Dogecoin’s $1 billion loss means its $0.15 price target is…

- DOGE’s price might slip below $0.13 since liquidity in the derivatives dropped

- Fewer coins moved over the week, indicating that the cryptocurrency’s run has taken a break

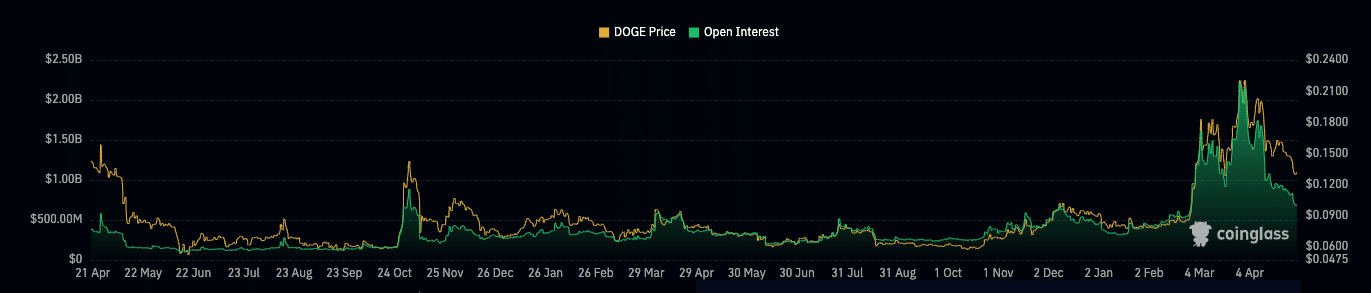

According to Coinglass, since 1 April, Dogecoin’s [DOGE] Open Interest has fallen from $2.11 billion to $780 million. Here, Open Interest (OI) is the value of open positions in a contract. The metric increases or decreases based on net positioning.

If the OI increases, it means new money is coming into the market and buyers are aggressive.

A lot of money leaves DOGE

However, the OI decline for Dogecoin implies that contracts worth over $1 billion were closed in a little over 30 days. From a trading perspective, this means that sellers have been aggressive while most traders took liquidity out.

This inefficiency has also affected DOGE’s price. According to CoinMarketCap, DOGE was valued at $0.13 at press time. This figure alluded to a 28.11% price fall in the last 30 days alone.

While the memecoin’s price appreciated over the last 24 hours, in light of the OI decline, it does not seem that the aggressive downside would stop soon. If this is the case, DOGE might either hold on to $0.13 or a decline to $0.11 could be next.

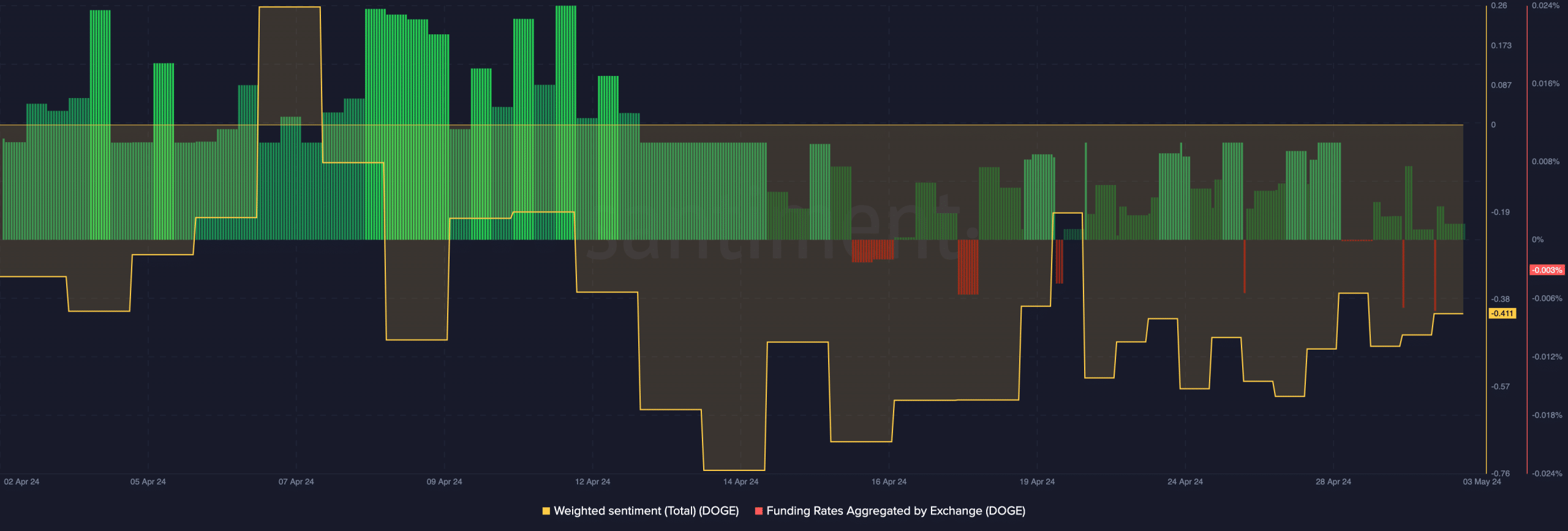

Furthermore, the broader market shares a similar sentiment too. AMBCrypto noticed this after evaluating the Weighted Sentiment.

