Dogecoin whale accumulation surges 868%: Will this help DOGE’s price?

- Dogecoin saw a dramatic surge in whale activity, marking an 868% increase.

- High concentration of liquidity appeared at $0.11 and $0.098, suggesting consolidation.

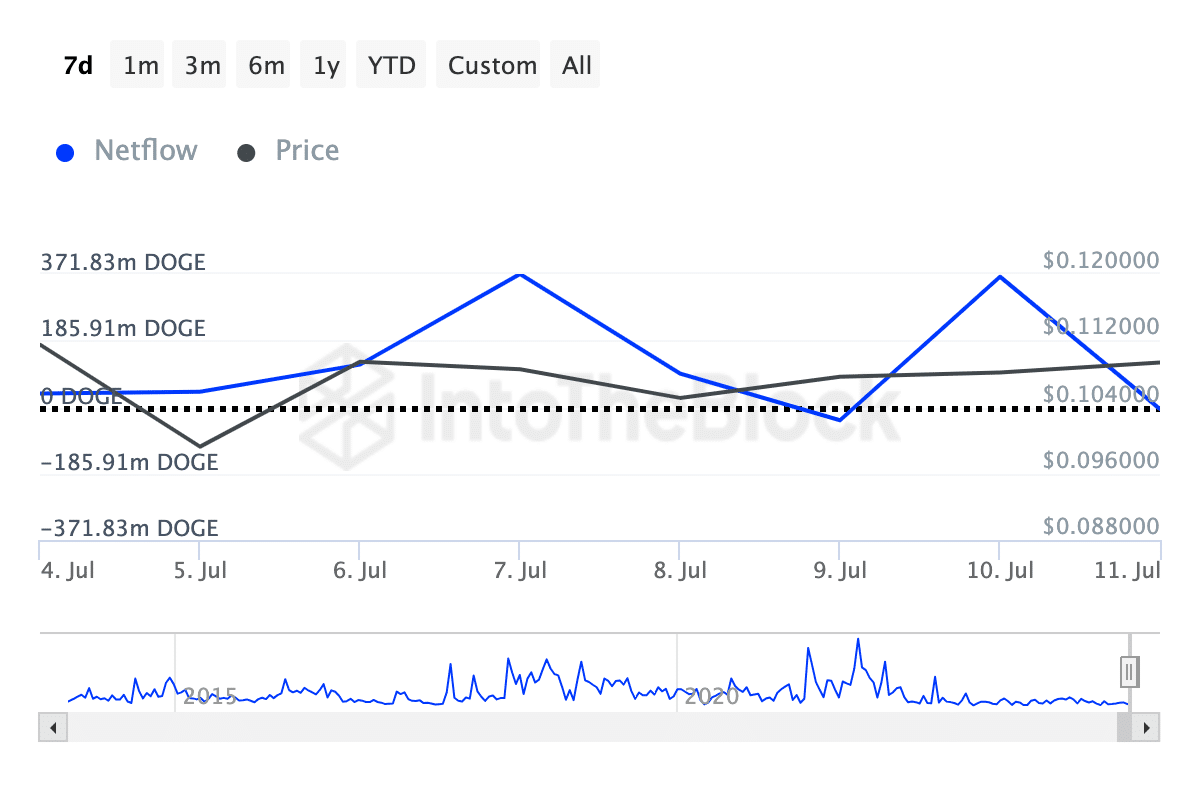

Dogecoin [DOGE] was one of the few cryptos that experienced a surge in whale activity. According to IntoTheBlock, the Dogecoin whale cohort surprised the market between the 9th and 11th of July.

For example, on the 9th of July, the large holders netflow was -37.05 million. The netflow is the difference between the large holders’ inflow and outflow. When it is negative, it means that whales distribute many coins.

Whales up, price down

This was the earlier situation with DOGE. But fast-forward to the 11th, the netflow was at an incredible height of 364.38 million coins.

This rise represented an 868% increase, and also indicated that Dogecoin whale accumulation was intense.

When whales make this such of move, the broader market takes it as a cue to buy and anticipates a price increase. But for DOGE, that has been the case, or it might be safe to say the impact has yet to reflect.

