Dogecoin whales are accumulating – Good news for traders like you?

- Whale accumulation and rising address activity suggested Dogecoin could soon break key resistance levels

- Mixed technical signals and low transaction counts highlighted caution

In a significant development that has caught the attention of the crypto market, Dogecoin [DOGE] whales have acquired over 90 million DOGE within the last 48 hours. This strategic accumulation is a sign of growing confidence among large investors, potentially positioning Dogecoin for a major price breakout.

At press time, Dogecoin was trading at $0.3155, following a slight 0.19% dip over the last 24 hours. However, the real question remains whether this momentum can ignite the next bullish phase or lead to further consolidation.

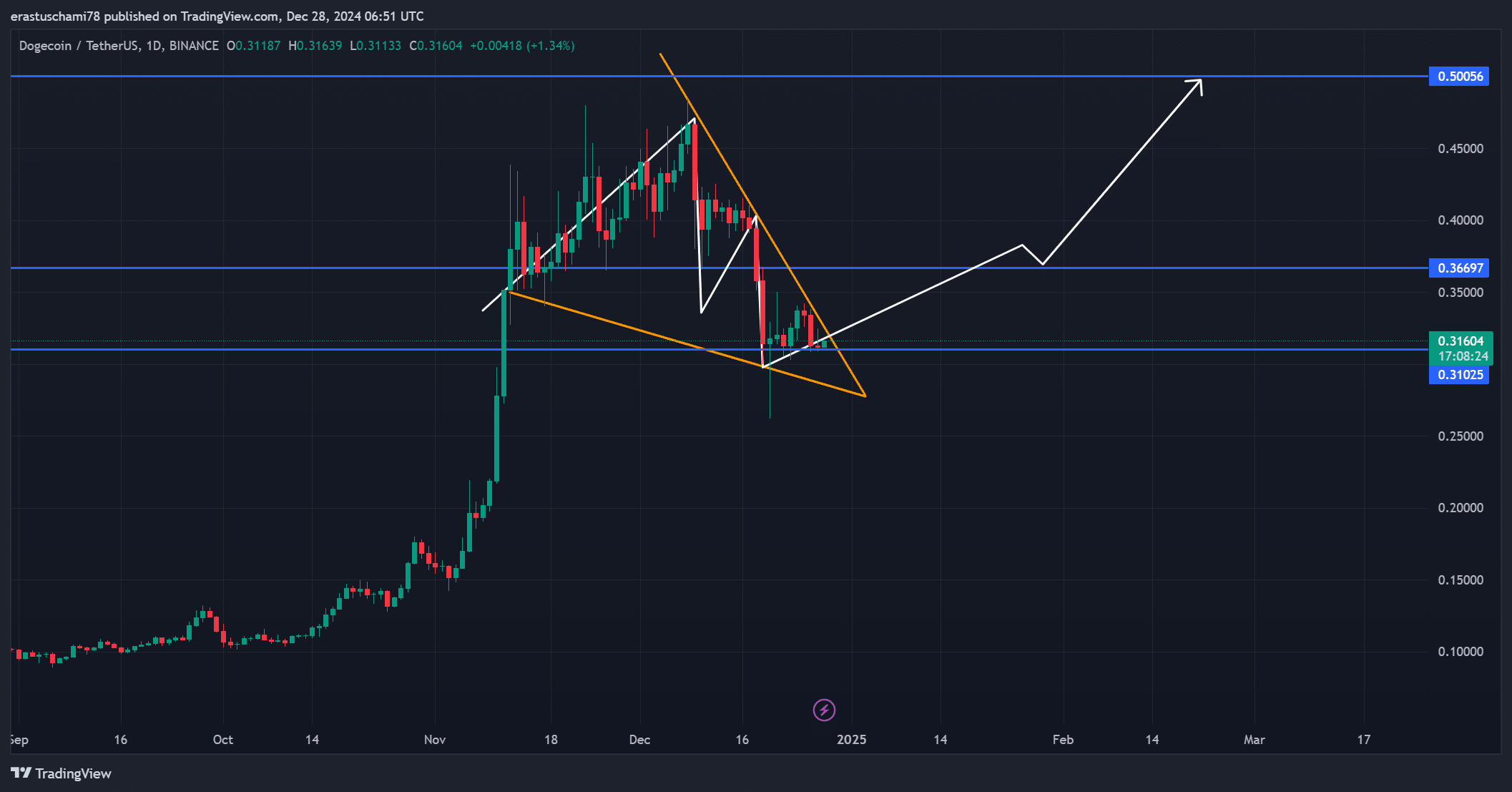

DOGE’s price action – A breakout or another consolidation?

At press time, Dogecoin’s price action indicated a tightly coiled setup as it traded within a bullish pennant pattern. The critical resistance level stood at $0.366, which could serve as a launching pad for a rally towards $0.50 if breached.

However, a failure to break above this resistance might prolong the consolidation phase, frustrating bullish traders.

