Dogecoin’s 30-day low after 10% fall – Time to exit the market?

- Dogecoin’s value has fallen by double digits over the last seven days

- Its declining Futures open interest pointed to liquidity exit from its derivatives market

The market’s leading memecoin Dogecoin [DOGE] extended its seven-day losses as it failed to react positively to post-halving hype. At press time, the altcoin was valued at $0.15, logging a minor 0.13% price uptick in the last 24 hours, according to CoinMarketCap.

In fact, DOGE’s price has fallen by 10% over the past week, making it the only leading memecoin to see a double-digit price decline in the last seven days.

What can coin holders expect?

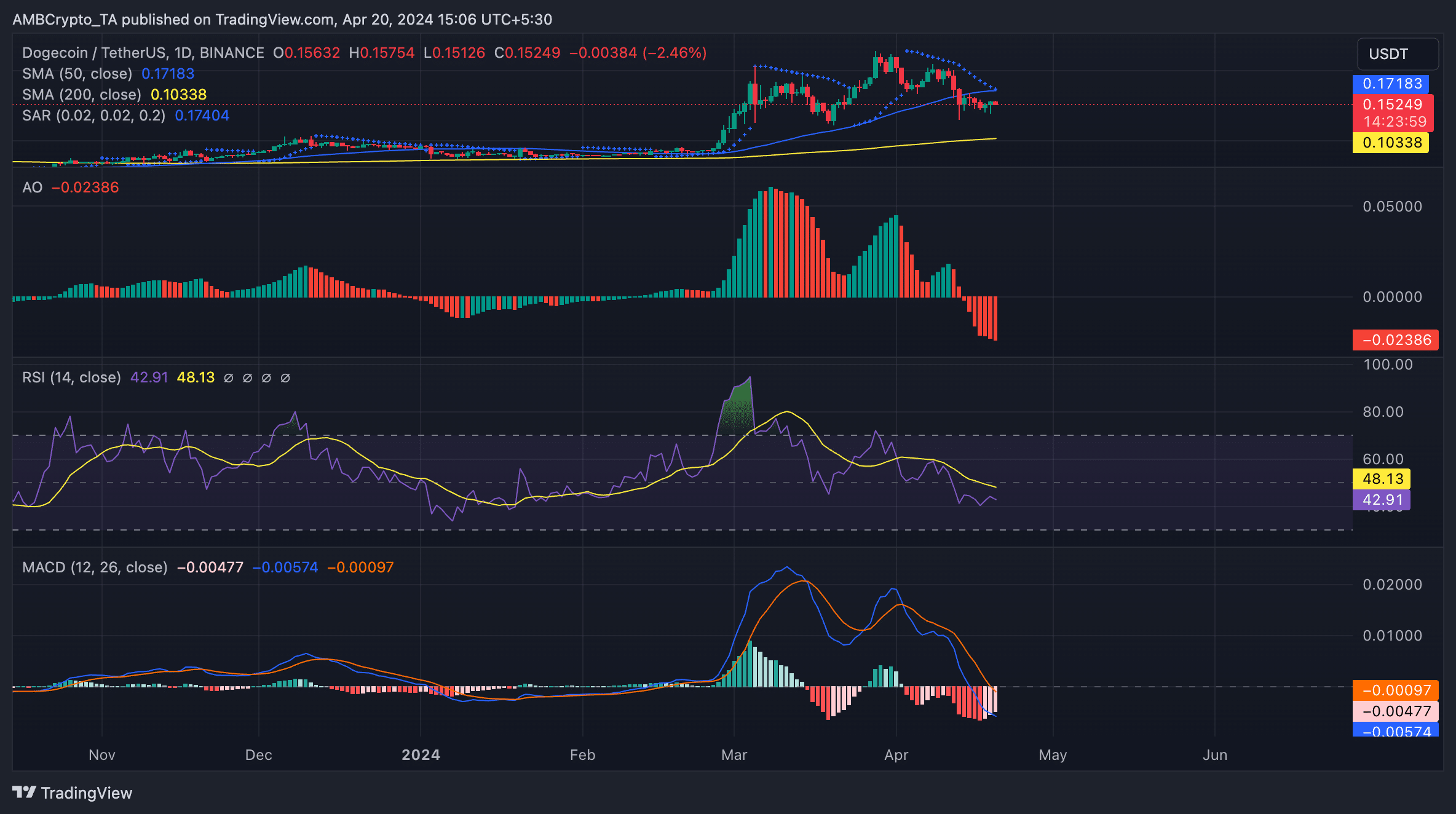

On the altcoin’s price charts, bearish readings remain significant. For starters, DOGE’s price crossed below its 50-day small moving average (SMA) and trended under its 200-day SMA, at press time.

DOGE’s decline below its 50-day SMA confirmed the shift in market’s sentiment from bearish to bullish. As it gears towards its 200-day SMA, the memecoin’s price may be approaching a long-term support level of $0.1.

Furthermore, the Awesome Oscillator, which measures DOGE’s market momentum, posted downward-facing red histogram bars, at the time of writing. This indicator has maintained this trend since 14 April. When an asset’s Awesome Oscillator trends in this manner, it is an indication that selling pressure is significant.

The decline in DOGE’s Relative Strength Index (RSI) below its neutral line confirmed the fall in demand for the memecoin. At press time, DOGE’s RSI had a reading of 42.87. Simply put, this value suggested that market participants favoured coin sell-offs over accumulation.

Additionally, the coin’s MACD line (blue) rested below its signal (orange) and zero lines at press time. This crossover highlighted that DOGE’s short-term trend is weaker than its longer-term trend.

Realistic or not, here’s DOGE’s market cap in BTC’s terms

Traders view this as a sign to exit their long positions and take short ones.

Another indication that long trades may not be beneficial in the long term was the position of DOGE’s Parabolic SAR at press time. The dots that make up the indicator rested above its price candles.

Market participants often interpret this to mean that a market is in a downtrend and a price decline will continue.

Finally, in the coin’s derivatives market, its Futures open interest cratered to a 30-day low. According to Coinglass data, DOGE’s Futures open interest had a value of $953 million, at the time of writing.