Dogecoin whales stir as Stochastic RSI warns of a correction

- Dogecoin whale activity sees a 63% surge in large transactions within 24 hours.

- Stochastic RSI hints at a possible short-term correction despite rising social volume.

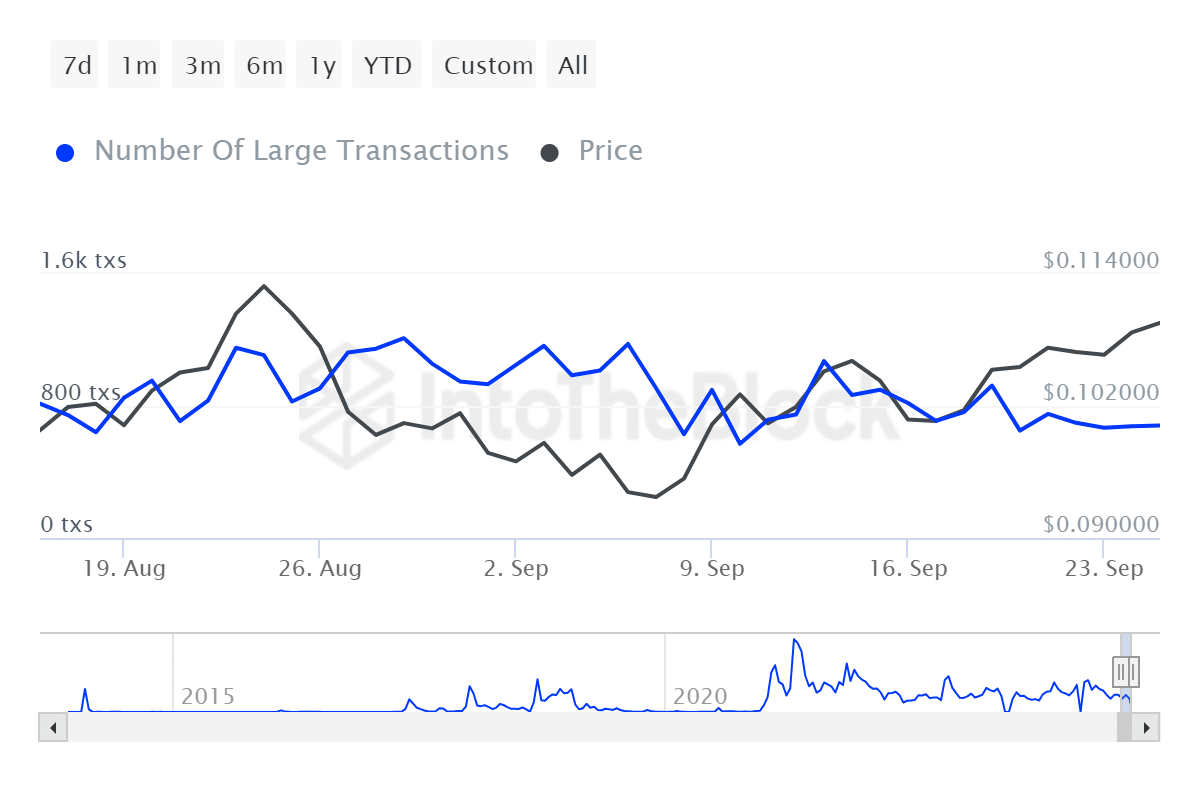

Dogecoin [DOGE] has recorded a spike in whale activities in the past 24 hours. Its large transactions surged by 63%, with whales moving 65.41 billion DOGE. This huge holding by the biggest players in the market represents 41% of Dogecoin’s total supply.

The aforementioned surging whale activity suggests that large investors are taking positions, which may be accompanied by increased market volatility.

A spike in whale transactions tends to precede potential significant price movements. When whales make such big moves on DOGE, the market usually follows through with their moves.

This could, therefore, be an indicator that a big price move might be on the cards.

