Dogecoin

Dogecoin’s market dominance hits 1% – Thank you whales, but what’s next?

Dogecoin is set to conclude October with over 60% gains, but exchange flow data could have its say.

- Dogecoin bulls showed up strong as the memecoin demonstrated its dominant position

- Whales have been accumulating, but exchange flows suggested that profit taking is happening

Dogecoin appears to be following in Bitcoin’s footsteps as far as its latest performance is concerned. Both have delivered an impressive rally since mid-October, confirming that DOGE is still the king of the memecoins.

In fact, while Dogecoin’s dominance was as low as 0.74% in mid-October, it has since recovered above 1% for the first time since May. It held a value of 1.04%, at the time of writing. This was courtesy of the strong bullish resurgence that Dogecoin has been enjoying recently.

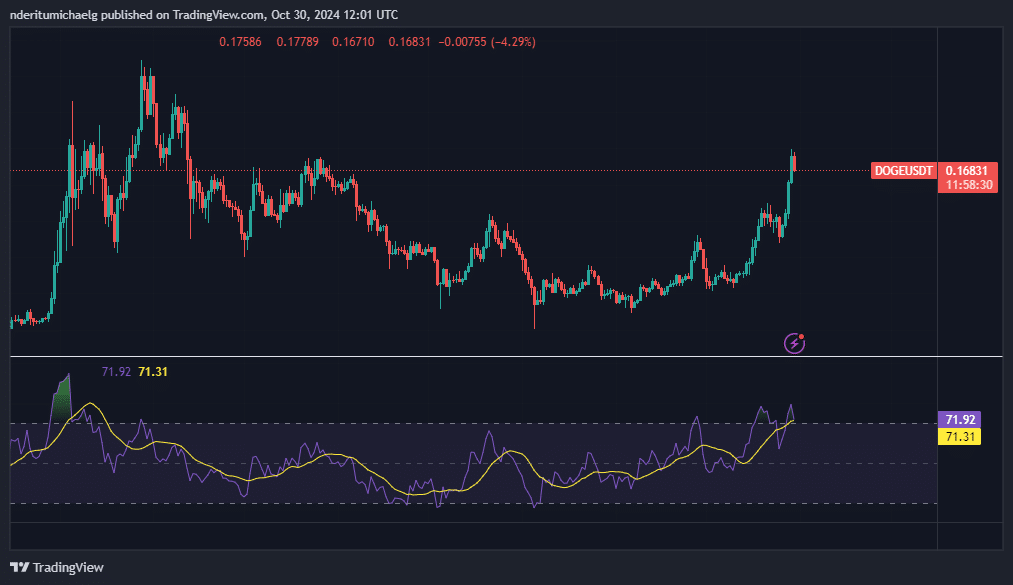

For perspective, Dogecoin peaked at $0.179 on Tuesday. The last time that its price was at this level was in April earlier this year. It soared by 74% from its lowest point in October to its highest point so far and by 62% to its $0.168 press time price level.

Is DOGE due for a cooldown? Well, the memecoin recently flashed multiple signals which may suggest that some profit-taking will occur in the coming days. For example, its latest peak was right within a historic resistance zone and a slight pullback had already occurred in the last 24 hours.

Also, Dogecoin seemed extremely overbought after its latest rally. However, the downside was limited – A sign that investors might anticipate more bullish extension.

Dogecoin whales continue accumulating

On-chain data revealed that Dogecoin’s latest rally was backed by robust demand from whales. For example, inflows into large holder accounts soared from 79.55 million DOGE to 1.36 billion DOGE, as of 29 October.

Outflows also surged from 74.42 million DOGE to 782.45 million DOGE during the same period of time. This confirmed that buying volume from whales was significantly higher than selling volume.

Will sell pressure intensify at its current level? Exchange flows suggested that it has already been happening. Exchange inflows were above 833 million DOGE, at the time of writing. On the contrary, exchange outflows were at 597 million DOGE.

The lower exchange outflows than inflows may imply a shift from dominant demand in favor of sell pressure due to profit-taking. This would explain why Exchange inflows were higher than outflows.

While the aforementioned information means that there could be some sell pressure as the weekend approaches, it is also worth noting the higher level of optimism in the market. This may encourage some investors to leave some unrealized profits on the table in the hopes that the price will rally higher in the coming months. Such an outcome could lead to limited downside.