Dogecoin whale transactions surge – Are they selling or accumulating?

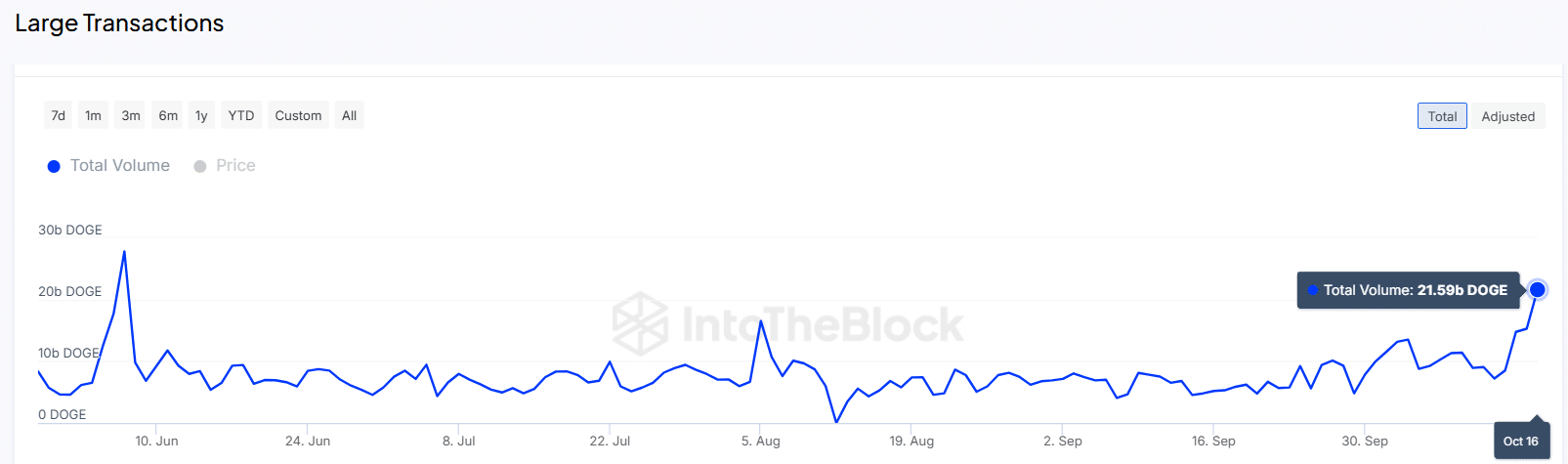

- Large Dogecoin transactions have increased from 15.27 billion to 21 billion.

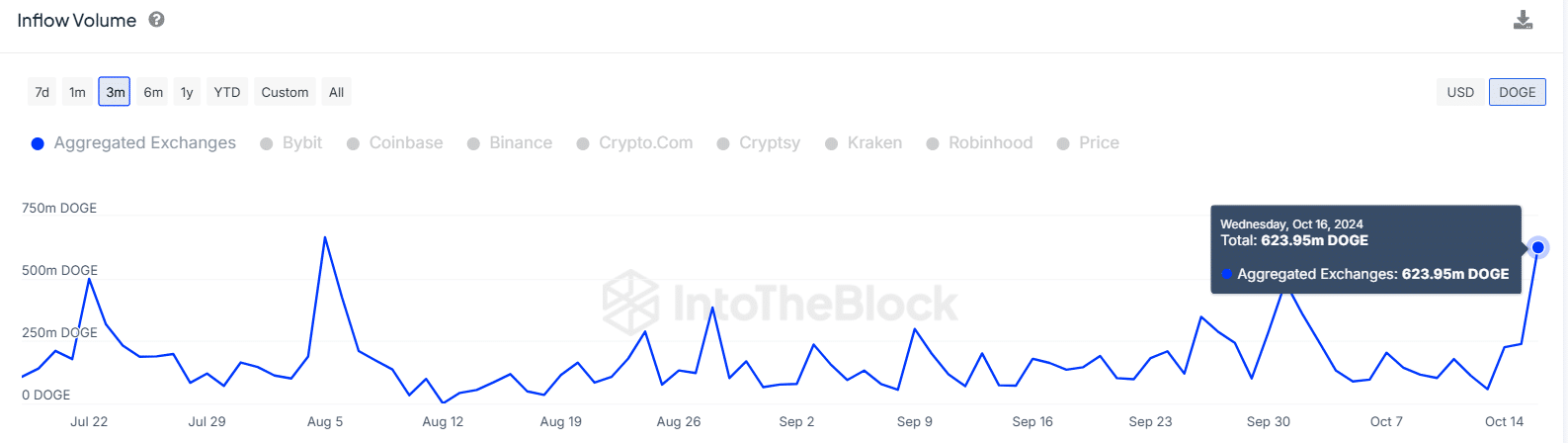

- Exchange inflows also reached an eight-week high of more than 623 million, which could increase the selling pressure.

