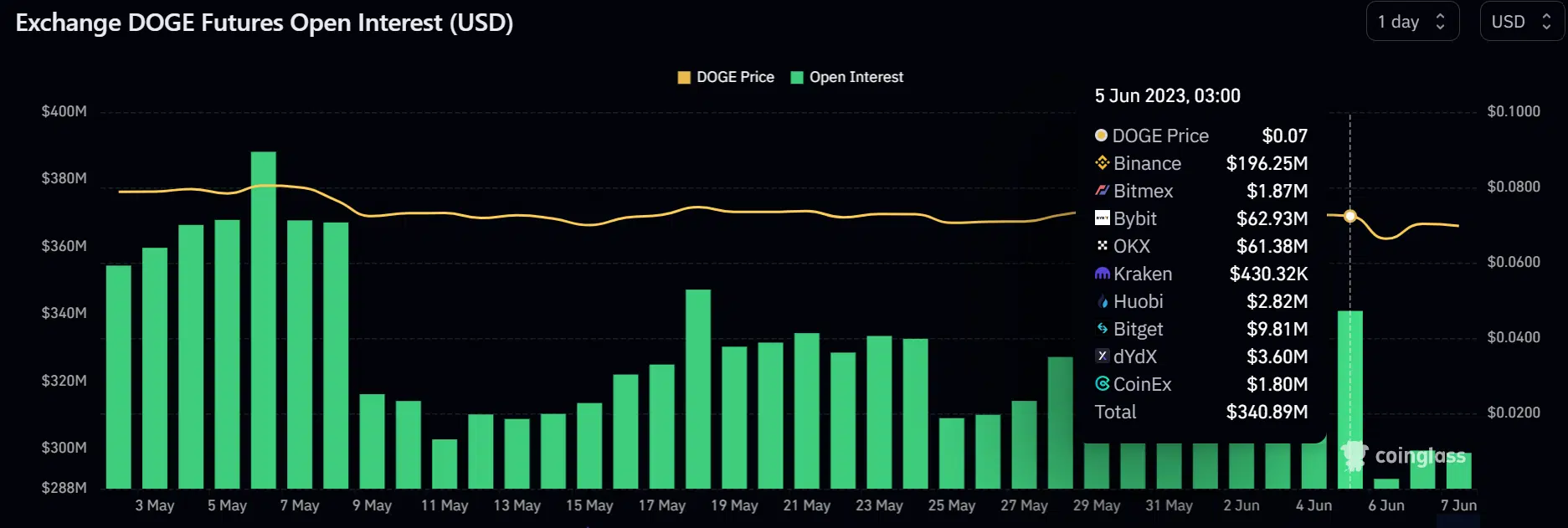

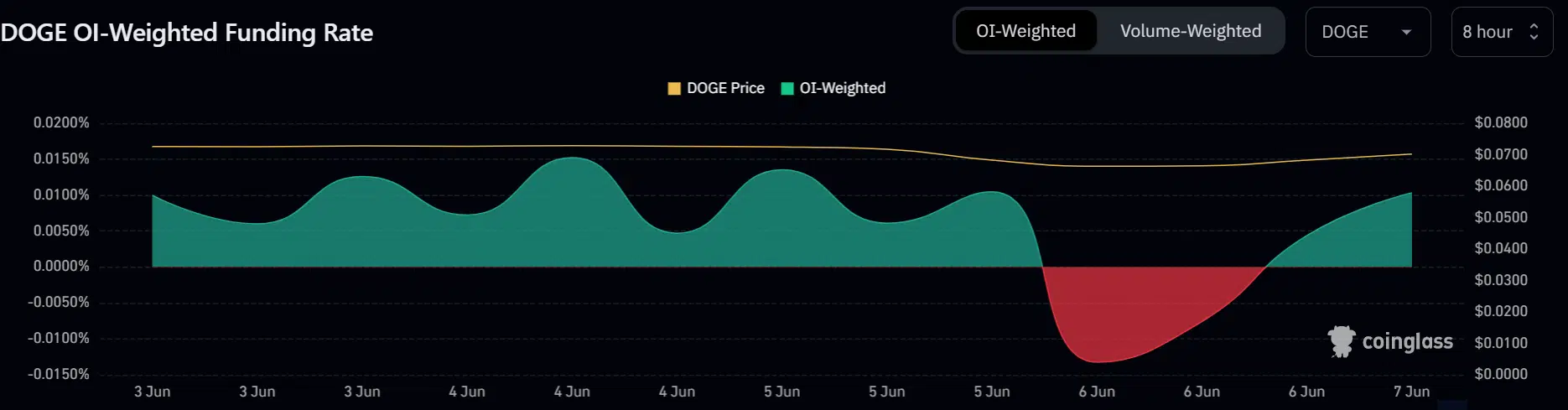

OI and funding rates improved

How much are 1,10,100 DOGEs worth today?

DOGE’s open interest (OI) rates, the total number of futures or options contracts, decreased from $340 million before the Binance lawsuit to <$300 million post 6 June. The figure hit $290 million on 6 June but has improved to $298 million at press time.

A surge >$300 million could signal hopes of further bullish trend. In addition, the improvement in OI was also matched with positive funding rates. However, bulls can only gain leverage beyond $0.0710 and $0.0734.