According to data from Santiment, Dogecoin’s Weighted Sentiment was -0.411. This reading implies that market participants do not expect a short-term recovery for DOGE.

Besides this, we considered the Funding Rate. Funding Rate is the cost of holding an open perp position. If funding is positive, it means longs are paying shorts a fee.

No way to $0.15 now

A negative reading implies that shorts are paying longs. At press time, DOGE’s Funding Rate was positive but moving lower. As the price moves higher and funding drops, perp buyers might be in disbelief.

With little to no aggression from longs, DOGE’s price might evade flipping the overhead resistance. Therefore, an upswing past $0.15 might be impossible within the next few days.

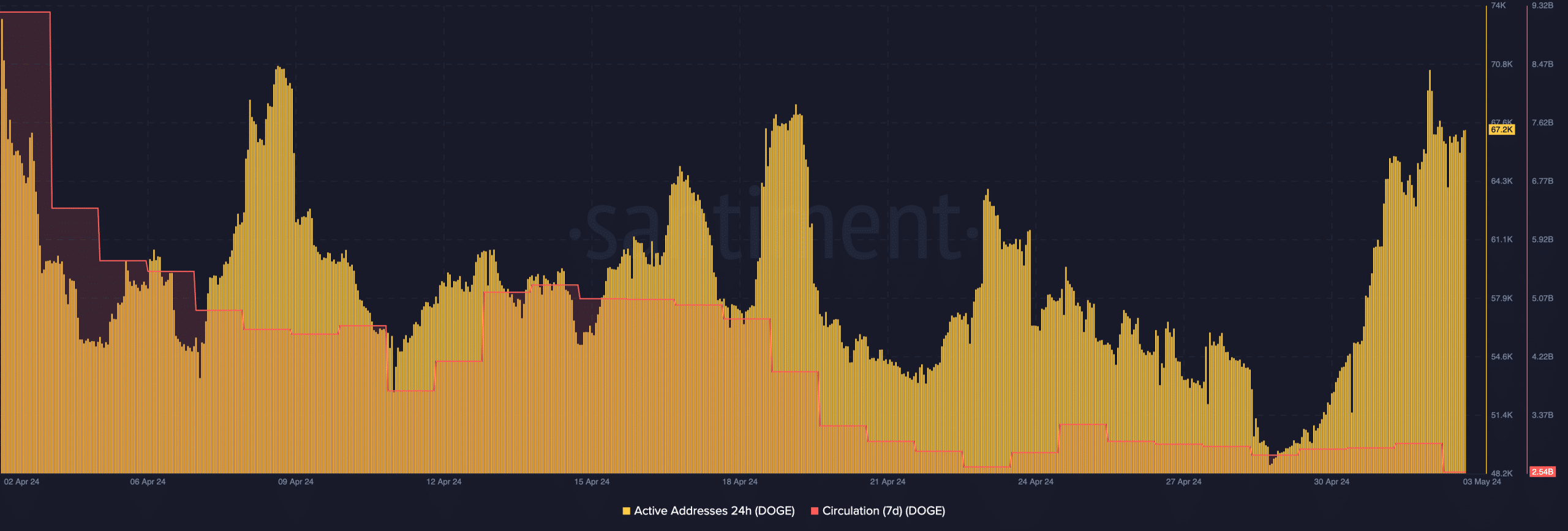

Furthermore, activity has started to rise again on Dogecoin’s network. On 25 April, the number of active addresses on the network was less than 50,000.

Active addresses show the number of wallets interacting with a project. At press time, that number had increased to 67,200— Meaning that users are back to making a lot of transactions on the network.

However, this metric was nowhere near the levels seen when DOGE changed hands at $0.20. If the metric stays at this level, DOGE’s price might hike, but it is almost certain that the uptrend will not last.

Is your portfolio green? Check the DOGE Profit Calculator

Additionally, the one-day circulation was 2.54 billion, indicating that Dogecoin’s usage fell on the charts. Ergo, as long as fewer coins are moved, DOGE might remain stuck within a tight range.