At press time, DOGE’s price was $0.10. While this was a 2.66% decrease in the last 24 hours, it represented a 10.35% within the last seven days.

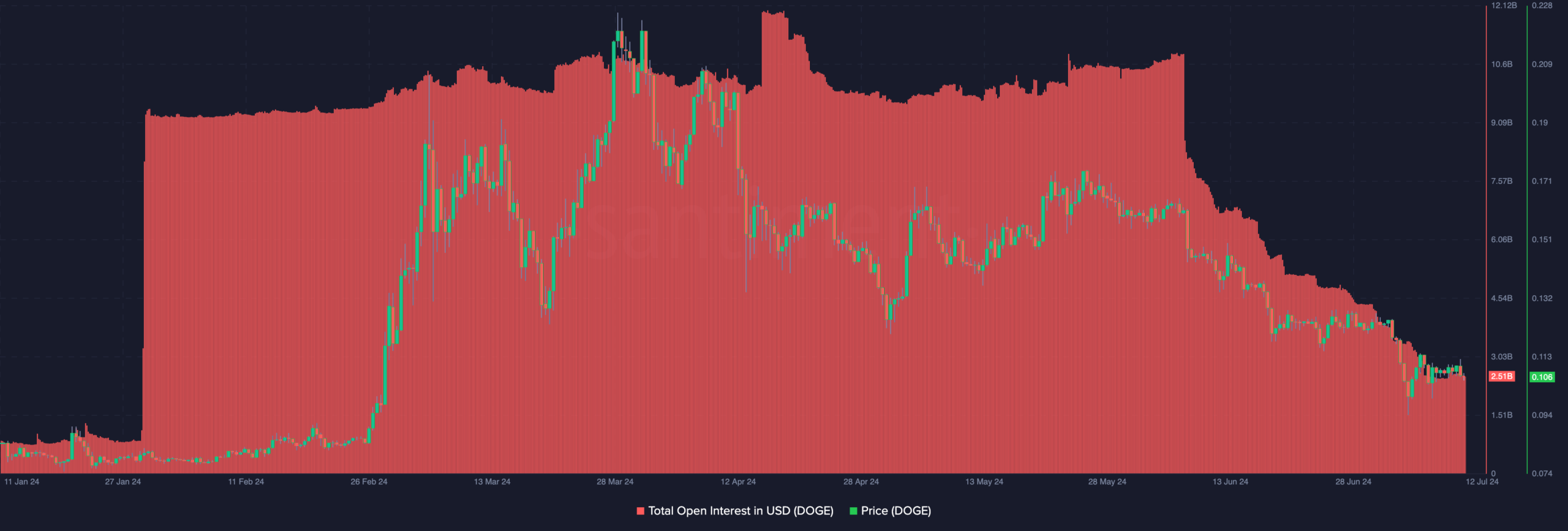

One of the reasons Dogecoin whale accumulation has not had a significant effect on the price is the Open Interest (OI). This indicator refers to the sum of the value of open contracts in the market.

When OI increases, it means that market participants are putting more money in the market and increasing net positions. On the other hand, a decrease implies that traders are closing existing positions and taking out liquidity.

DOGE aims for $0.11, if not…

Usually, an increase backs the price trend — in most cases, an upswing. But when the OI falls, price declines as well. At press time, on-chain data from Santiment showed that Dogecoin’s Open Interest was down to $2.51 billion.

This was the lowest it had hit since the 27th of January. The simple interpretation here means that traders do not trust DOGE’s price action to yield substantial gains.

If this remains the case, the price of the coin might find it challenging to rebound. To assess where price might reach, AMBCrypto analyzed the Liquidation Heatmap.

