Dogecoin’s 15% rise in 7 days means THIS for your DOGE holdings

- Dogecoin’s price increased by more than 15% in the last seven days.

- Most metrics and market indicators looked bullish on DOGE.

Dogecoin [DOGE] investors were rejoicing as the meme coin had a comfortable weekly rally.

The good news was that the latest price uptick allowed the meme coin to go above a key resistance level, which can result in a macro-bull rally soon.

Dogecoin breaks a barrier

Dogecoin’s price dipped to $0.12 on the 1st of May, but soon after that, it gained bullish momentum. The uptrend allowed the meme coin to push its price up by 15% in the last seven days.

According to CoinMarketCap at the time of writing, $0.1635 has a market capitalization of over $23 billion.

A possible reason behind this surge could have been Elon Musk.

AMBCrypto reported earlier how Tesla updated the FAQ section on its website, stating that DOGE may now be used to purchase even more Tesla products.

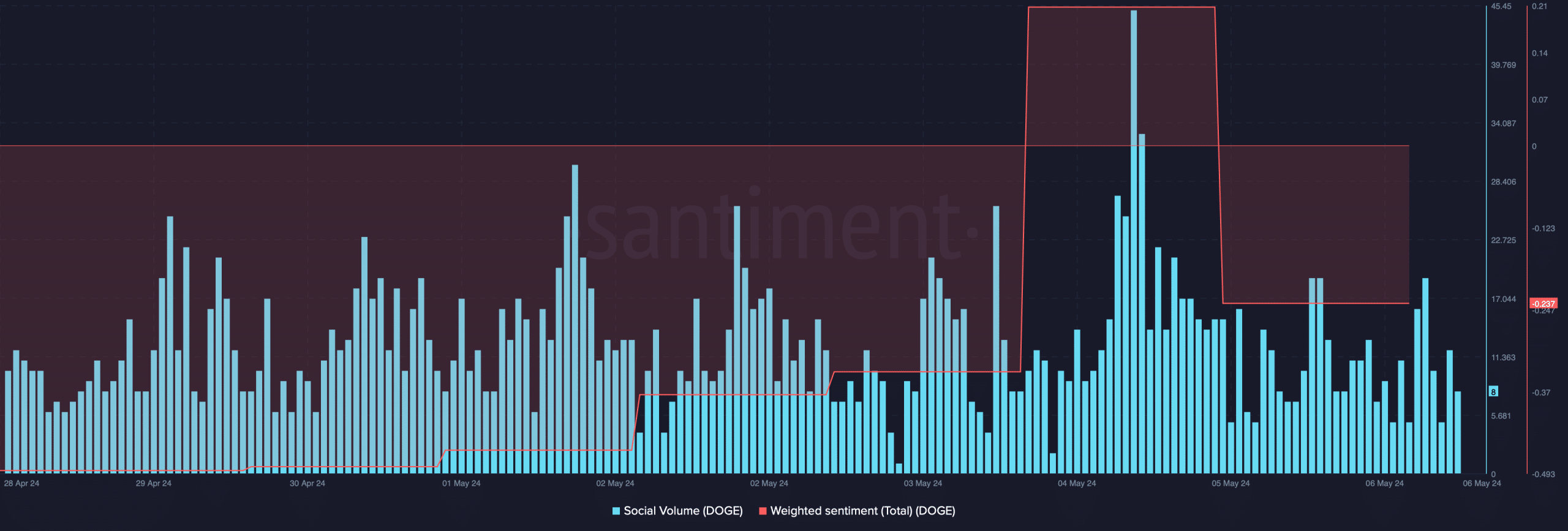

It was interesting to note that despite the daily price uptick, sentiment around DOGE remained bearish, as evident from the dip in its Weighted Sentiment.

Its Social Volume also declined after spiking on the 4th of May.

Rekt Capital, a popular crypto analyst, recently posted a tweet that gave hopes for a further rise in the meme coin’s price.

