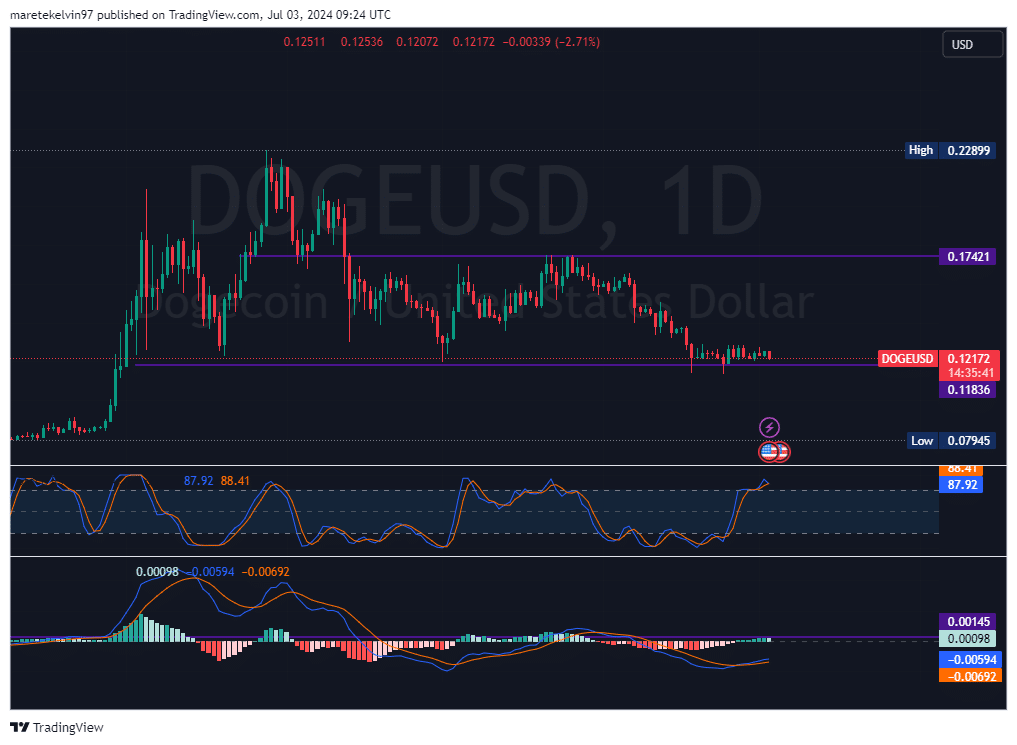

Dogecoin’s make-or-break moment: Can DOGE cross the crucial $0.1184 support?

- Dogecoin tested a crucial support level at $0.1184.

- Metrics suggested a short term price correction.

Dogecoin [DOGE] was approaching a critical support level at $0.1184 that has been tested four times since the 19th of March.

This moderate slip in price comes after a recent moderate price surge in the last seven days. Recently, DOGE has not recorded any significant movement.

The price has been consolidating around the support zone since the 19th of June.

As of writing, DOGE was priced at $0.1184, up 1.25% in the last 24 hours and 3.38% in the last seven days, with its market capitalization at $17.4 billion.

However, trading volume has seen a significant surge of 25.71%, with $497.7 million worth of DOGE changing hands in the last 24 hours.

This short-term dip in price and a long-term surge indicate that DOGE was going for a short term correction to the key support level.

Source: TradingView

The stochastic RSI was in an overbought zone, suggesting that a short term correction is on the horizon.

