Dogecoin zooms past March lows – More pumps likely?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- D1’s structure was bearish but could change if DOGE moves above 50% Fib level.

- DOGE’s open interest rates improved, and funding rates turned positive.

Memecoins fronted a remarkable recovery after Bitcoin’s [BTC] foray into the $30k zone. Dogecoin [DOGE], a tier-1 meme-coin, hiked over 9% in the past seven days, according to CoinMarketCap. It zoomed past the March low of $0.065, but bulls had to clear the 38.20% Fib level of $0.06906 to gain more leverage.

Is your portfolio green? Check out the DOGE Profit Calculator

Will bulls push forward?

At press time, price action climbed above the 23.6% Fib level of $0.06292, but D1’s market structure was still bearish. Moving above the 50% Fib level of $0.074 will flip the structure bullish.

In the meantime, the Chaikin Money Flow eased and registered an uptick above the zero mark, showing improved capital inflows into Dogecoin’s market. Similarly, the Relative Strength Index was about to cross the 50-mark for the first time since late April. The RSI movement could experience some resistance at the 50-mark.

So, a slight pullback is likely at the 38.2% Fib level of $0.069 and could ease at the March low of $0.065 or 23.6% Fib level of $0.06292 before attempting to continue the recovery. These levels could offer new buying opportunities, targeting the 50% Fib level ($0.074).

A close below the 23.6% Fib level ($0.063) will invalidate the bearish thesis. Such a move could increase bearish intent and sink DOGE towards $0.060 or $0.053.

Open interest and funding rates improved

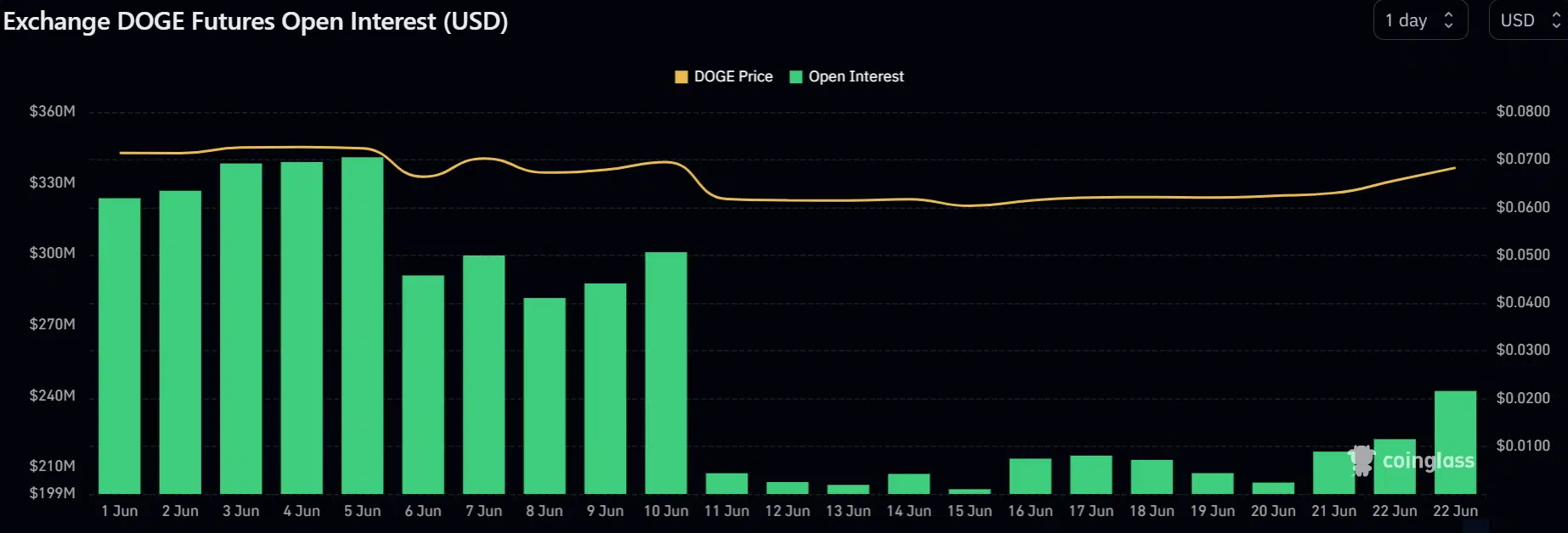

DOGE’s open interest (OI) rates, the total number of futures contracts at any given time, decreased from >$300 million in early June to around $200 million in the second half of June. At the time of writing, the OI registered an uptick and climbed above $240 million, reinforcing bullish sentiment in the futures market.

How much are 1,10,100 DOGEs worth today?

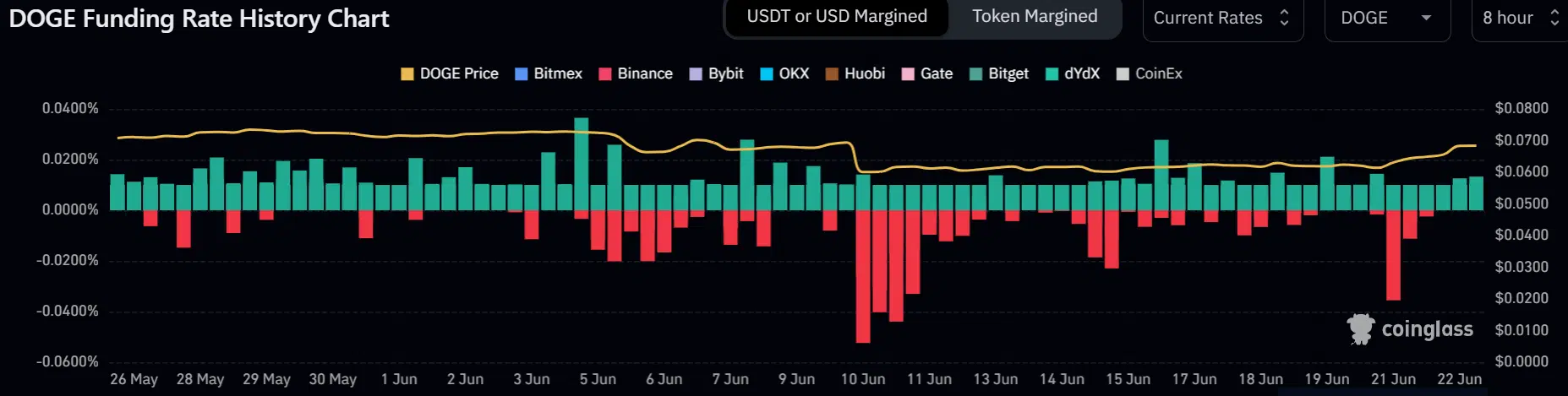

Similarly, the funding rates flipped positively after BTC retested the $30k, suggesting a likely further uptrend if BTC doesn’t register sudden losses in the coming days.