As per the tweet, Dogecoin has just flipped a multi-year resistance into new support, putting an end to its macro downtrend.

The tweet also mentioned that this development has now confirmed a macro uptrend for DOGE, which might allow it to reach new highs in the coming months.

Dogecoin’s possible weekly targets

Though the macro-uptrend has begun, it would be ambitious to hope DOGE touches an all-time high anytime soon. Therefore, AMBCrypto analyzed DOGE’s metrics to find which way it was headed this week.

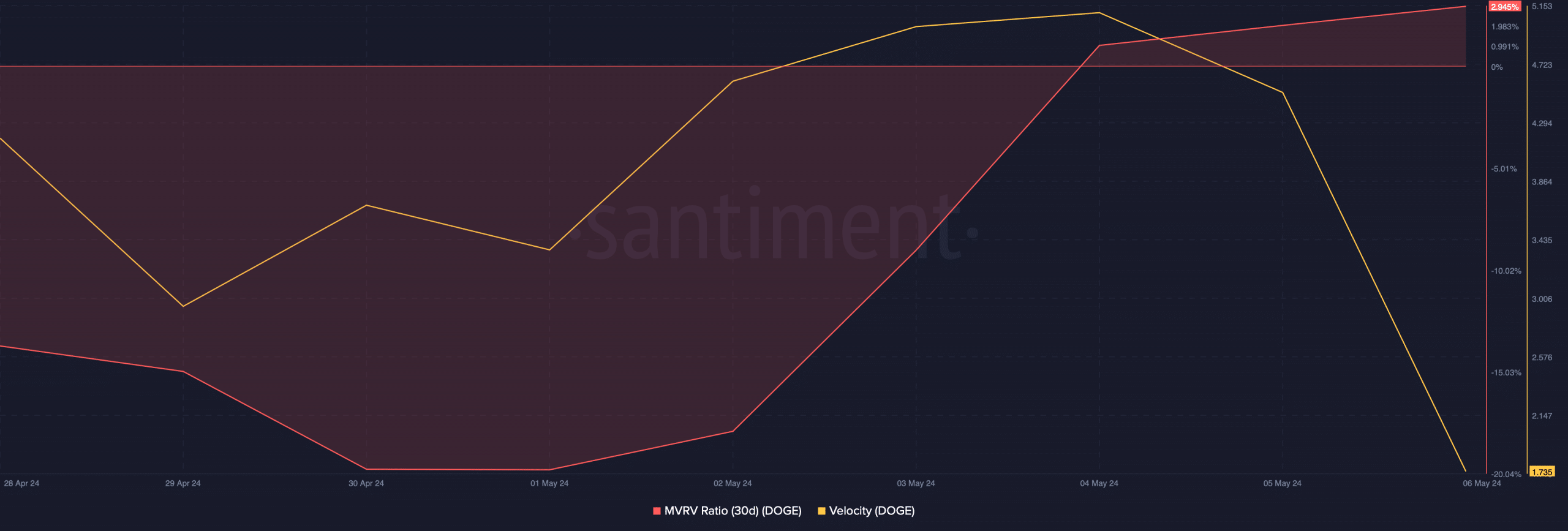

Our analysis of Santiment’s data revealed that the meme coin’s MVRV ratio turned positive. This meant that more investors were in profit.

Its velocity also shot up, indicating that DOGE was used more often in transactions within a set time frame.

A few of the technical indicators also looked pretty bullish. For instance, the MACD displayed a clear bullish crossover.

The Relative Strength Index (RSI) also registered an uptick, indicating that the chances of a continued price surge were high. However, the Money Flow Index (MFI) was bearish as it remained under the neutral mark.

Realistic or not, here’s DOGE’s market cap in BTC’s terms

To see the possible targets DOGE might reach if the bull rally continues. Our analysis of Hyblock Capital’s data revealed that it will be crucial for DOGE to cross $0.1669, as liquidation would rise sharply at that level.

A successful breakout above that mark would open the door for DOGE to touch $0.18 or $0.19.