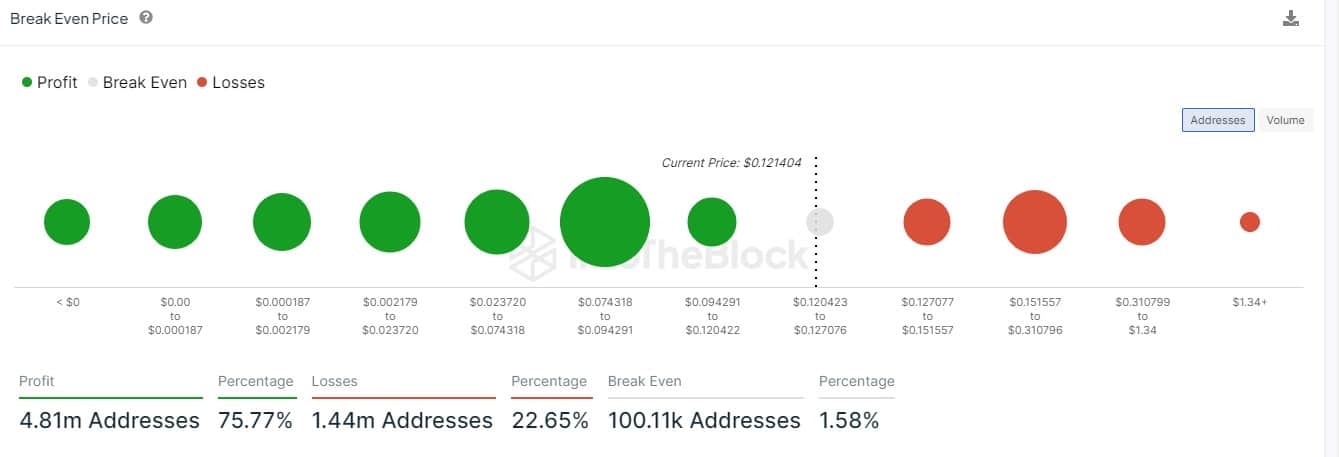

Profit-taking pressure mounts

AMBCrypto’s analysis of break-even data from IntoTheBlock indicated that a significant 75.77% of DOGE addresses remained profitable.

This high profitability rate, coupled with bearish sentiment, has triggered a wave of profit-taking among short-term investors.

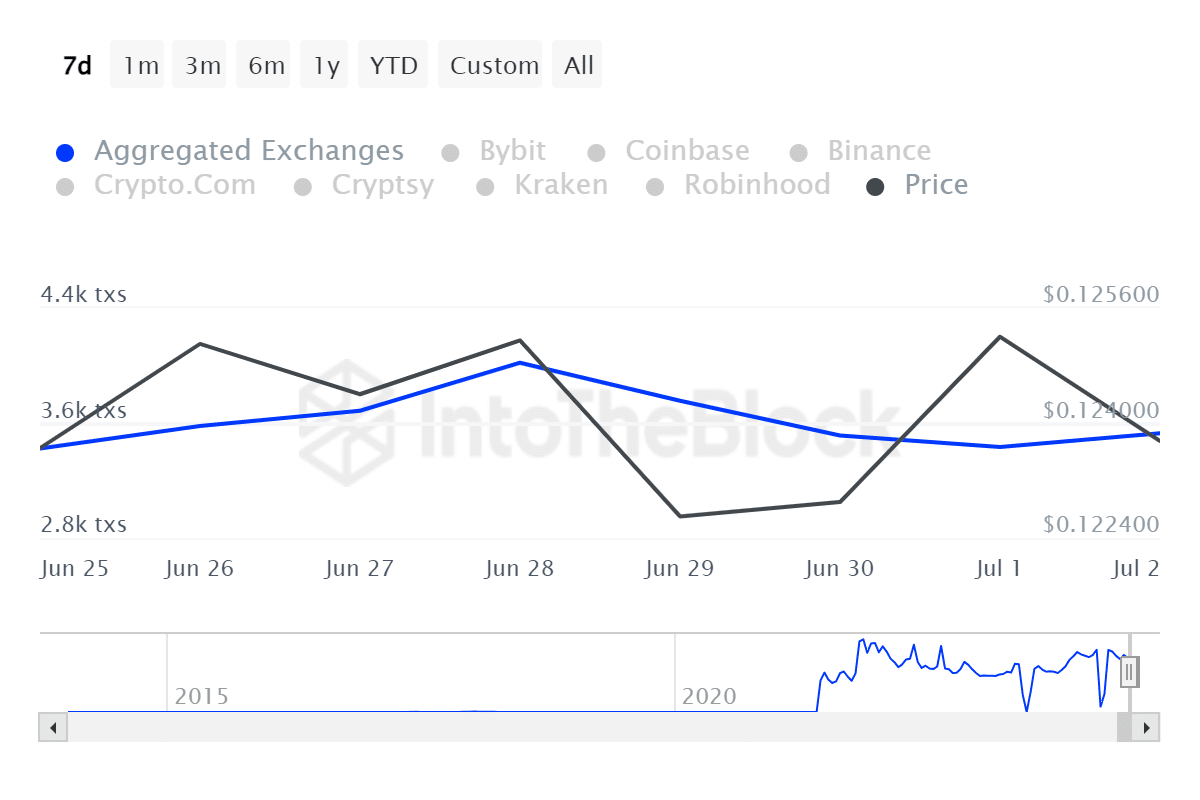

Exchange outflows signal potential downside

AMBCrypto’s analysis of IntoTheBlock data showed a surge in exchange outflow transactions. This surge in transaction outflow indicated that investors were moving their DOGE holdings to exchanges.

This increase in exchange outflows is significant, given the current market conditions.