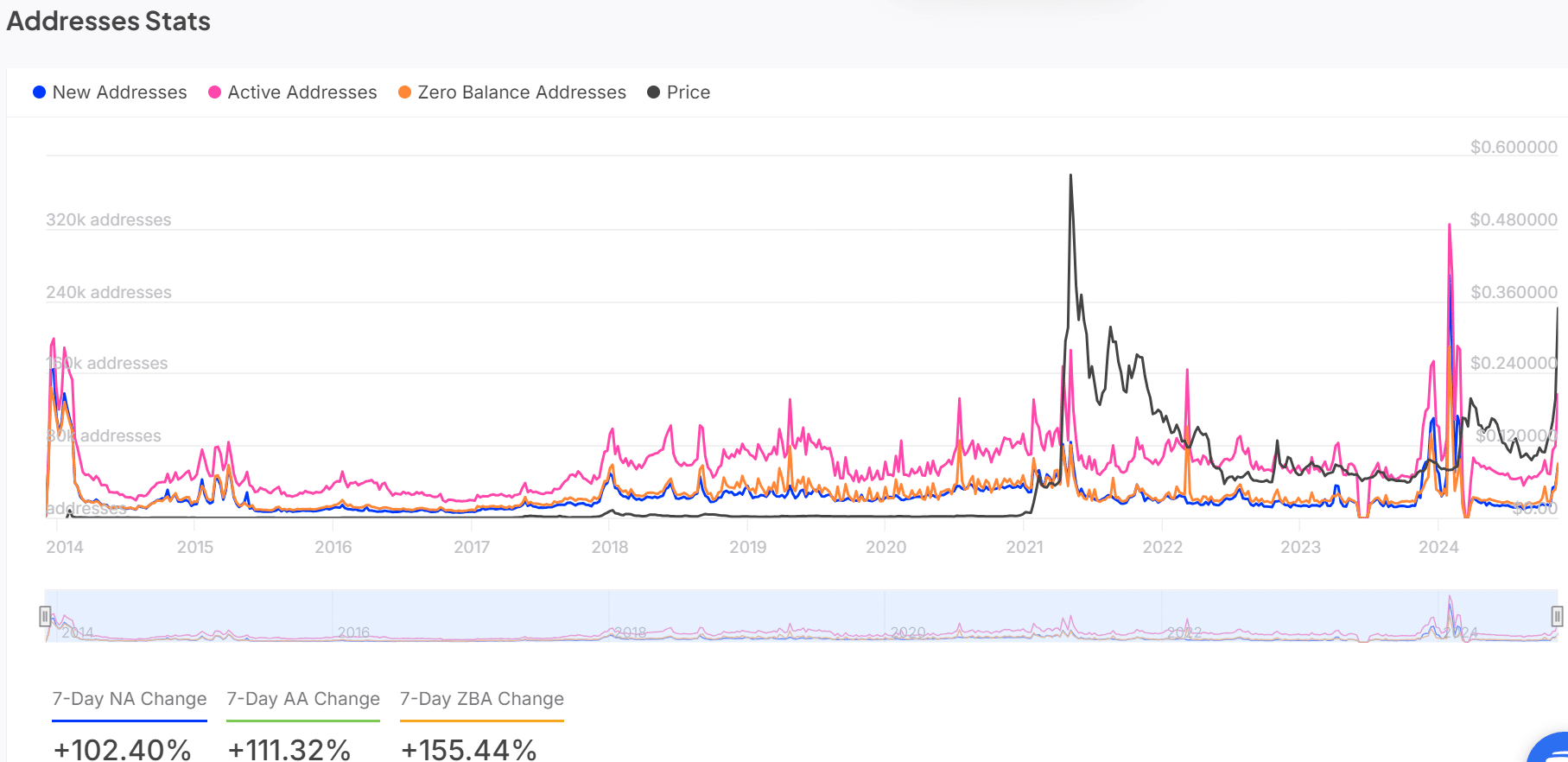

Analyzing Dogecoin’s address activity

Examining Dogecoin’s address statistics revealed an encouraging trend in network activity. The past week has seen a 102.4% spike in new addresses, while active addresses have climbed by 111.32%.

These numbers pointed to a surge in user engagement – A metric often tied to price growth. Moreover, zero-balance addresses have risen