Dogecoin’s 200 mln accumulation: Will it help DOGE see a sustained rally?

- Whales accumulated 200 million DOGE, signaling potential for future price growth despite volatility.

- DOGE’s stock-to-flow ratio has risen sharply, indicating increased scarcity and upward price pressure.

Whales have accumulated over 200 million Dogecoin [DOGE] over the past two weeks, showing strong confidence in the asset despite ongoing volatility.

This significant increase in holdings suggests that large investors believe in the memecoin’s potential for future growth.

As of press time, Dogecoin was trading at $0.1929, up by 4.59% in the last 24 hours. Therefore, this whale accumulation could potentially signal the start of a price rally, though market dynamics will ultimately dictate the next moves.

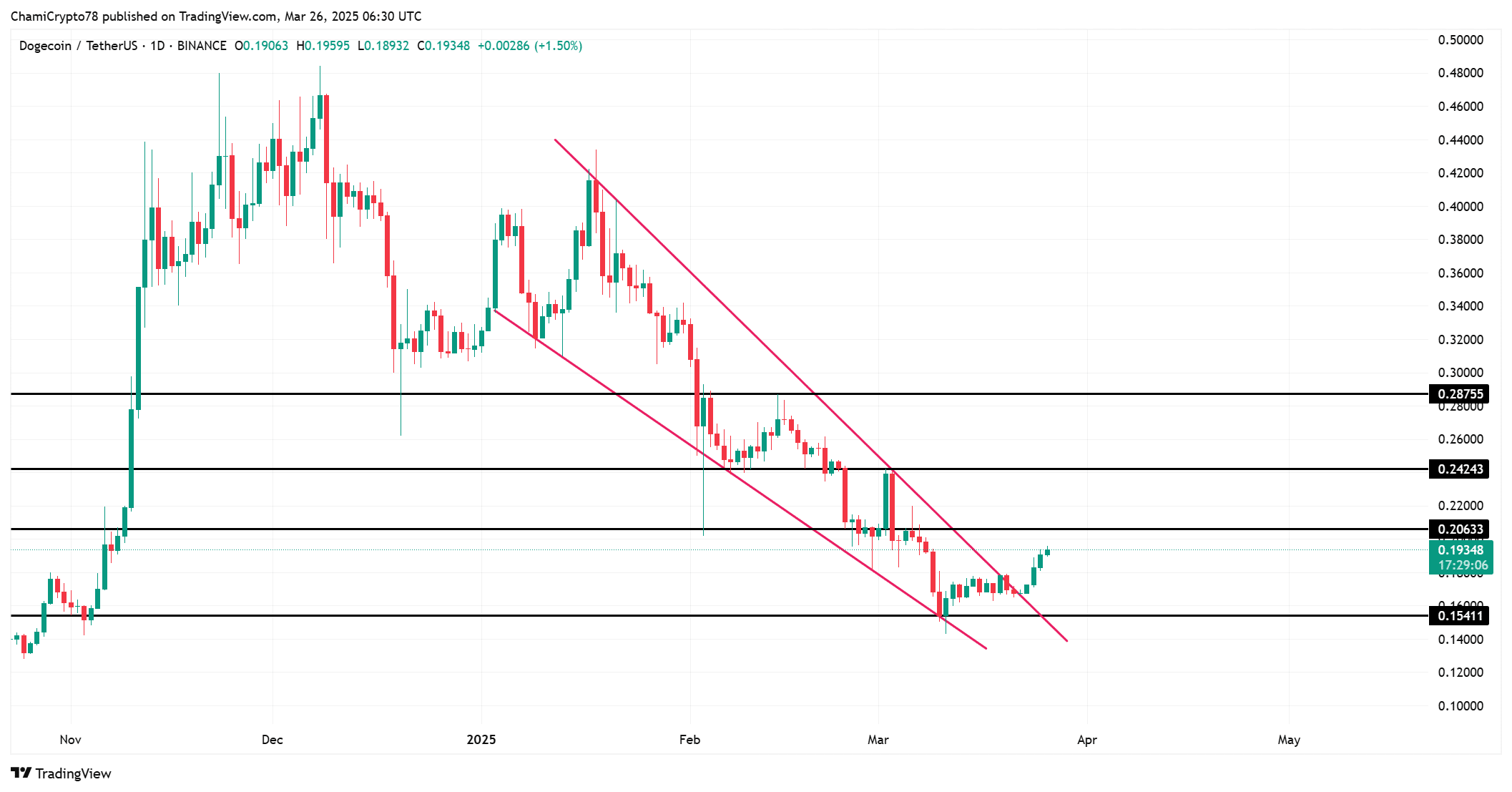

Dogecoin: Breaking through key levels