As bears capitalize on their gains, this selling pressure could drive DOGE’s price lower to the critical $0.1184 support for the fifth time since the 19th of March.

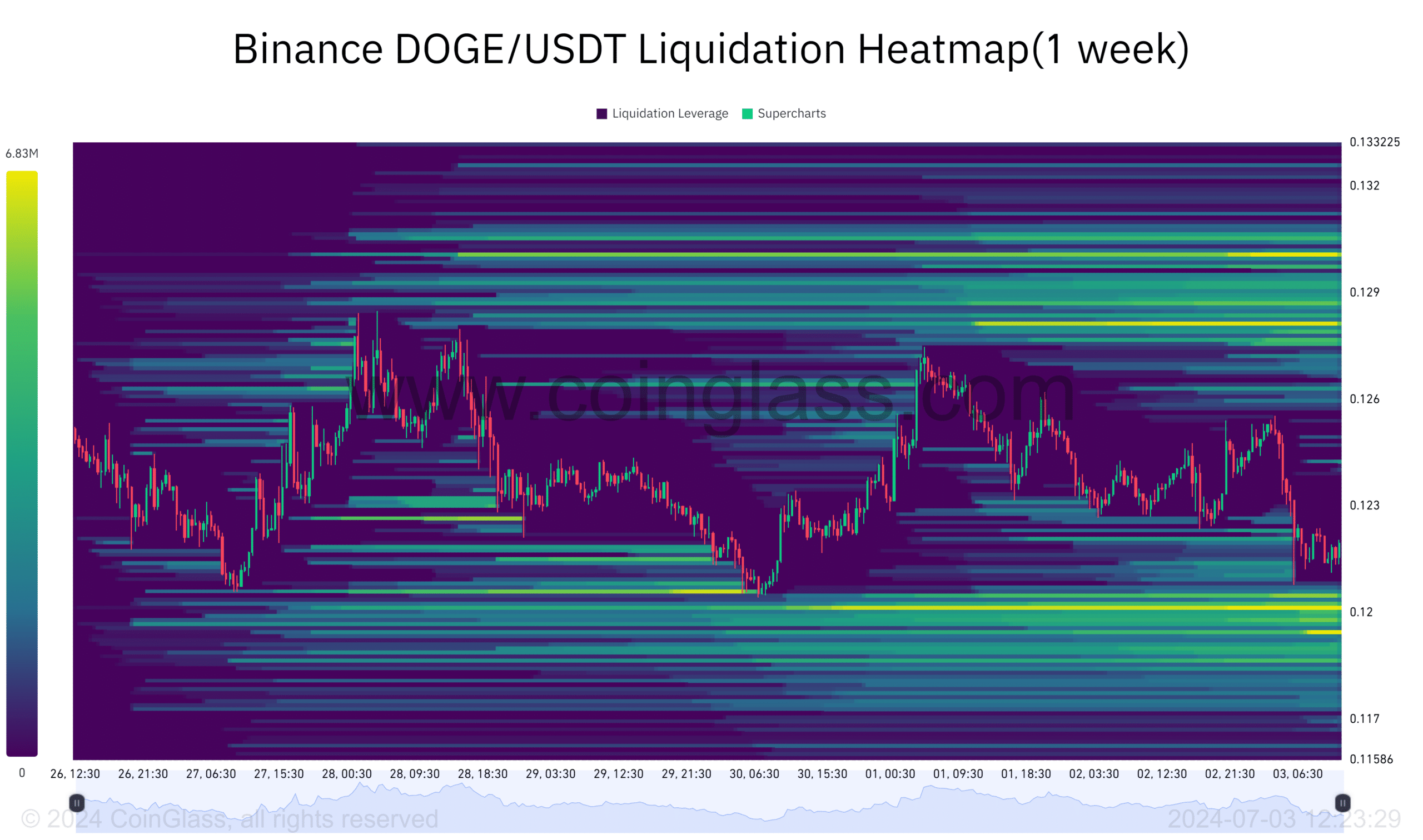

Liquidity to determine DOGE’s fate

With DOGE standing on the edge, AMBCrypto further analyzed the market liquidity at the $0.1184 level to determine its near-term direction.

The liquidation heatmap data from Coinglass indicated a dip below $0.120, which could trigger a chain reaction of liquidations, potentially increasing downward pressure.

Is your portfolio green? Check out the DOGE Profit Calculator

At the same time, if the bulls step in to defend the support level, DOGE may bounce and test the $0.132 resistance level.

Dogecoin, thus, stands at a crossroads. The correlation between profit-taking pressure and buyer support at $0.1184 will be crucial in determining whether DOGE can hold its ground or face a further decline.