Dogecoin’s network activity drops to 6-month low: Is DOGE in danger?

- DOGE’s network activity has dropped sharply to its six-month low.

- Technical indicators showed a sluggish but growing bullish trend.

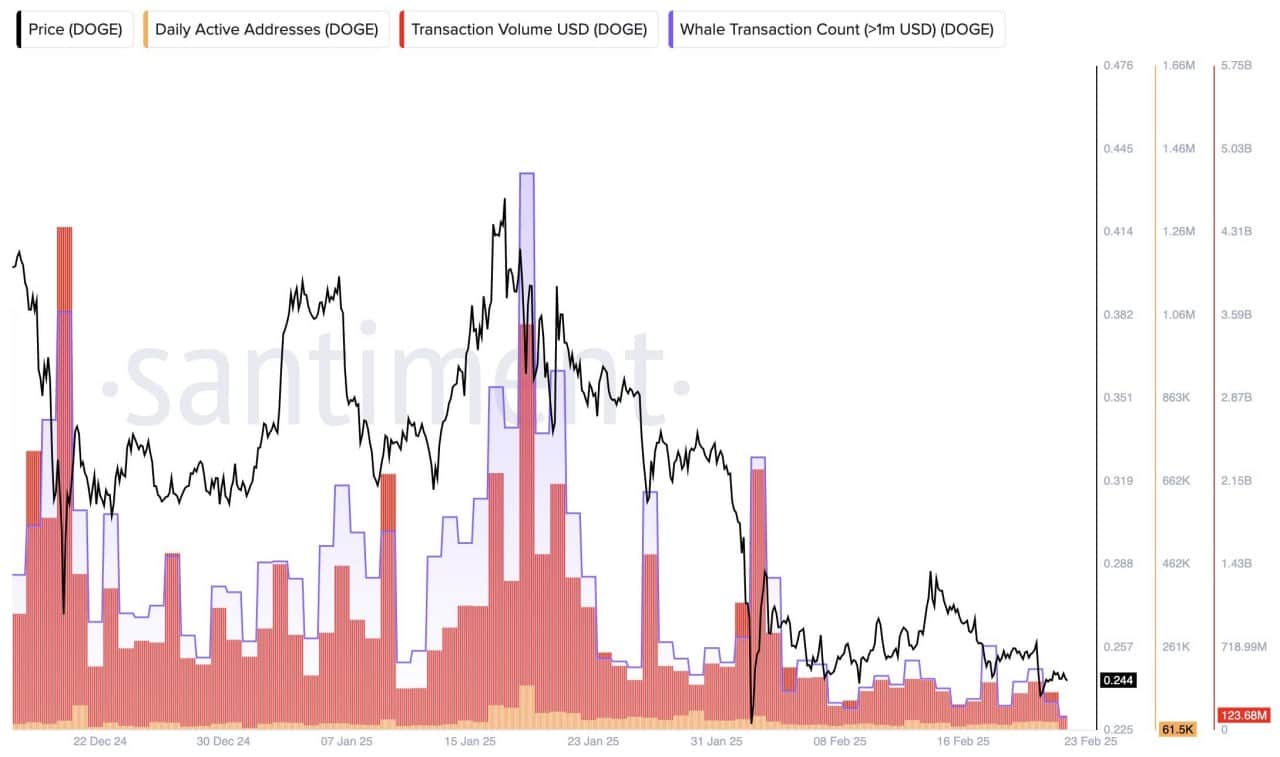

Dogecoin’s [DOGE] network activity has fallen to its lowest level since October 2024 with just 66 large whale transactions and less than 60,000 active addresses daily.

The slowdown raises questions about the next direction of DOGE’s price.

