Dogecoin

Dogecoin’s bullish breakout: Is $0.66 DOGE’s next stop?

Dogecoin broke above a bullish pattern, hinting at a price hike towards $0.66.

- DOGE’s trading volume increased along with the price.

- Selling pressure on DOGE increased in the last few days.

Dogecoin [DOGE] has once again turned volatile in the last 24 hours with its promising price pump. Thanks to the latest uptick, the world’s largest memecoin managed a breakout from a bullish pattern.

Will this clear DOGE’s path to $0.66?

Dogecoin turns bullish again

Dogecoin bulls once again gained control of the market, as the world’s largest memecoin’s price surged by nearly 8% in the last 24 hours.

With the latest pump, DOGE was

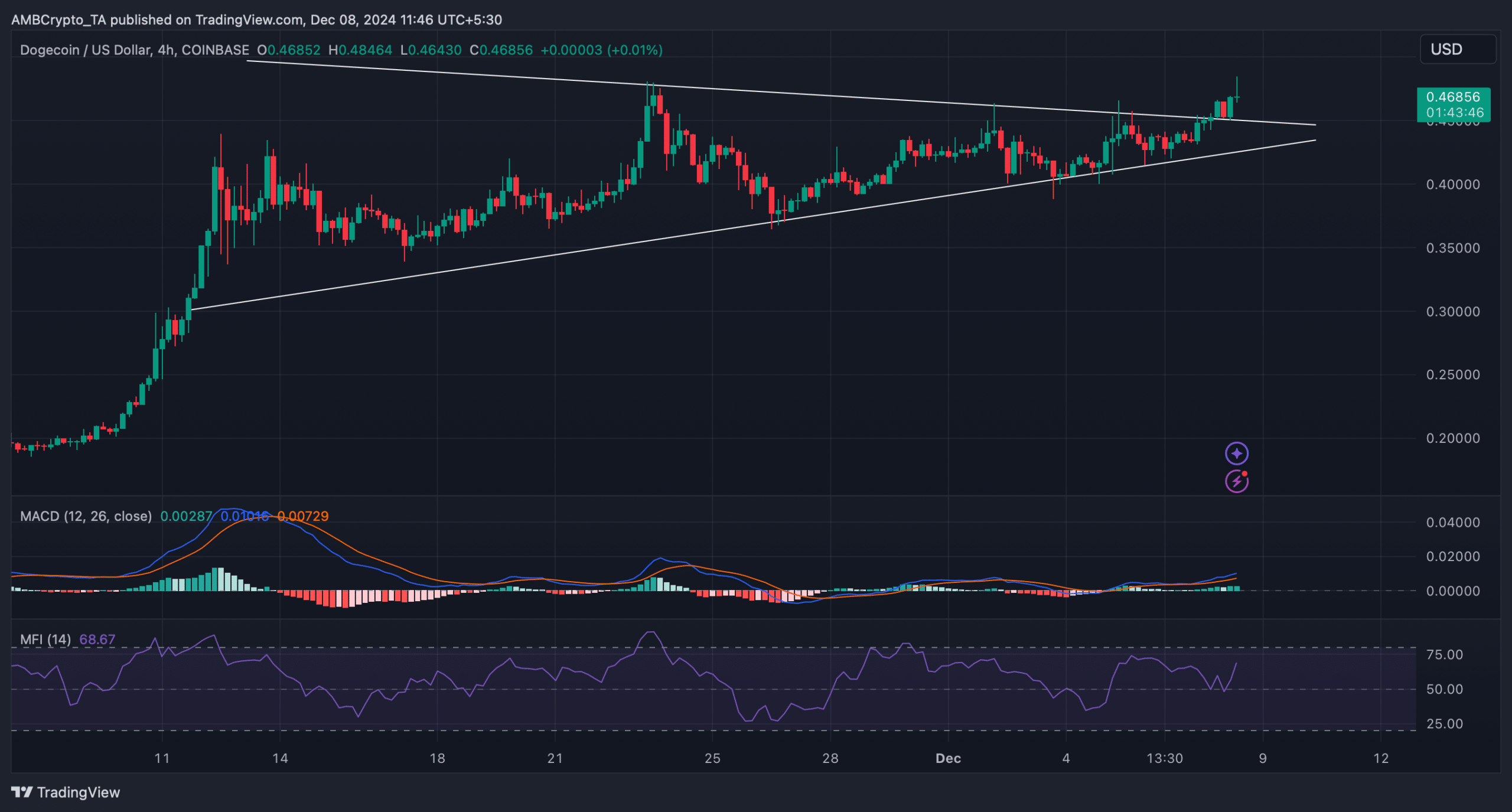

valued at $0.46 at press time, with a market capitalization of over $68.4 billion.The price hike allowed the coin to break above a bullish symmetrical triangle pattern. The pattern first emerged in early November and since then DOGE consolidated inside it, only to breakout on the 7th of December.

Meanwhile, the technical indicator MACD displayed a bullish upper hand in the market. DOGE’s Money Flow Index (MFI) also registered an uptick. A rise in the metric indicates that there is strong buying pressure in the market.

This increasing buying pressure can push Dogecoin towards its next target—$0.66.

However, such breakouts are often followed by slight corrections, which are usually a retest of the support before the start of a bull rally. Therefore, in case DOGE witnessed a pullback, investors shouldn’t panic.

What metrics suggest

The good news was that while DOGE’s price increased in the past 24 hours, the memecoin’s trading volume also surged by over 78%, acting as a foundation for the bull rally.

The big-pocketed players in the market also were trading the coin actively. This was evident from the rise in Dogecoin’s whale transaction count over the past seven days.

Additionally, the memecoin’s Long/Short Ratio registered an uptick in the 24-hour timeframe.

A hike in the ratio means that there are more long positions in the market than short positions—an indication of rising bullish sentiment in the market.

However, IntoTheBlock’s data revealed a bearish trend. Dogecoin’s netflow ratio increased in the last few days as it reached 4.68% from -2.33%.

This clearly meant that investors were dumping their holdings, causing selling pressure to rise.

Whenever selling pressure rises, it is followed by price correction, which could cause DOGE’s price to drop and allow it to retest the support of the aforementioned bull pattern.

Read Dogecoin [DOGE] Price Prediction 2024-2025

Nonetheless, if the selling pressure doesn’t affect DOGE’s uptrend, then it might first march towards $0.49 before targeting $0.66, as a slight liquidation barrier lies at that level.