Dogecoin whales make strange moves: Is it time to buy DOGE?

- DOGE’s Weighted Sentiment has dropped to its lowest level since January.

- It has flashed a buying signal, which the meme coin’s MVRV ratio confirms.

Dogecoin’s [DOGE] Weighted Sentiment has fallen to its lowest level since the beginning of the year, data from Santiment has shown.

According to the on-chain data provider, this presented a good buying opportunity for traders waiting to accumulate the leading altcoin.

An opportunity to buy?

An asset’s Weighted Sentiment tracks the overall mood of the market regarding it. The metric considers the sentiment trailing the asset and the volume of social media discussions.

When it returns a negative value, the asset’s market is overwhelmed by negative sentiment, and its price is expected to fall. Conversely, when the value is positive, the bulls are in control.

According to Santiment, the decline in DOGE’s Weighted Sentiment flashed a buying opportunity. This is because market participants who have waited for –

“The crowd to give up on these large-cap altcoins may finally have their buy opportunity with FOMO at a 2024 low.”

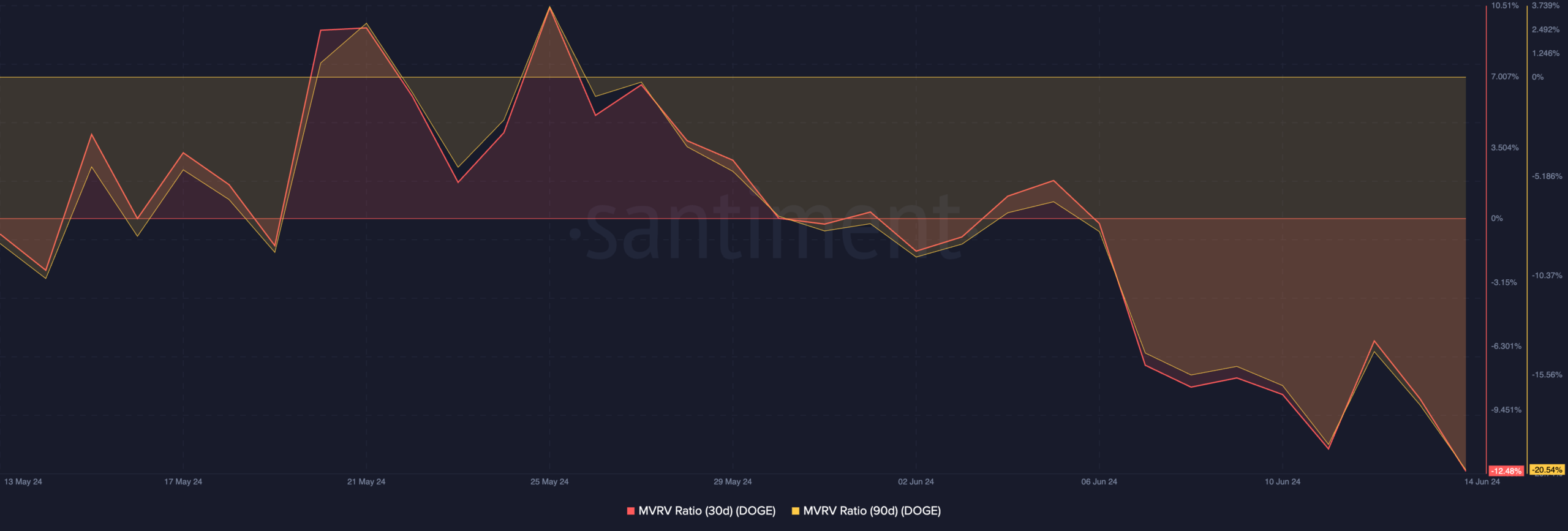

An assessment of the coin’s Market Value to Realized Value (MVRV) ratio confirmed this. AMBCrypto found that the token’s MVRV ratio assessed over different moving averages returned negative values.

