Why Dogecoin traders should brace for volatility

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- The market structure was firmly in favor of the sellers.

- The large imbalance overhead meant a full retracement of the recent losses was possible.

Bitcoin [BTC] found temporary respite at the $25k area on 15 June. After a brief drop to $24.8k, the BTC prices rebounded higher and climbed to $26.6k going into the weekend. However, the resistance levels overhead was strong, and sentiment in the market was not bullish.

Realistic or not, here’s DOGE’s market cap in BTC’s terms

Therefore, it was possible that Bitcoin could see a minor move upward to collect liquidity. In doing so, the rest of the altcoin market including Dogecoin could follow. Thereafter, a bearish reversal would be the likely outcome, but traders must be prepared for a rally as well.

Dogecoin bubbled beneath the 50% retracement level but bulls lacked the volume to push any higher

Over the past week, the trading volume of DOGE has been low in comparison to the move that brought the prices beneath the $0.07 support. This showed indecisive market participants waiting for a clear direction or some news to spur prices in some direction. Hence, attempting to open trade positions could be risky until it is resolved.

The Fibonacci retracement levels highlighted the 50%, 61.8%, and 78.6% retracement levels as strong resistance levels. Yet, with Bitcoin’s short-term structure showing some upside was possible, sellers must be cautious. A move back to the $0.072 level or slightly higher to squeeze out early short sellers before the resumption of the downtrend was a likely possibility.

The Chaikin Money Flow showed significant capital inflow over the past three days with a reading above +0.05. The Awesome Oscillator also clambered above the 0 level to show faint bullish momentum. Risk averse traders can wait till DOGE establishes Monday’s high to get an insight into the market sentiment.

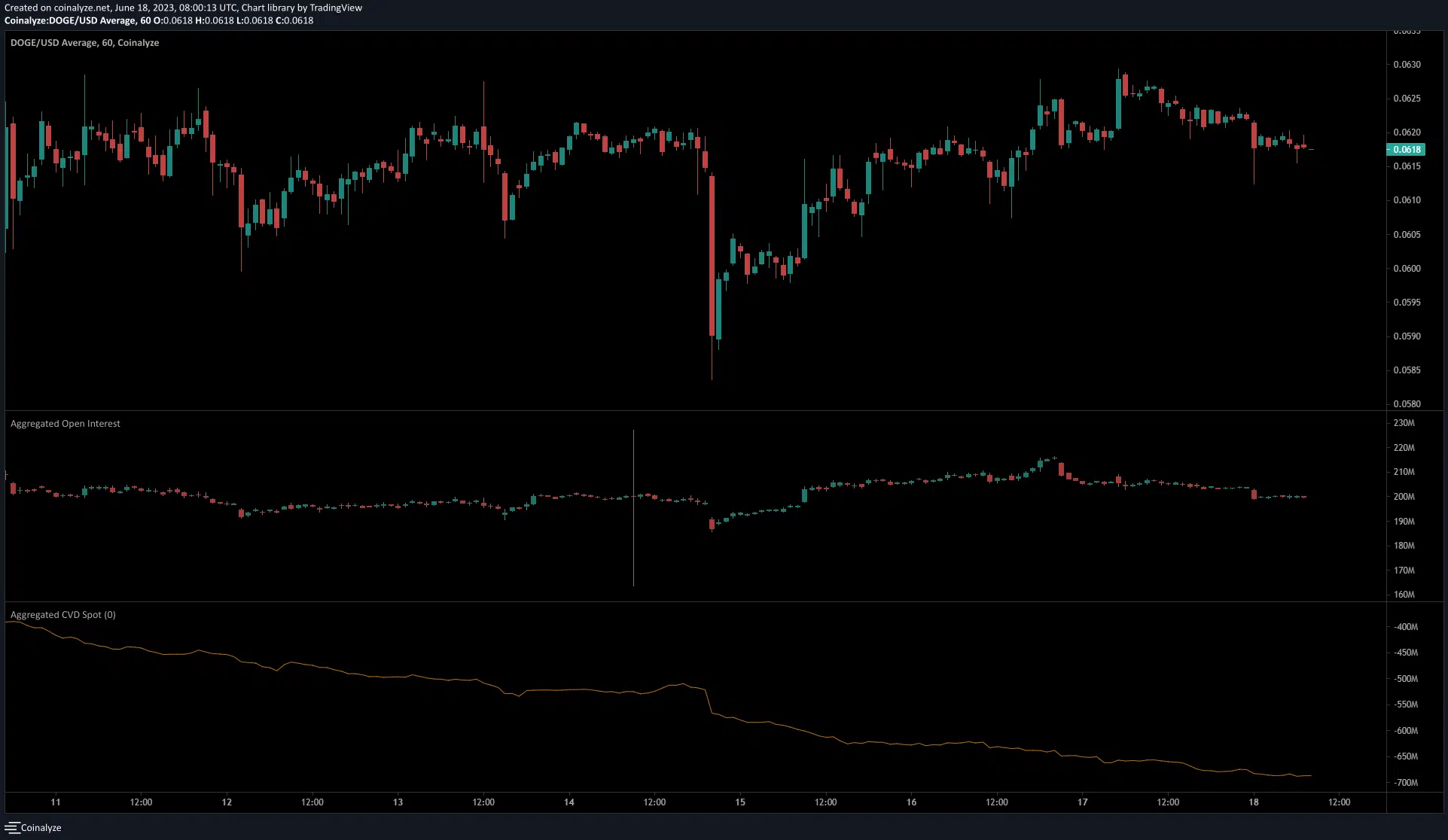

The falling CVD reflected clear seller dominance

Source: Coinalyze

To support the bearish notion, the spot CVD has been in a strong downtrend over the past week. Zooming out on the Coinalyze chart it was seen that early May was when the spot CVD had trended higher. It began to fall lower from mid-May and was yet to stop.

How much are 1, 10, or 100 DOGE worth today?

The Open Interest increased by close to $28 million from 15 June to 17 June when Dogecoin bounced from $0.059 to $0.063.

In the past 24 hours, both the OI and the price have slumped slightly. Overall, the OI did not reflect bullish sentiment yet, although bulls are very likely to pile on if DOGE saw a move toward $0.07.