Dogecoin [DOGE], the largest memecoin by market capitalization, has been one of the best performers among the top ten largest cryptos. In the last seven days, DOGE has gained by 13% to trade at $0.12 at press time.

Data from CoinMarketCap shows that these gains came from growing interest in the meme coin as trading volumes had jumped by nearly 60% at press time.

Whales likely contributed to the rising volumes as large DOGE transactions have jumped by 40% to a four-month high of 21 billion tokens.

This spike shows that whale activity around DOGE is increasing, which could be behind the recent volatility. However, a further look at exchange inflow data shows that this spike could also result in selling pressure.

On 16th October, more than 623 million DOGE tokens were sent to exchanges. This marked the highest level of exchange inflows in two months.

The spike in large transactions and exchange inflows suggests that DOGE is in a distribution phase where whales are taking profits, which could weaken the uptrend.

Dogecoin price analysis

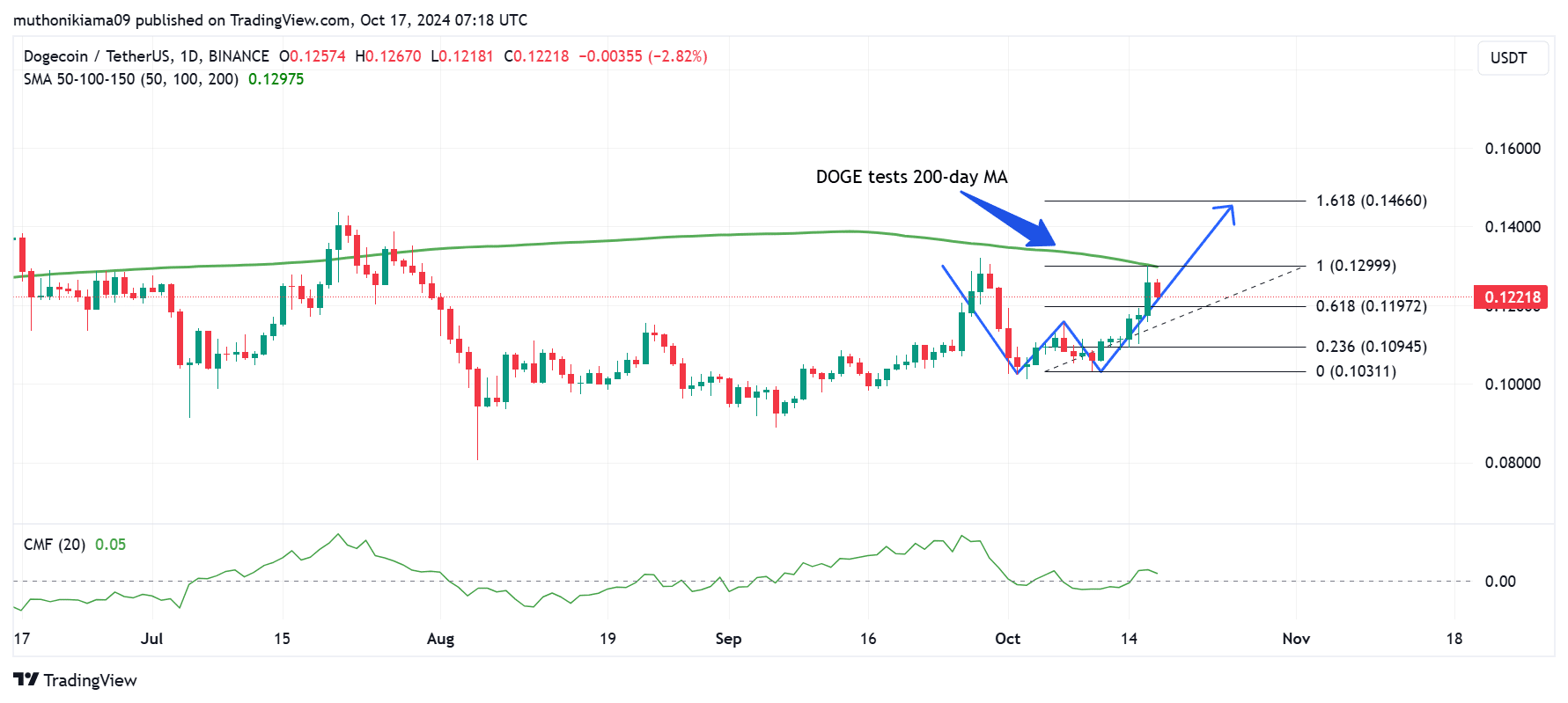

A look at the daily chart shows that DOGE has completed a bullish W pattern. This is a bullish reversal pattern that suggests DOGE is resuming its uptrend, with the next price target set at $0.146.

