Dogecoin’s MACD crossover hint — Will DOGE rally by 180% again?

- Dogecoin’s weekly chart, at press time, was on the verge of a MACD crossover

- DOGE monthly past cycle align for future movements.

Dogecoin (DOGE), the crypto-market’s largest memecoin, could be on the verge of a significant price move on the charts. In fact, traders have been optimistic, with traders showing strength on the weekly timeframe for four consecutive weeks now.

Despite recent market dips due to geopolitical tensions in the Middle East, there may be potential for recovery. Historically, DOGE has rallied by 90% and 180% following a moving average convergence divergence (MACD) bullish crossover on the weekly chart.

At the time of writing, a new MACD bullish crossover seemed to be forming. This could push DOGE towards replicating its previous 180% surge. Buying momentum has gradually increased too – Another sign of a possible breakout in the near future.

Dogecoin, at press time, was also showing bullish signs after a retest of its macro falling wedge pattern on the daily timeframe. If DOGE continues this upward trend, a bounce from its press time support level could lead to further gains.

However, if this bounce fails, DOGE might face a reset, bringing further downside for the memecoin and possibly affecting other altcoins.

DOGE monthly cycles and potential gains

Looking at historical patterns, DOGE has consistently flipped key levels in its previous monthly cycles, marking the start of bull runs. The first instance of this pattern appeared in 2017, leading to a 90% rally.

In 2021, the same pattern led to a 180% surge. Currently, the consolidation phase is longer, and the market dynamics are aligning in a way that suggests another 180% rally might be possible.

This trend, coupled with historical data, highlights a strong possibility for higher price gains. This is likely to set the stage for another bull run on the charts.

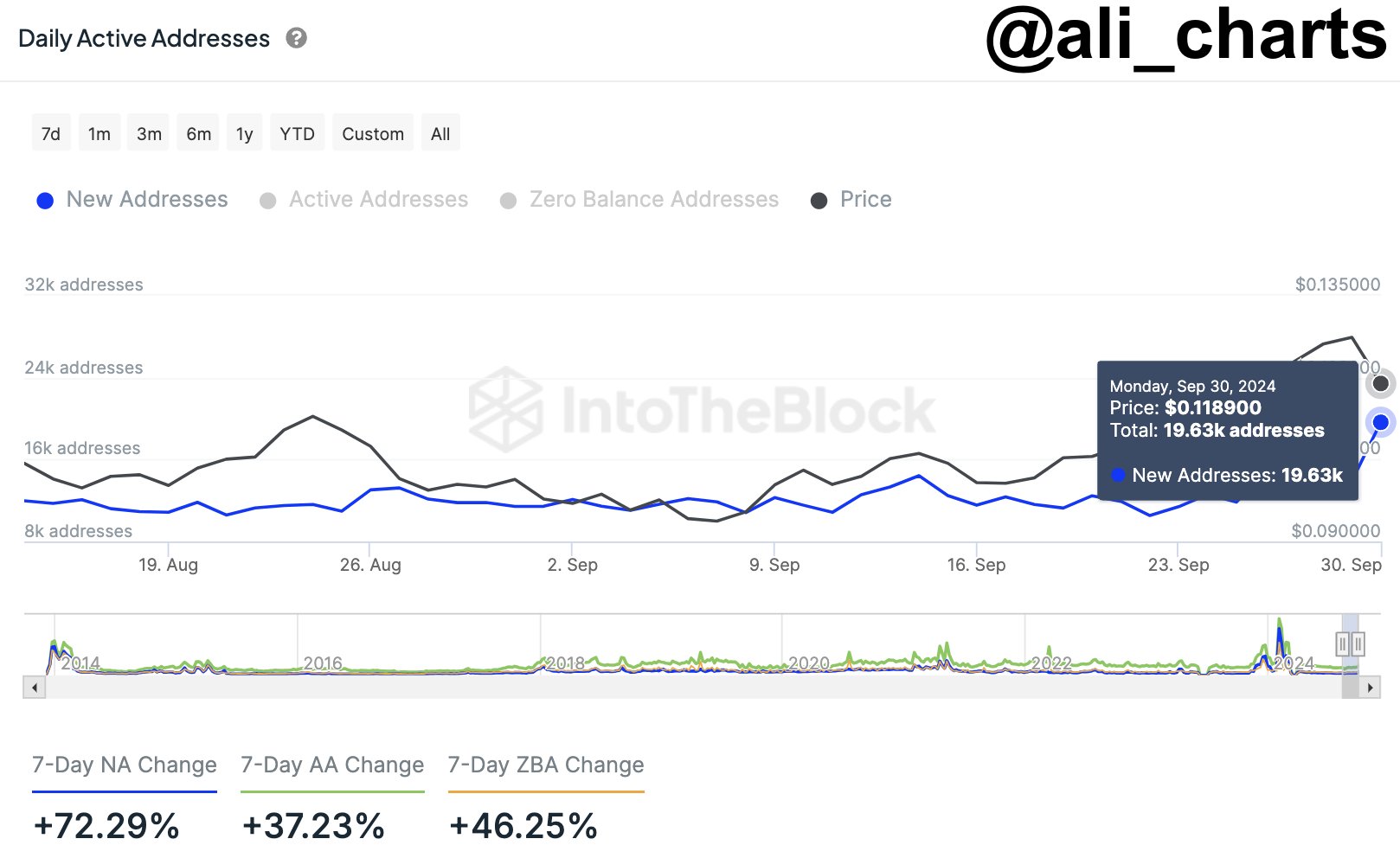

Network growth and market dynamics

Dogecoin’s network has seen notable growth lately too. Over the past week, for instance, new DOGE addresses surged by 72%. In fact, just yesterday, over 19,600 new addresses were created.