by 155.44%, indicating an influx of new participants testing the ecosystem.

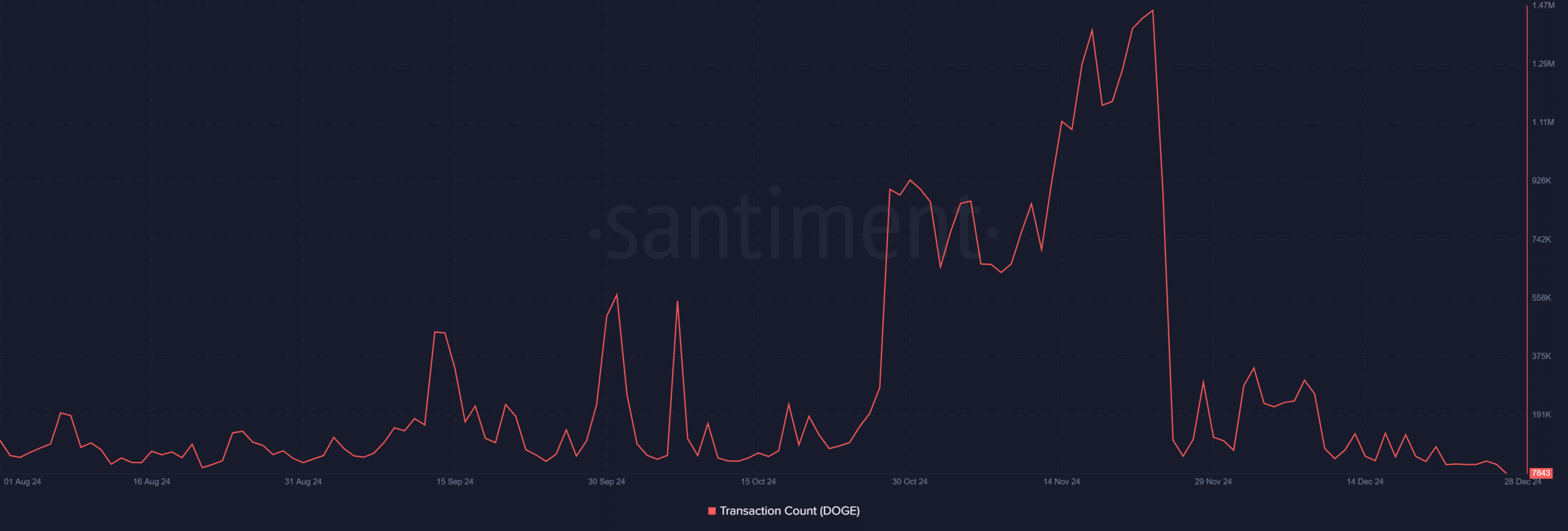

Dogecoin’s transaction count signals caution

Despite growing whale interest, Dogecoin’s transaction count dropped significantly, with only 7,843 transactions recorded at press time. This decline underscored muted on-chain activity, which could act as a headwind against bullish momentum.

