Dogecoin whale’s 200M move: Will this help DOGE break $0.43?

- Dogecoin whales have shifted sentiment, fueling buying pressure and potential price rally

- Monitoring whale activity is crucial as Dogecoin aims for key price levels and resistance

Dogecoin [DOGE] has seen significant price fluctuations in recent days, with its value dipping to $0.36 on the 23rd of November as major whales reduced their holdings.

However, at press time, Dogecoin was trading at $0.40, reflecting a shift in sentiment as these key stakeholders have resumed buying. This renewed accumulation, coupled with other technical indicators pointing to bullish momentum, could suggest that DOGE’s price was gearing up for another upward move.

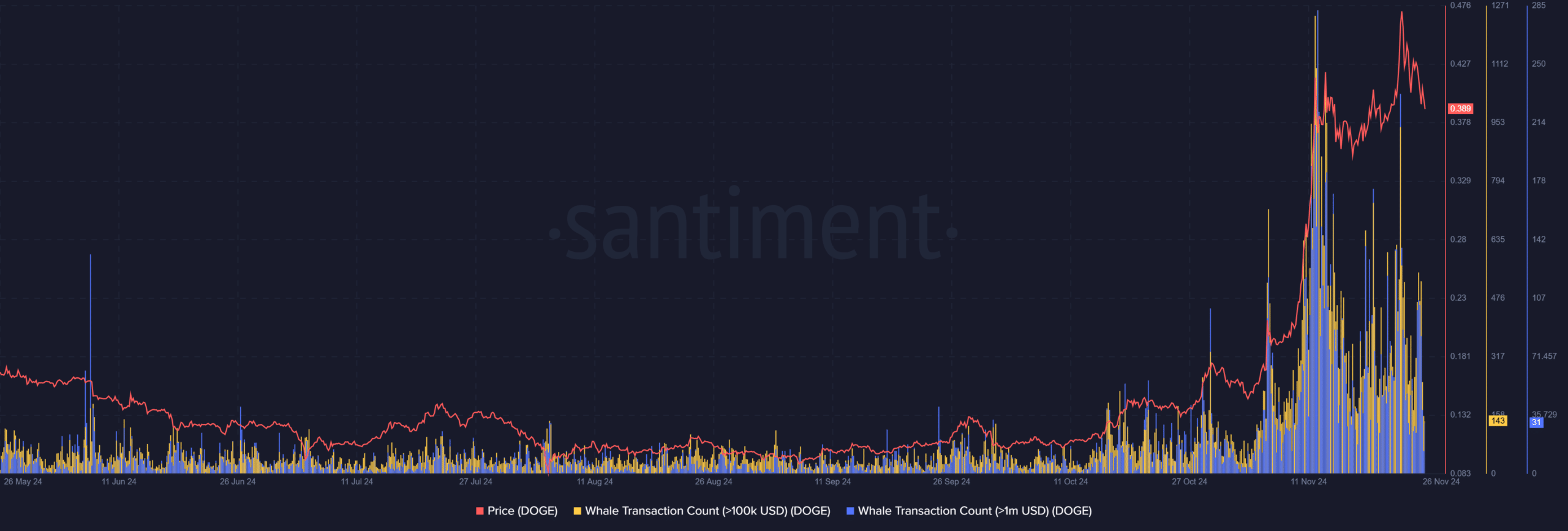

Whale activity and its impact

When Dogecoin’s price dropped to $0.36, whale holdings declined from 10.59 billion to 10.39 billion DOGE, according to Santiment data. This sell-off increased market pressure, triggering the price dip.

However, whales have since resumed accumulation, adding approximately 200 million DOGE, valued at $84 million at the current price of $0.42.

This renewed buying pressure is alleviating selling pressure and fueling bullish sentiment. The shift in whale activity pointed out the growing confidence in DOGE’s potential for another rally, with their actions serving as a key driver for the token’s price recovery.