This growth is a sign of increasing interest in DOGE, meaning that traders and investors are preparing for potential price gains.

That being said, external factors such as geopolitical tensions in the Middle East could still impact market dynamics and DOGE’s ability to reach this target.

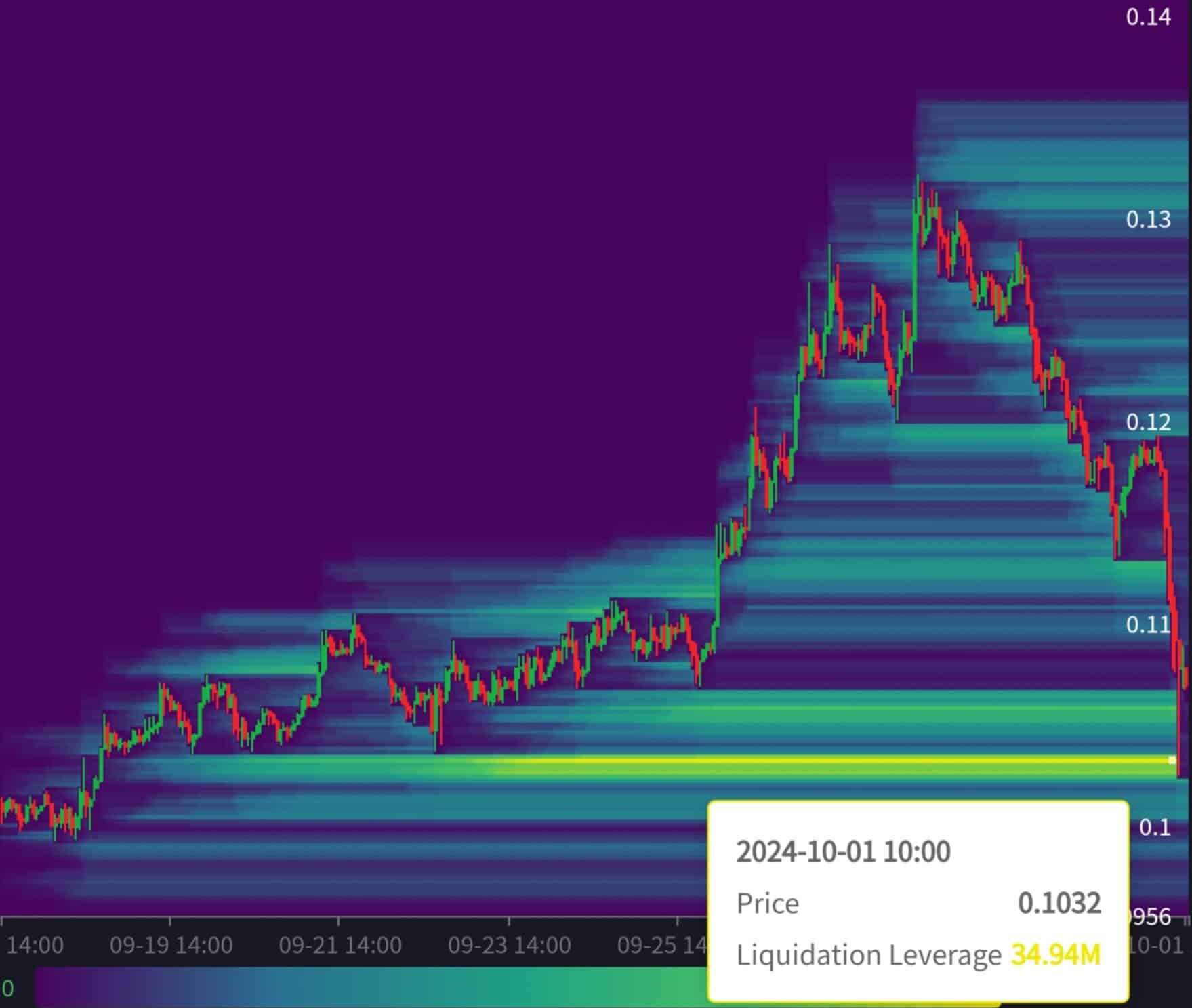

Liquidation levels and price movements

DOGE has also liquidated major short positions, hitting a key target at $0.1032. This resulted in the liquidation of $34.9 million worth of long positions.

The next crucial liquidation zones will play a significant role in determining DOGE’s next price movements. Traders will need to watch these levels closely to assess whether Dogecoin can maintain its bullish momentum or face more volatility in the coming weeks.

With strong technical indicators, network growth, and historical patterns, Dogecoin is well-positioned to make significant gains.

If the market aligns, DOGE could achieve its 180% rally target. However, traders should remain cautious of potential risks.