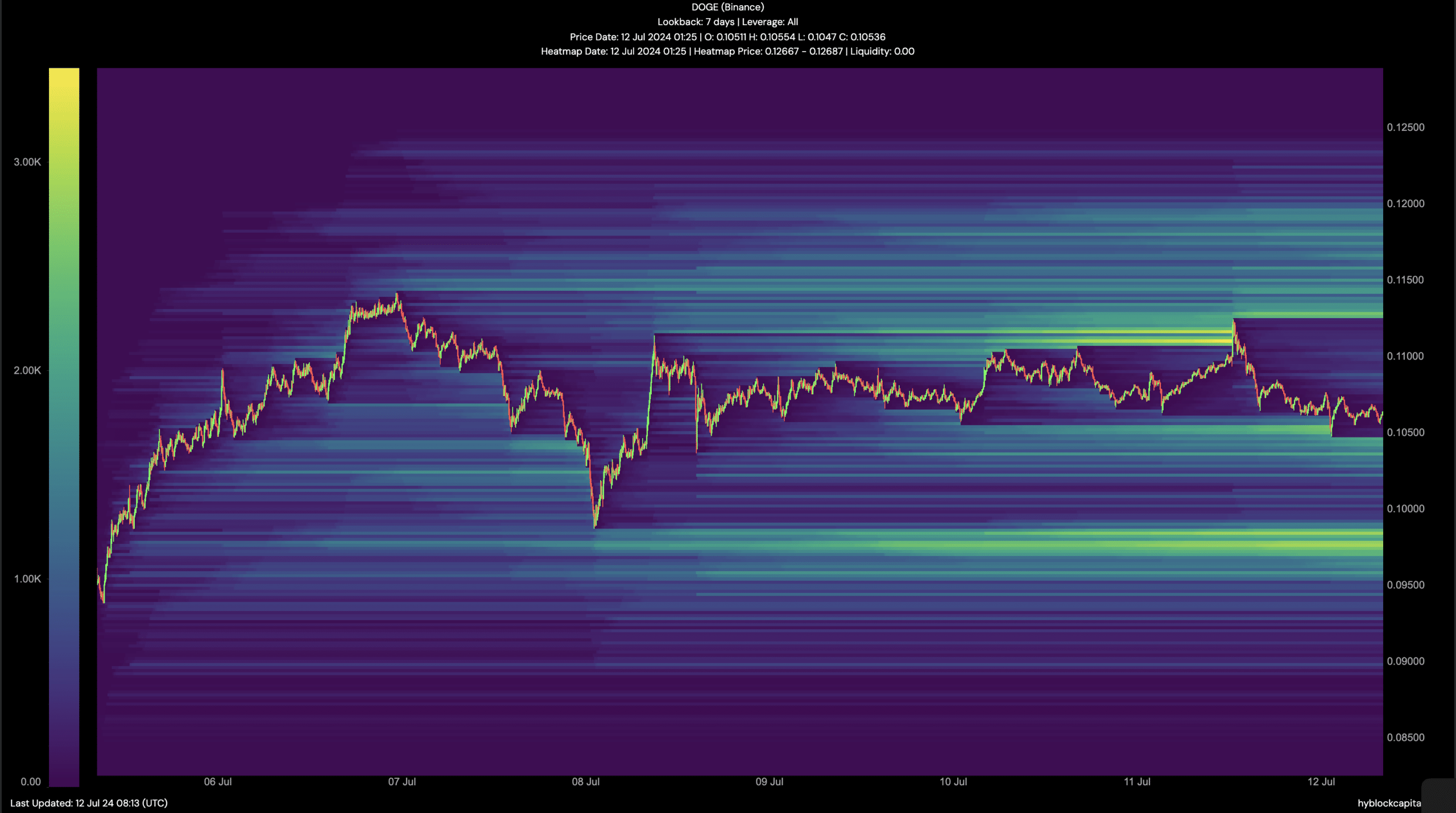

This heatmap shows price levels where a liquidation event might happen. If liquidity is concentrated at a point, price might move in the direction.

Liquidation occurs when an exchange forcefully close a trader’s position due to inability to meet margin requirement.

Is your portfolio green? Check out the DOGE Profit Calculator

As of this writing, we noticed that there was high liquidity at $0.11. Therefore, if buying pressure increase, DOGE’s price could move toward that level.

However, if Dogecoin whale impact remains low, another liquidity concentration existed at $0.098. As such, if selling pressure outweighs buying, DOGE could move lower to the mentioned price.