Dogecoin’s bullish momentum gains traction: Key levels to watch

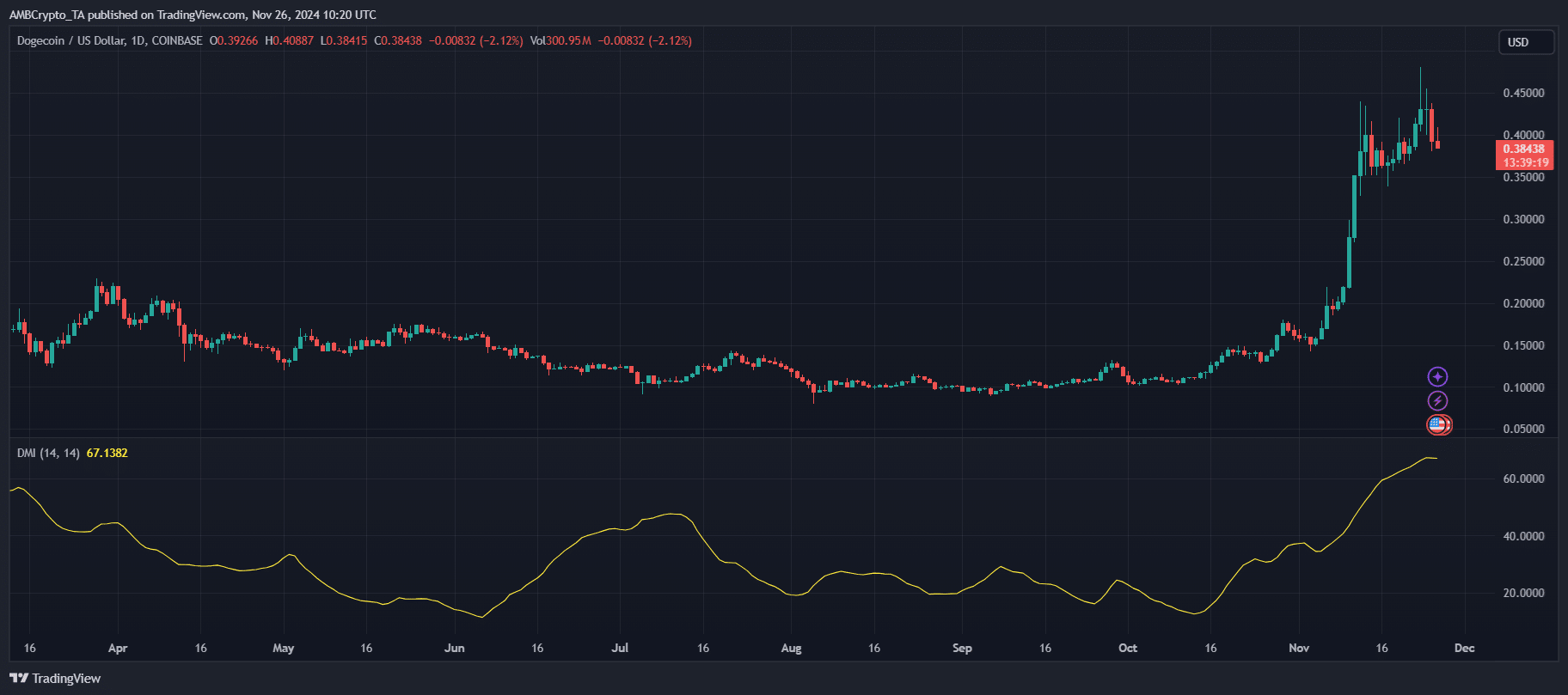

The ADX, a vital indicator of trend strength, surged to 68.00, confirming Dogecoin’s robust bullish momentum. This reading signifies a well-established uptrend, suggesting that DOGE could break past the $0.40 mark with continued market support.

However, the $0.43 resistance level has proven challenging, with the cryptocurrency failing to sustain momentum above it. Declining trading volume also signals caution, as sustained buying interest is critical to propelling DOGE higher.

On the downside, the $0.36 support level remains a crucial safety net for bulls, providing room for a rebound if selling pressure intensifies. Market participants should monitor volume trends closely to gauge the likelihood of a breakout or a retest of support.

Dogecoin price outlook: Key scenarios and market drivers

Dogecoin’s future price movements largely depend on whale activity and broader market conditions. In a bullish scenario, if whales continue accumulating and DOGE manages to break through the $0.43 resistance, it could push toward $0.48 in the near term.

Prolonged buying interest and positive sentiment might even fuel a rally, reigniting hopes of reaching the psychological $1 mark.

Read Dogecoin’s [DOGE] Price Prediction 2024–2025

On the flip side, a bearish scenario could emerge if whales resume selling or market support weakens, potentially driving DOGE back to $0.32. A drop below this level would signal a significant downside risk, undermining recent bullish momentum.

Traders should keep a close watch on whale movements and key price levels to navigate these uncertain market dynamics.