However, such quiet periods have historically preceded sharp price moves, making this a situation worth monitoring closely.

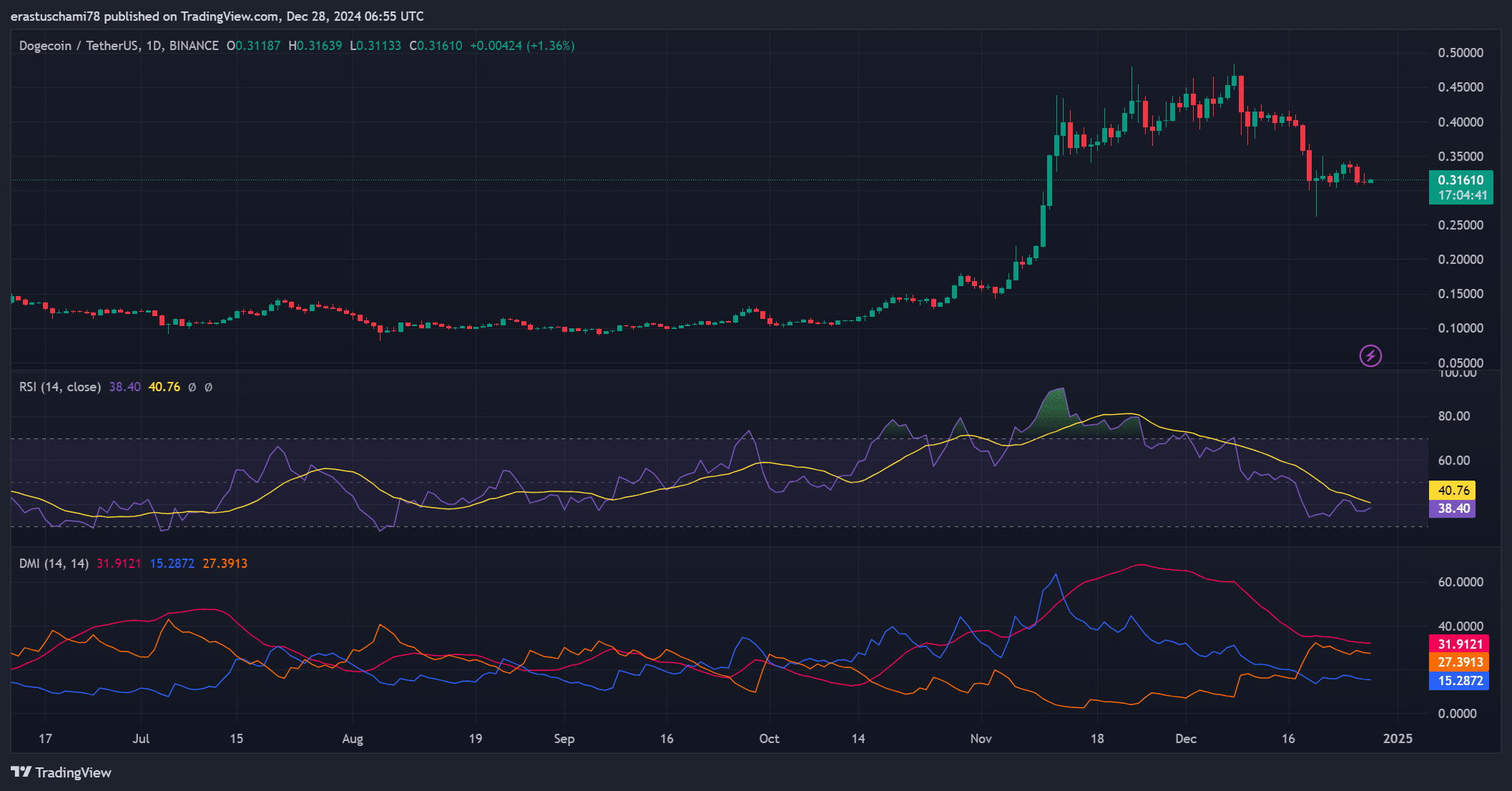

DOGE’s technical indicators

Dogecoin’s technical indicators highlighted a market at a crossroads. The Relative Strength Index (RSI) seemed to be hovering around 40.76, hinting at a market edging towards oversold conditions, but not quite there yet.

Meanwhile, the Directional Movement Index (DMI) alluded to bearish dominance, with the -DI at 31.91 overshadowing the +DI at 15.28. Therefore, while the technical outlook is not overtly bearish, it highlighted the importance of a strong catalyst to reverse the prevailing trend.

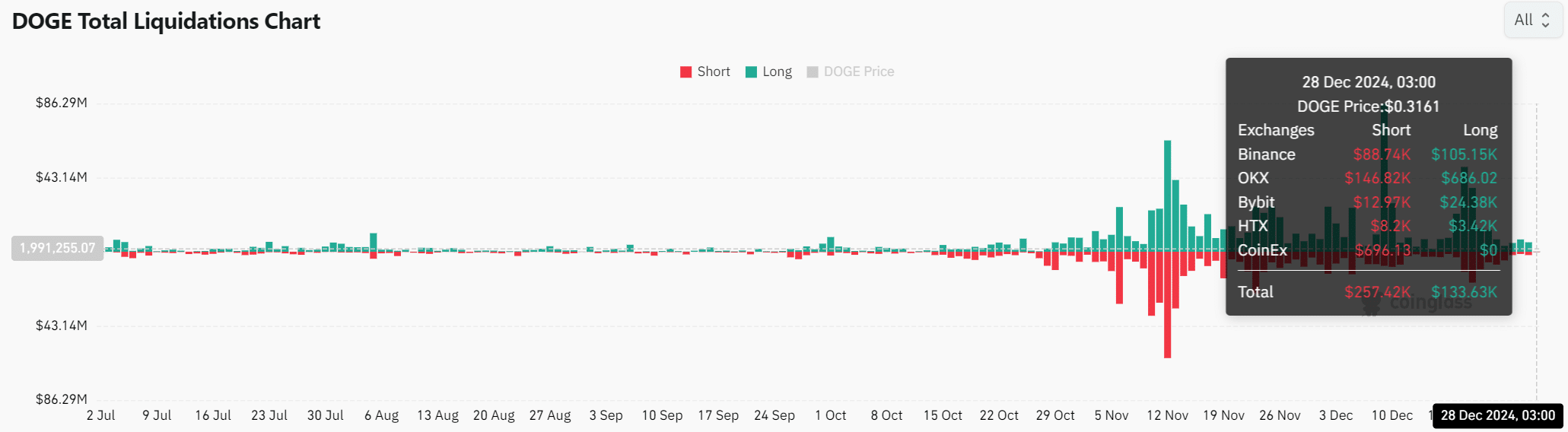

Liquidation data – Signs of shifting momentum?

Liquidation figures presented a nuanced perspective, with $257,420 in short positions liquidated compared to $133,630 in longs. This imbalance suggested that short-sellers are starting to lose control, potentially paving the way for a bullish reversal.

However, this shift will require sustained buying interest to turn the tide fully.

Read Dogecoin’s [DOGE] Price Prediction 2024–2025

Dogecoin’s recent whale accumulation and rising address activity highlight its potential for a breakout.

However, with low transaction counts and mixed technical signals, the current market remains uncertain. If DOGE successfully clears $0.366, the next bullish phase could begin. For now, cautious optimism prevails.