A closer look at Dogecoin’s recent price action reveals some interesting developments. After struggling in a descending wedge channel, Dogecoin broke out successfully and bounced from a key support level of $0.24243.

With the price is now hovering around $0.19311, it faces immediate resistance at $0.24243, which will be crucial for further upward movement.

The price action demonstrates a potential turning point, as breaking through this resistance could lead to a more sustained rally.

However, the success of this move depends on whether DOGE can maintain its upward momentum and not fall back into the descending wedge channel.

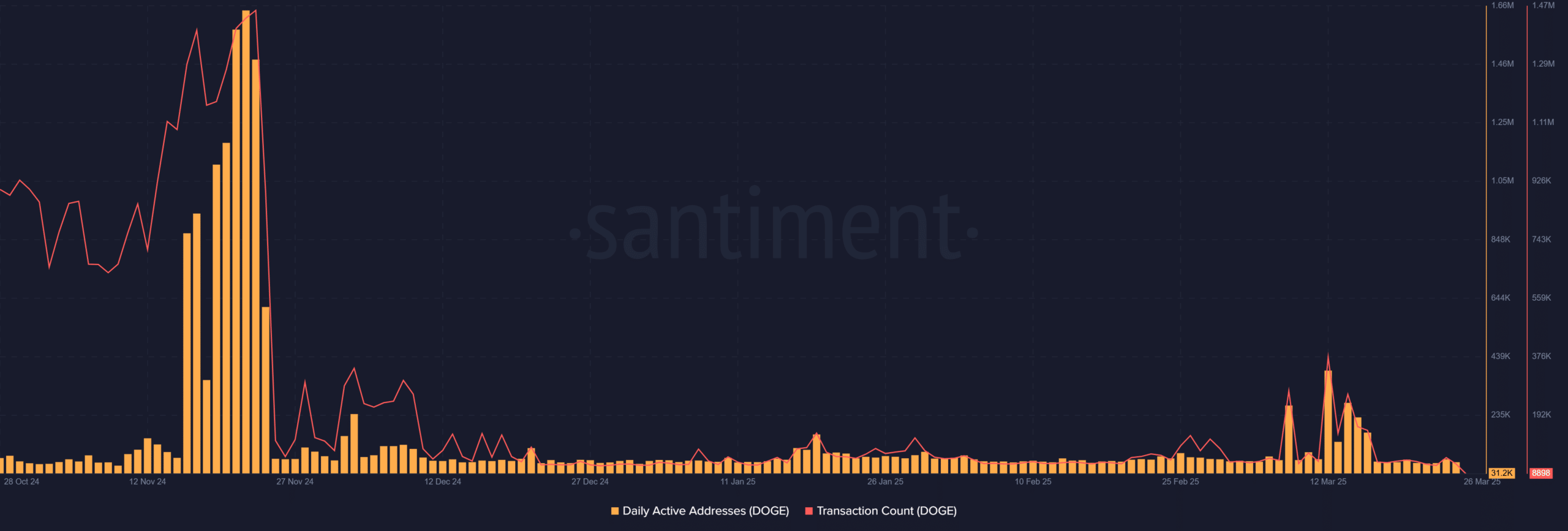

DOGE daily active addresses and transaction count: Still low

Despite the positive whale activity, Dogecoin’s network remains relatively inactive in terms of daily active addresses and transaction volume.