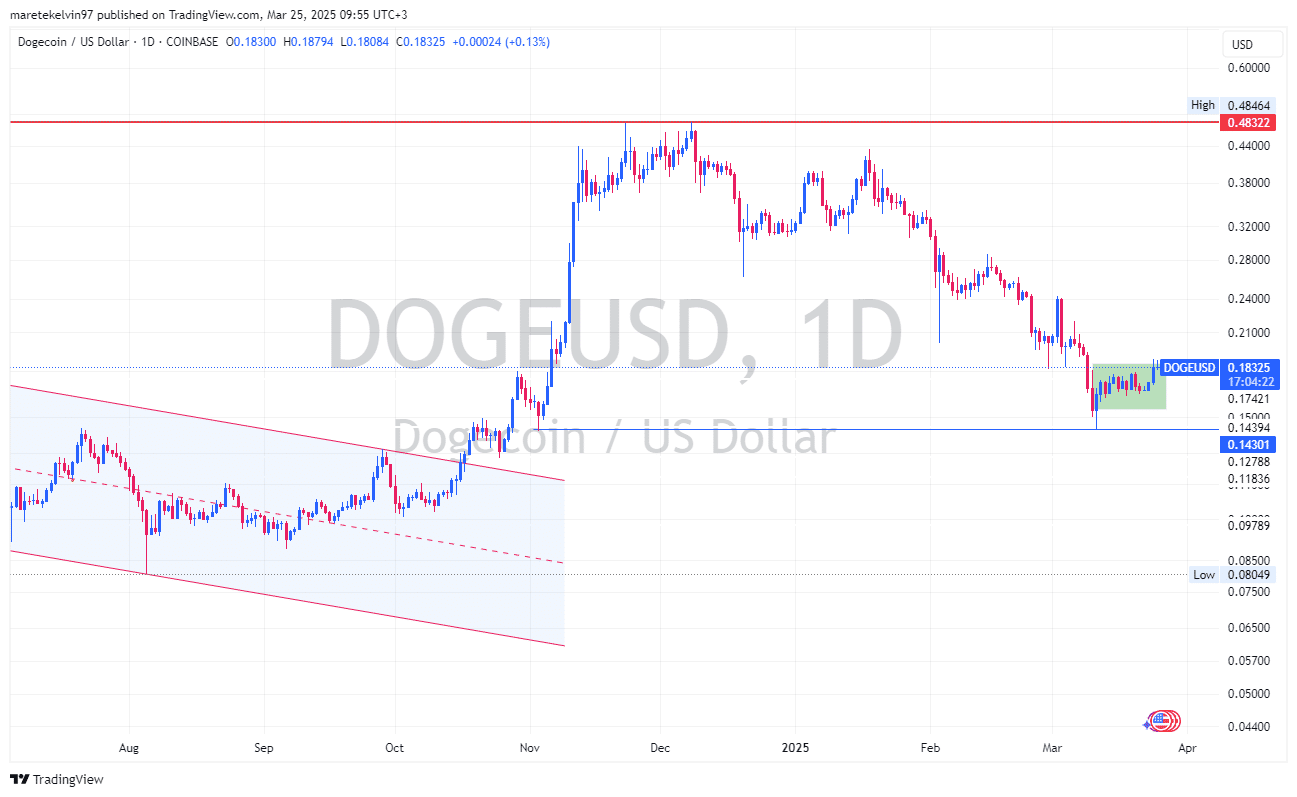

DOGE price stuck in a consolidation phase

On the day chart, DOGE shrinking bullish momentum is evident, with the memecoin trading sideways after reversing the important $0.143 support price level.

The altcoin has not seen significant developments throughout the past week, with its price remaining in a consolidated range at around $0.172.

As of writing, the altcoin was trading at $$0.1837, a 4.4% up over the last 24 hours.