Per Santiment’s data, DOGE’s MVRV ratios on 30-day and 90-day moving averages were -12.48% and 20.54%, respectively, at the time of writing.

An asset’s MVRV tracks the ratio between its current market price and the average price of its every coin or token in circulation.

The asset is deemed overvalued when the metric is positive or returns a value above one. This means that its current market is significantly higher than the price at which most investors acquired their holdings.

On the other hand, a negative MVRV value shows that the asset in question is undervalued. It suggests that its market value is below the average purchase price of all its tokens in circulation.

This often presents a good time to buy as it suggests that at its current price, the asset trades at a discount relative to its historical cost basis.

Dogecoin whales exit the market

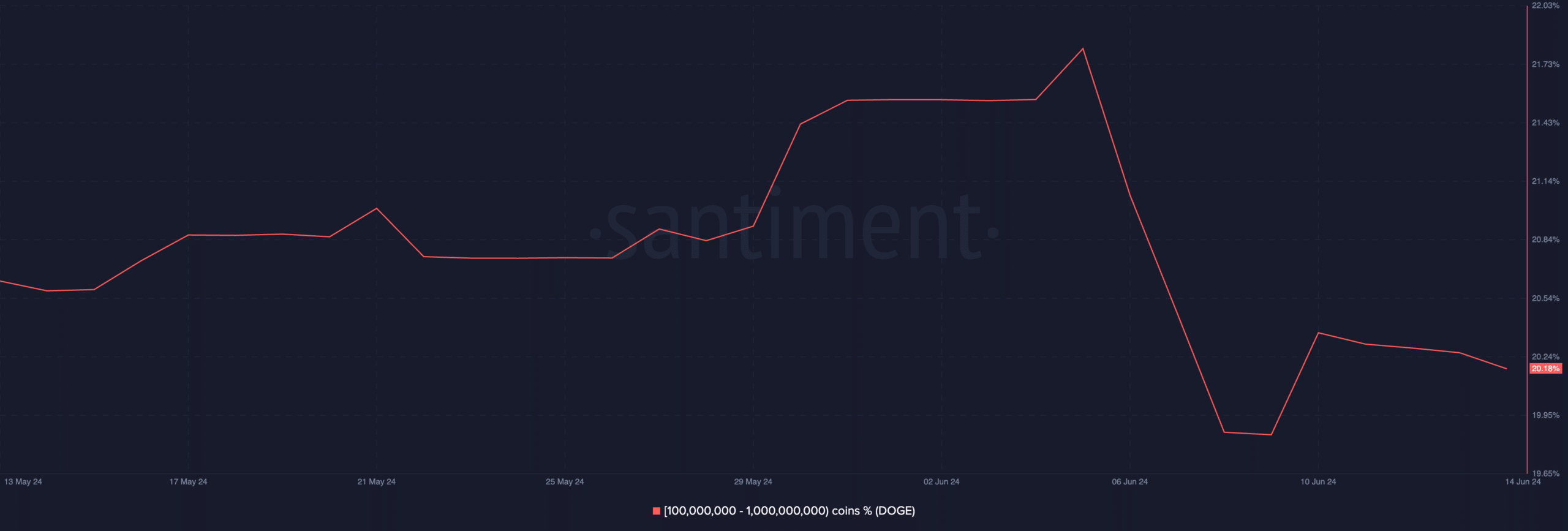

AMBCrypto found that there has been a decline in the amount of coins held by DOGE’s whales.

On-chain data from Santiment showed that between the 15th and the 16th of June, the DOGE’s supply held by its cohort of investors, with over 1,000,000,000 coins, dropped from 48.72% to 47.54%.

Interestingly, during that period, the share of DOGE’s supply held by its mid-sized whales, with a 100 million to 1 billion DOGE balance, spiked.

Is your portfolio green? Check out the DOGE Profit Calculator

This suggested they had accumulated the coins that DOGE’s largest whales dumped.

As of this writing, this group of DOGE whales held 20.18% of the coin’s total supply.