However, for DOGE to make this breakout, it needs to flip resistance above the 200-day Simple Moving Average (SMA). The Chaikin Money Flow is positive showing that buyer pressure remains higher than selling pressure, which could support this breakout

If DOGE fails to flip this resistance, it could drop to test support at the 0.236 Fibonacci level ($0.109).

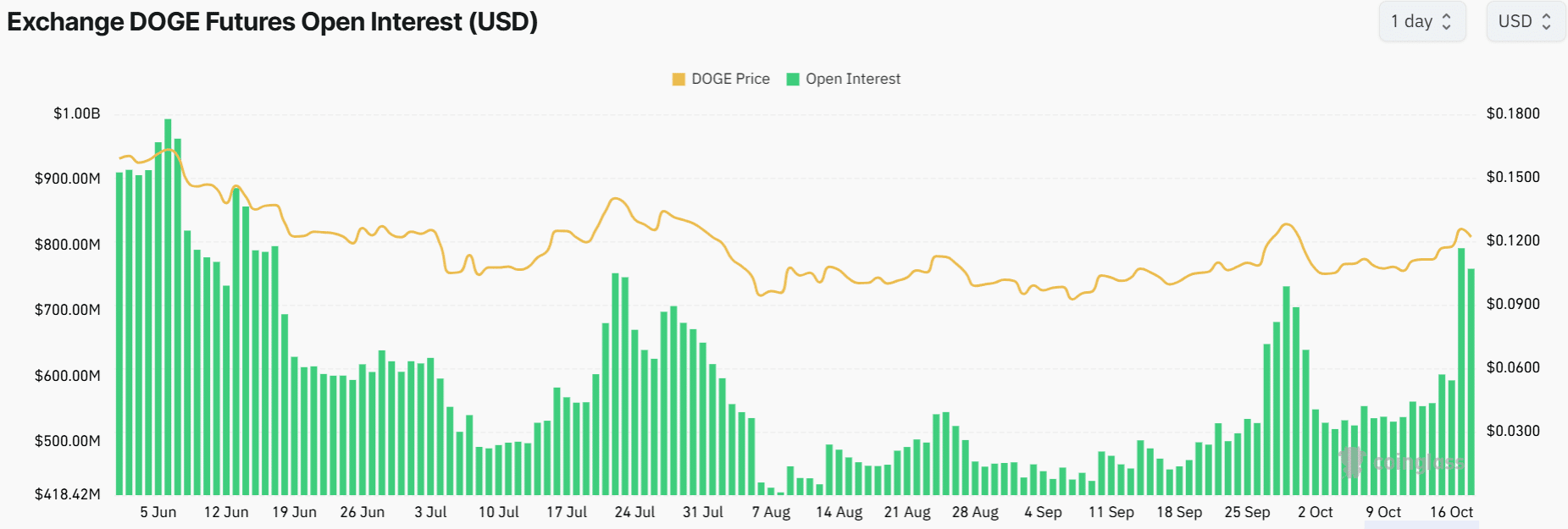

Dogecoin’s recent gains appear to be driven by a spike in open interest to a four-month high of $795M at press time. This increase shows that traders are opening new positions on DOGE.

However, given that the long/short ratio has dropped from 1 to 0.86 at press time, the spike could suggest that traders are beginning to open short positions.

Realistic or not, here’s DOGE market cap in BTC’s terms

Additionally, this rising interest in DOGE from futures traders is not being seen in the spot market. As AMBCrypto reported, the number of Dogecoin holders has dropped by more than 106,000 over the past week.

This points towards the meme coin being in a distribution phase where traders are likely booking profits.