Dogecoin

Dogecoin vs Shiba Inu – This memecoin will lose big when selling wave hits

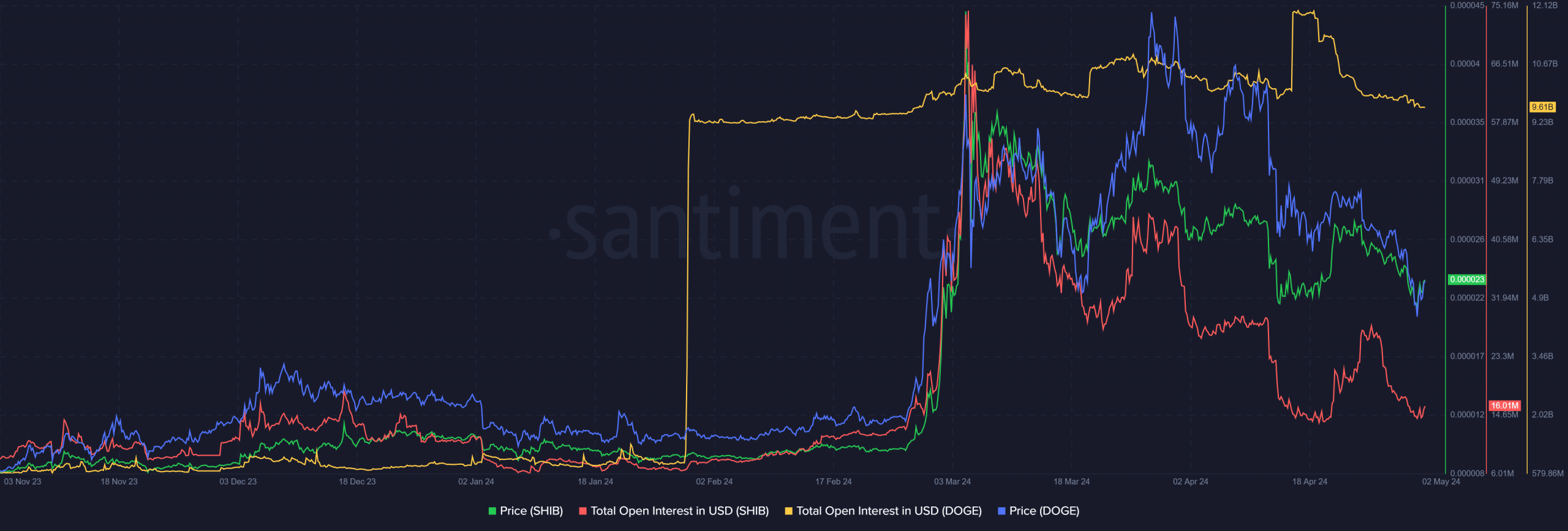

The Open Interest and funding rates of Dogecoin and Shiba Inu gave clues about the strength of each memecoin.

- Both Dogecoin and Shiba Inu have long-term holders with a decent profit

- Speculators seemed more eager to short-sell one of them, compared to the other

Dogecoin [DOGE] and Shiba Inu [SHIB] recorded losses of 11.4% and 8.5%, respectively, over the past week. Both memecoins have gained just over 10% in the past 36 hours, meaning that the losses were much greater at the lowest point in the past week.

Bitcoin [BTC], at the time of writing, was trading under $60,000 too, while the sentiment across the market was fearful. Ergo, it seemed unclear how low this downtrend could go.

Hence, AMBCrypto analyzed the Futures market data to see if either DOGE or SHIB had formed a potential bottom before their bullish reversal.

Comparing the speculator sentiment behind Dogecoin and Shiba Inu

Source: Santiment

The Open Interest behind Shiba Inu has been on a steady downtrend since the first week of March. The price has also been in a retracement phase. Together, they highlighted a consistent lack of conviction from the bulls.

Some short-term bounces saw a large OI spike, but these were quickly reversed. It revealed that more and more market participants have been forced onto the sidelines. Meanwhile, Dogecoin was different.

It too saw a decline in OI, but most of it came in the second half of April. The price action showed that its bounce toward late March was larger, 86% for DOGE compared to 39% for SHIB. This explained the difference in Open Interest and hence, the sentiment.

It is fair to conclude that both mem coins are under a lot of pressure from sellers. Both projected bearish sentiment, but Shiba Inu has been weak for a longer period.

Which of the two is closer to forming a bottom?

Source: Santiment

Since SHIB has retraced for a longer period, could it be the token closer to forming the bottom? The funding rate behind Shiba Inu has been negative for many consecutive days in April. The stretches from 13 to 21 April, and from 27 April to 2 May.

On the contrary, DOGE saw a minor negative funding rate on Binance for a handful of days in the past two weeks. This suggested that market participants were more eager to short SHIB than DOGE, once again reinforcing the bearish sentiment.

Realistic or not, here’s DOGE’s market cap in BTC’s

termsFinally, the 365-day MVRV ratio of both memecoins were fairly healthy at 25.58% and 28.84% for Dogecoin and Shiba Inu, respectively. This showed that despite the recent losses, holders were still up by a respectable amount.

It is likely that DOGE and SHIB will need Bitcoin to recover its bullish impetus before having a chance at recovery themselves. Until that happens, it is reasonable to conclude that SHIB is more likely to post heavier losses than DOGE in the event of a large wave of selling.