Source: IntoTheBlock

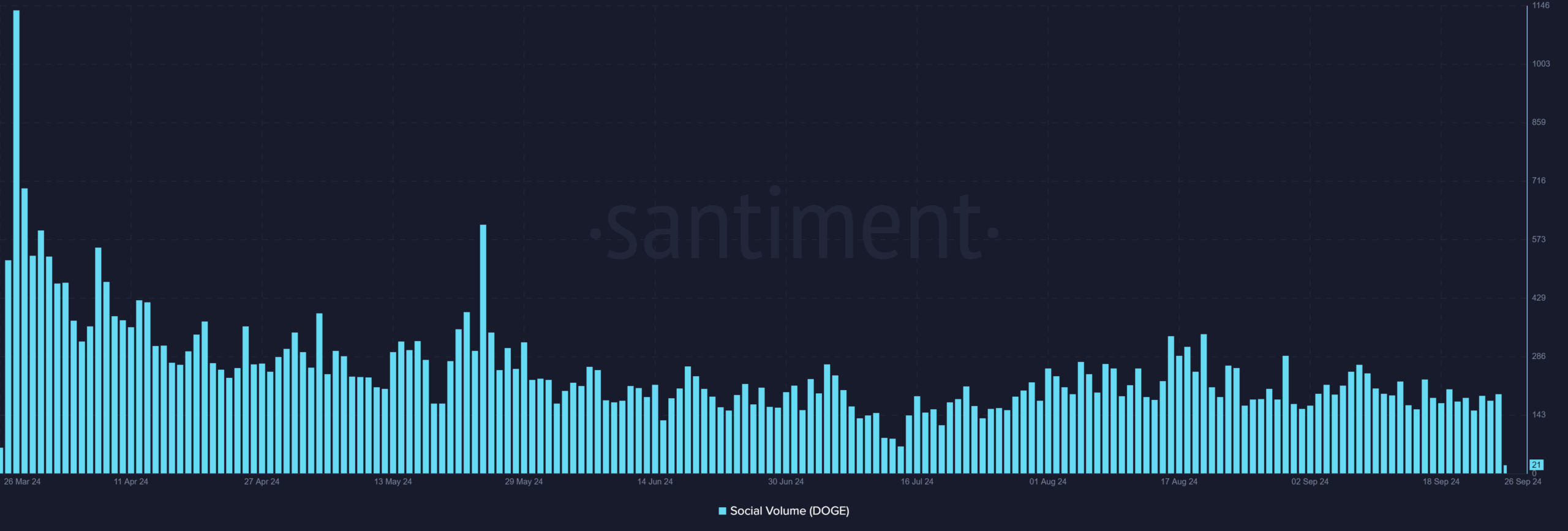

Dogecoin social volume is on the rise

Dogecoin social volume has been on an upward trajectory for the last three days. Social volume helps in the identification of some market sentiment.

Historically, higher volumes of conversations result in new investor interest that puts up demand.

Increased social volume may imply more chatter going on in the crypto ecosystem surrounding Dogecoin, which could influence speculations that may give it further boost.

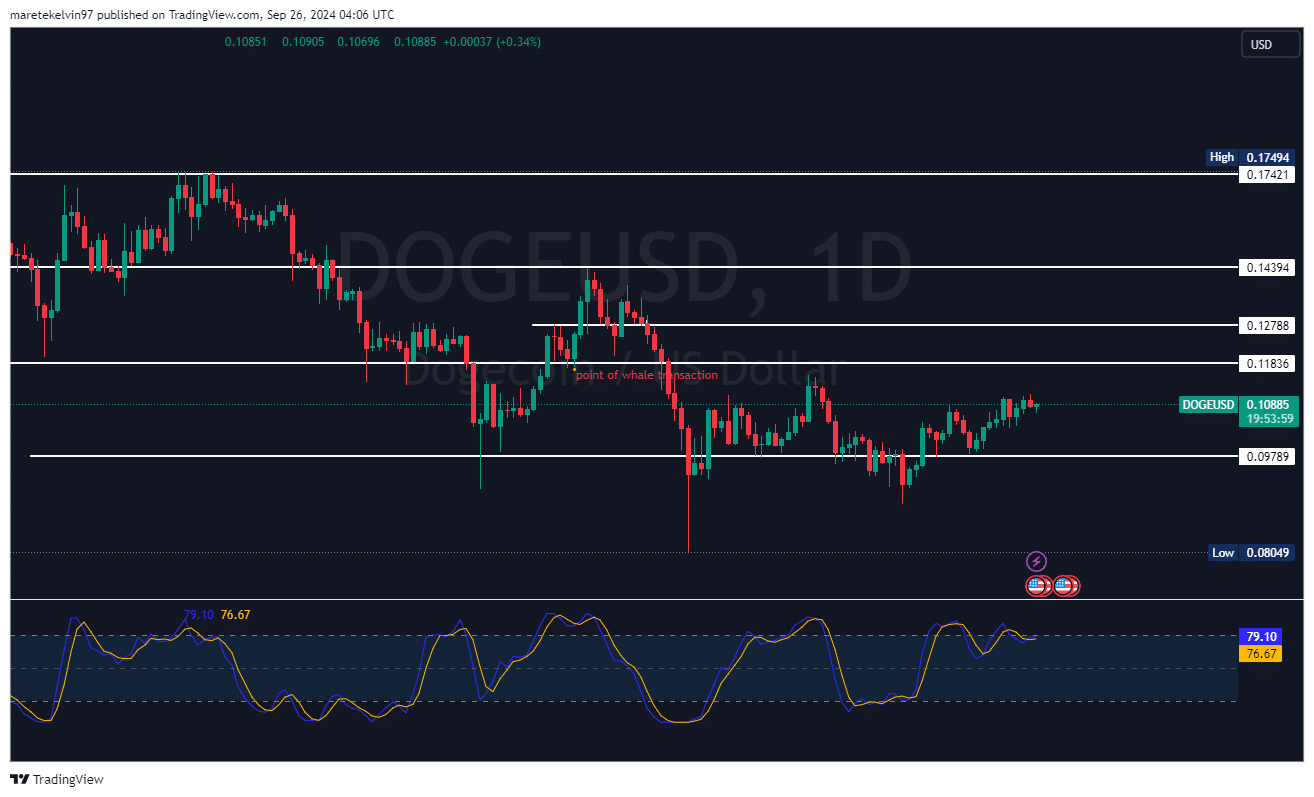

Stochastic RSI suggests a short-term correction

Despite these encouraging signs, the stochastic RSI has just recorded a bearish crossover. This suggests that the market might face a small correction before any upward momentum could resume.

Although Dogecoin has been flirting with a bullish breakout, this crossover suggests pulling back slightly before making its next move.

Read Dogecoin’s [DOGE] Price Prediction 2024–2025

Whale activity is high, and so is social interest. But the bearish stochastic RSI crossover is just a reminder that prior to any major price movement.Short-term corrections are bound to occur.

For now, holding firm and waiting for better signals might be the best approach.