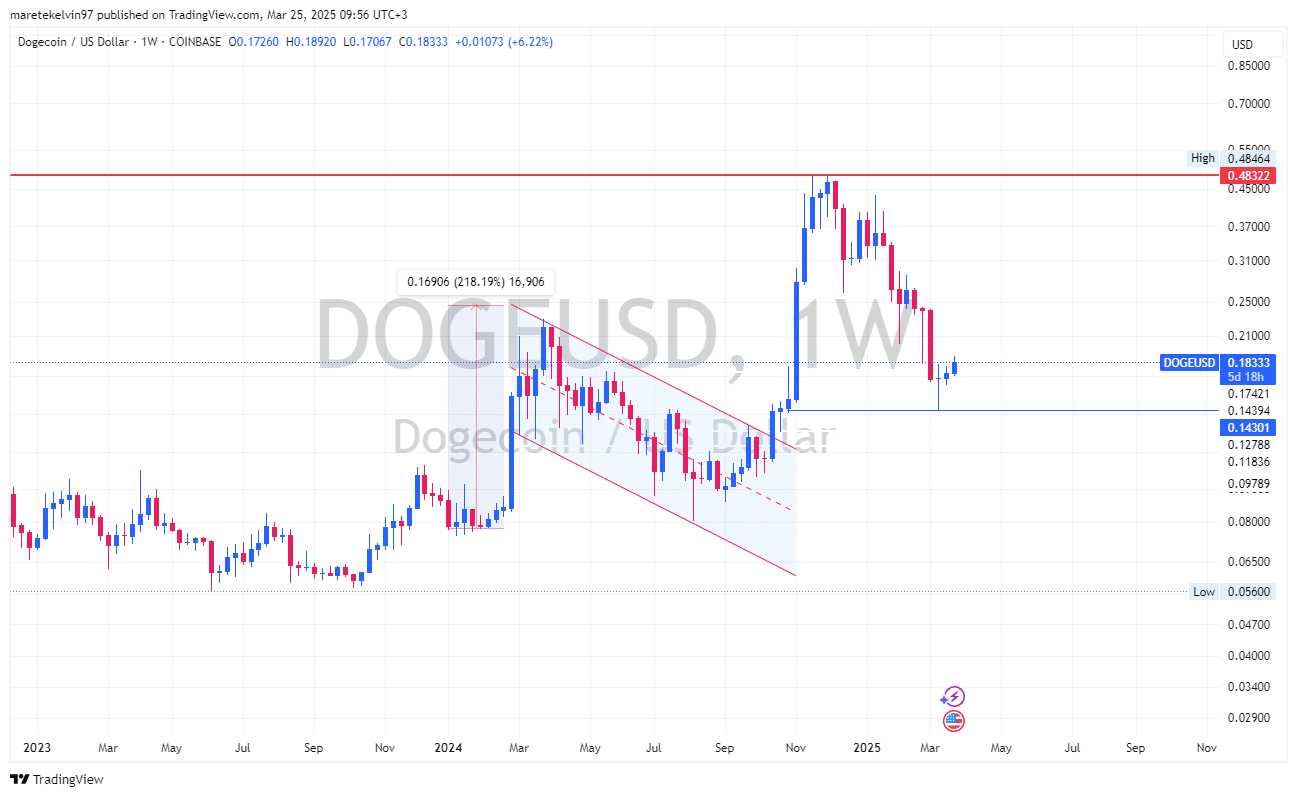

Despite a recent drop in key on-chain metrics, the memecoin is showing signs of recovery. The weekly chart presents a more optimistic outlook.

While progress has been slow, the long-term trend is gradually turning bullish. This suggests a potential rally could occur if broader market sentiment improves.

Whale action is shrinking

DOGE whale trades and large transfers often indicate strong interest from large investors. Santiment’s data shows these trades have fallen to just 66, signaling reduced high-volume trading that may hinder a significant price breakout.

Similarly, the decline in active addresses points to reduced retail participation. With fewer daily transactions, liquidity decreases, making DOGE prices less responsive to market volatility.

In the short term, DOGE’s lack of momentum and reduced network activity may continue to suppress its price. A drop below $0.143 could lead to further losses, potentially reaching $0.12.

However, the weekly chart hints at a sluggish bullish shift, suggesting accumulation is in progress. If Bitcoin and the broader crypto market recover, DOGE could rally and test higher resistance levels.

For now, Dogecoin remains in a holding pattern. Traders should monitor for a breakout from its current range or changes in whale activity for clearer market direction.