Dogecoin vs. WIF – How the memecoin climbed by 16% to stake its claim

- DOGE has attracted significant liquidity, surpassing its rival – WIF

- However, a few roadblocks still remain.

As memecoins continue to dominate the weekly top gainers chart, AMBCrypto has noticed a slight divergence from previous cycles.

Contrary to earlier rallies where Dogwifhat [WIF] led the charge with the highest daily gains, Dogecoin [DOGE] has reclaimed its position as the leader. It posted a weekly gain of over 16% – Double that of WIF.

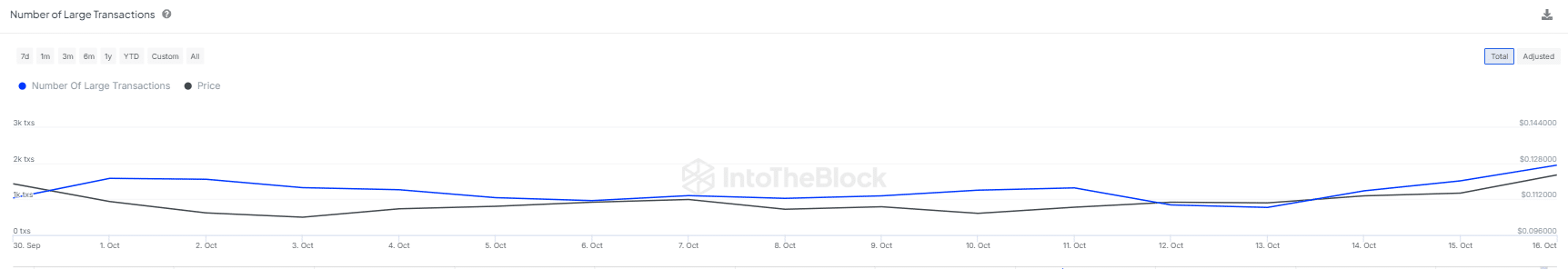

Over the past week, Dogecoin has seen its most lucrative period, with consistent daily gains on the price chart. This has brought its value close to $0.130 – A level last reached in July.

Most importantly, DOGE’s performance mirrored Bitcoin’s upswing of 10% this week, further establishing it as the leading high-cap memecoin during bullish cycles.

Supporting this trend, the number of transactions over $100k using DOGE also hit a local high of 1.95k txs, indicating strong interest from retail investors.

In short, DOGE bulls have recovered much of the losses incurred during the recent memecoin-led “supercycle,” one where Dogecoin faced significant competition from rivals.

During this period, low-cap memecoins and new entrants, led by WIF, capitalized on the market dynamics, putting pressure on DOGE’s position.

Spot traders capitalized on DOGE’s dip

However, spot traders displayed resilience throughout, strategically entering the accumulation phase when DOGE fell on the charts.

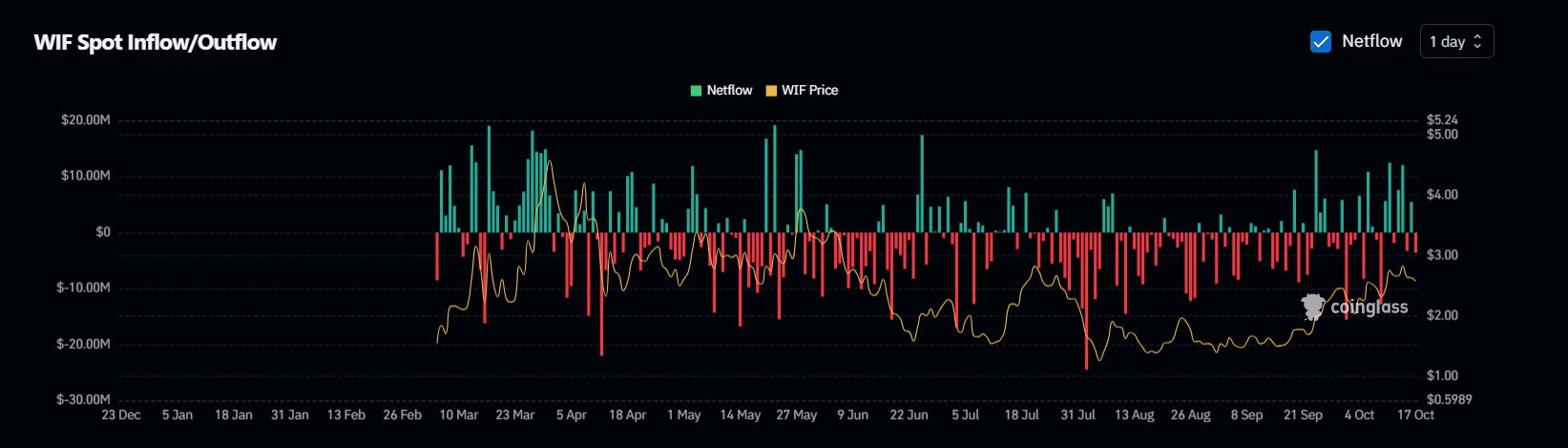

This approach mirrored the strategy previously employed with WIF, where traders absorbed selling pressure by capitalizing on the dip to buy.

And yet, with WIF nearing the $3 threshold just three days ago, these traders have shifted into a distribution phase, depositing millions of WIF tokens into exchanges. This movement means that $2.9 may have served as a local high for WIF.

A similar pattern may also emerge for DOGE. If BTC falls below $67k, it could trigger panic selling and instill fear in the market.

According to the law of volatility, a risk-on environment may shift attention away from memecoins and towards high-cap altcoins.

Read Dogecoin’s [DOGE] Price Prediction 2024–2025

If this trend holds, Dogecoin might falter towards the $0.12 support for a potential recovery. However, if fear escalates, many holders may liquidate their positions, causing DOGE to pull back below $0.11.

Overall, the current market cycle has caused a significant shift in the memecoin landscape, attracting major liquidity to DOGE.

This capital influx from WIF to DOGE has helped restore DOGE’s dominance as the largest memecoin by market cap. However, several roadblocks still remain to be addressed.