Dogecoin’s 7% hike leaves 73% addresses in profit – More incoming?

- DOGE rose to trade around the $0.133 price level on the charts

- Its price hike has pushed the altcoin into a bull trend

Dogecoin (DOGE) has seen significant gains over the last 24 hours, emerging as one of the market’s top performers over this period. However, that’s not all as this surge in price also led to a notable hike in the number of addresses moving into profit.

Dogecoin sees significant gains

An analysis of Dogecoin’s daily price trend revealed a significant bout of appreciation during the last trading session.

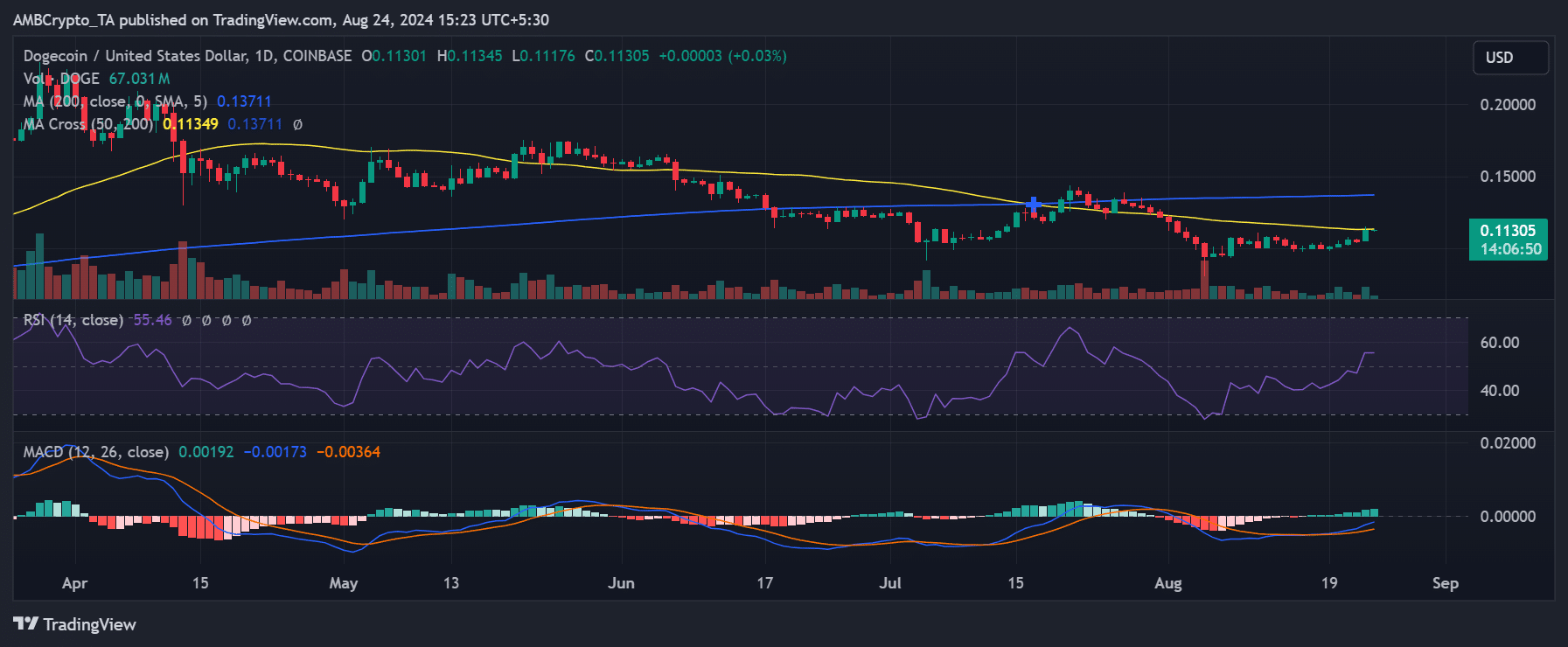

According to AMBCrypto’s analysis, Dogecoin surged by 7.37%, bringing its price to approximately $0.113. This surge allowed DOGE to breach its short-term moving average (yellow line). It had previously served as immediate resistance around its press time price level.

However, DOGE, at the time of writing, was yet to fully breach this resistance despite this upwards movement. Analysis revealed a stronger resistance level remaining at around $0.139, defined by its long-term moving average (blue line).

Additionally, Dogecoin’s Relative Strength Index (RSI) crossed above the neutral line for the first time in nearly a month. It had a reading of around 55.

This movement above the neutral line indicated a bullish trend, suggesting that momentum has been building in favor of further price hikes.

More Dogecoin accounts enter profit

According to data from IntoTheBlock, the latest price hike led to a significant rise in the number of Dogecoin addresses that are “in the money” or profitable. Currently, 4.72 million addresses, representing 73.62% of the total addresses holding DOGE, are in profit.

Meanwhile, 1.61 million addresses, or 25.04%, are “out of the money,” meaning they are holding at a loss, with the remaining 1.34% of addresses at break-even.

Further analysis revealed that if DOGE can successfully break through the resistance formed by its long-term moving average around $0.139, the percentage of profitable addresses could increase to around 80%.

This potential rise in profitability would further bolster investor confidence and could drive additional buying pressure, pushing the price even higher. The ability to surpass this key resistance level could be a crucial factor in Dogecoin’s sustained upward momentum.

DOGE playing catch-up with TON

At the time of writing, data from CoinMarketCap indicated that Dogecoin (DOGE) had a market capitalization of approximately $16.4 billion, placing it in the ninth position among cryptocurrencies by market cap. It currently trails Toncoin (TON), which holds the eighth spot with a market capitalization of around $17 billion.

– Is your portfolio green? Check out the Dogecoin Profit Calculator

Dogecoin’s latest uptick has improved the odds of DOGE catching up with TON in the market capitalization rankings. However, for DOGE to surpass TON and claim the eighth position, it will need to maintain this upward momentum and continue attracting investor interest.

Sustained price hikes and positive sentiment will be key factors in determining whether Dogecoin can close the gap and move up in the rankings.