At press time, Dogecoin has only 31,212 active addresses, with a low transaction count of 8,898.

These figures suggest that while large investors are actively accumulating DOGE, the broader market participation remains limited.

Therefore, for Dogecoin to experience a more significant rally, it will need an increase in user adoption and transaction activity, which can help fuel sustained price growth.

Without these factors, any gains may be short-lived, driven primarily by whale influence.

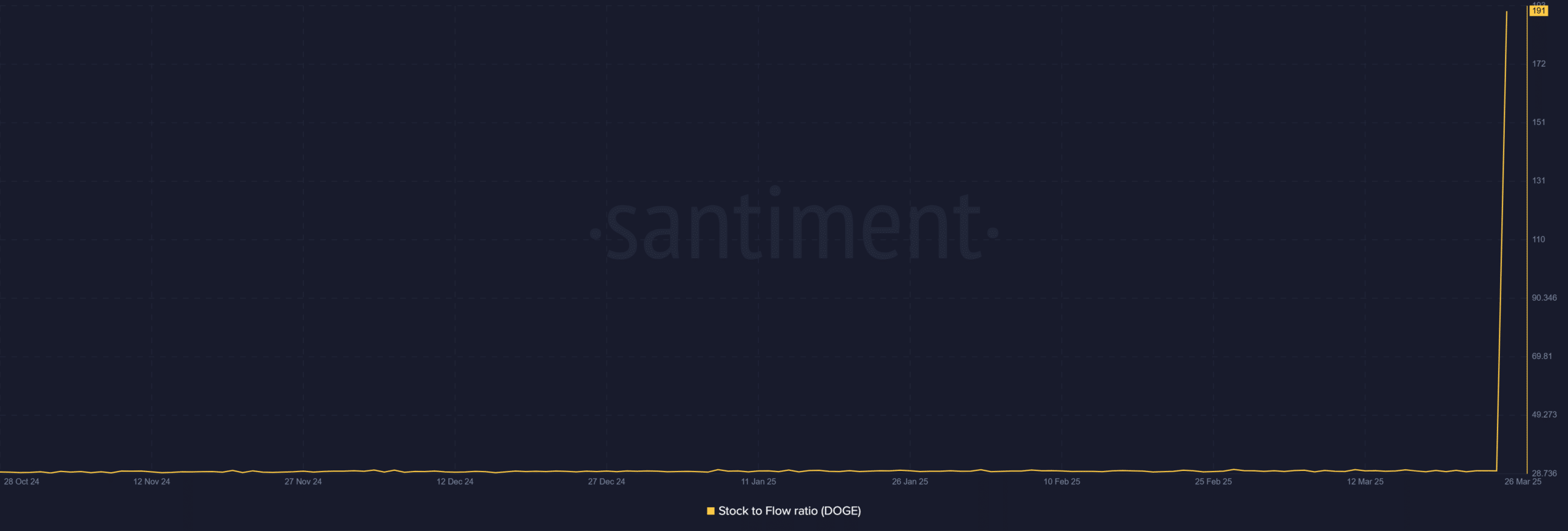

Sharp increase and implications

The stock-to-flow ratio for Dogecoin has seen a sharp rise, currently sitting at 191.12. This indicates a potential reduction in the available supply of DOGE, suggesting increased scarcity.

A higher stock-to-flow ratio often correlates with upward price pressure, as fewer coins in circulation can lead to higher demand.

However, this metric alone is not enough to guarantee long-term price growth.

Additionally, the rise in the stock-to-flow ratio reflects the broader market’s response to limited supply, but it is essential for this trend to be sustained in order for the price to climb further.

Can Dogecoin hold momentum for a price rally?

Whale activity and a sharp rise in Dogecoin’s stock-to-flow ratio provide a strong case for the possibility of a price rally.

However, the current lack of broad market participation, as indicated by the low number of active addresses and transactions, could limit the potential for a sustainable increase in price.

Therefore, while the whale accumulation points to optimism, significant price movement will depend on greater market engagement and sustained increases in supply scarcity.