Dogecoin’s struggles continue, but is a 2021-style bull run coming?

- Dogecoin price has dropped by 1.6%, trading at $0.1071 at press time, with a sluggish performance.

- An analyst predicted a potential rally, citing a pattern similar to Dogecoin’s 2021 bull run.

Dogecoin [DOGE], the meme-inspired cryptocurrency, has been battling market volatility over the past week, despite previous attempts to rally.

While Dogecoin saw a 2.7% increase last week, marking a slight upward trend, its more recent performance has been disappointing.

The cryptocurrency has dropped in value over the last 24 hours, hitting a low of $0.1065 before recovering slightly to its press time trading price of $0.1071.

This represented a 1.6% decline over the past day, adding to a sluggish trend that has left many investors questioning the asset’s ability to rebound.

Historical pattern of DOGE

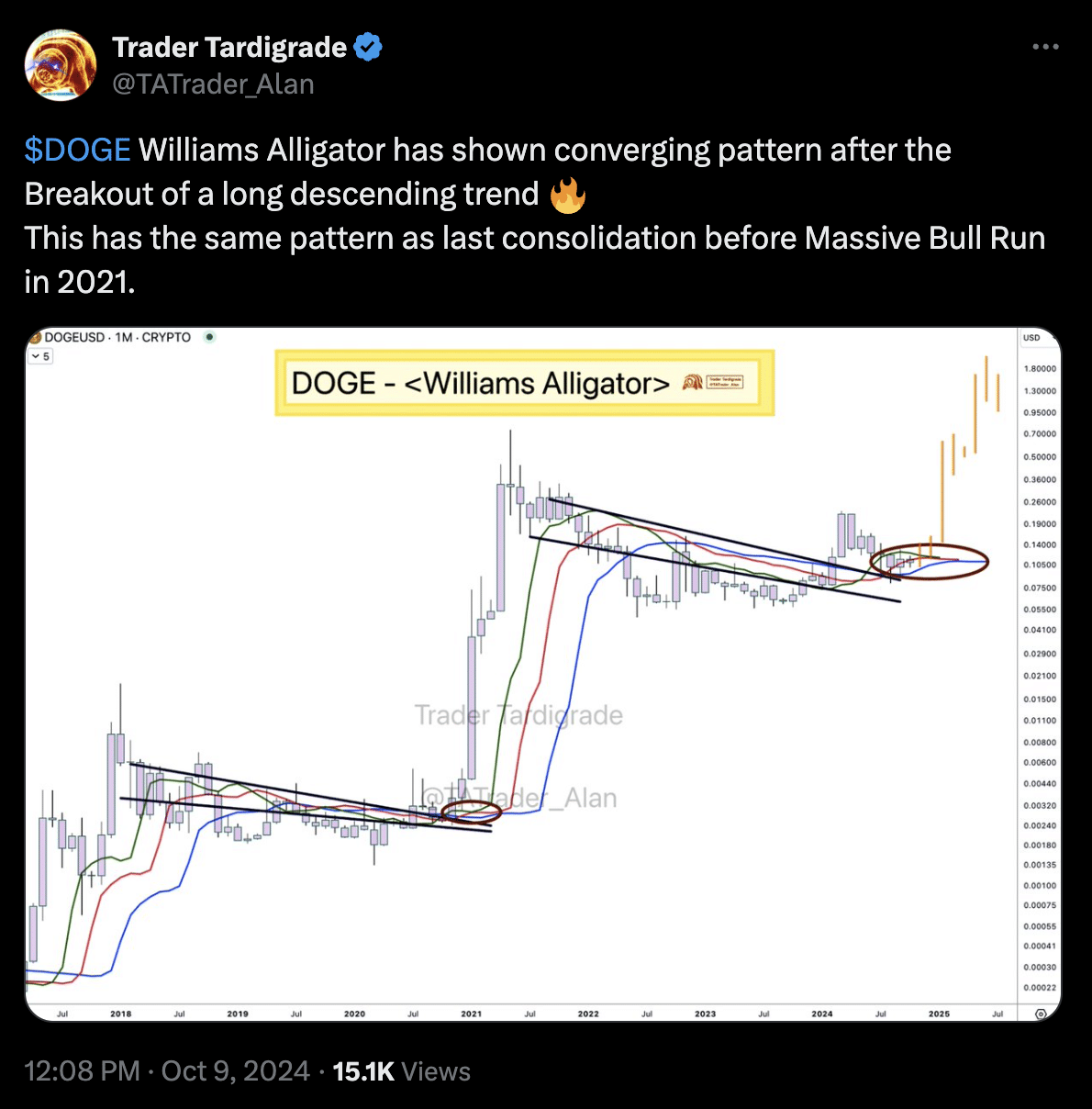

A notable development came from prominent crypto analyst Trader Tardigrade, who shared an optimistic outlook on Dogecoin via X (formerly Twitter).

The analyst pointed out a technical pattern known as the “Williams Alligator,” which suggested that Dogecoin could be primed for a breakout.

Trader Tardigrade noted that this pattern, which followed a breakout from a long-term descending trend, mirrored a similar consolidation phase witnessed before the massive bull run of 2021.

This observation has sparked discussions about whether Dogecoin might be nearing another significant rally in the near future.

Bull run on the horizon?

While the technical outlook hints at potential bullish momentum, a deeper analysis of Dogecoin’s fundamentals could offer a clearer picture of the asset’s trajectory.

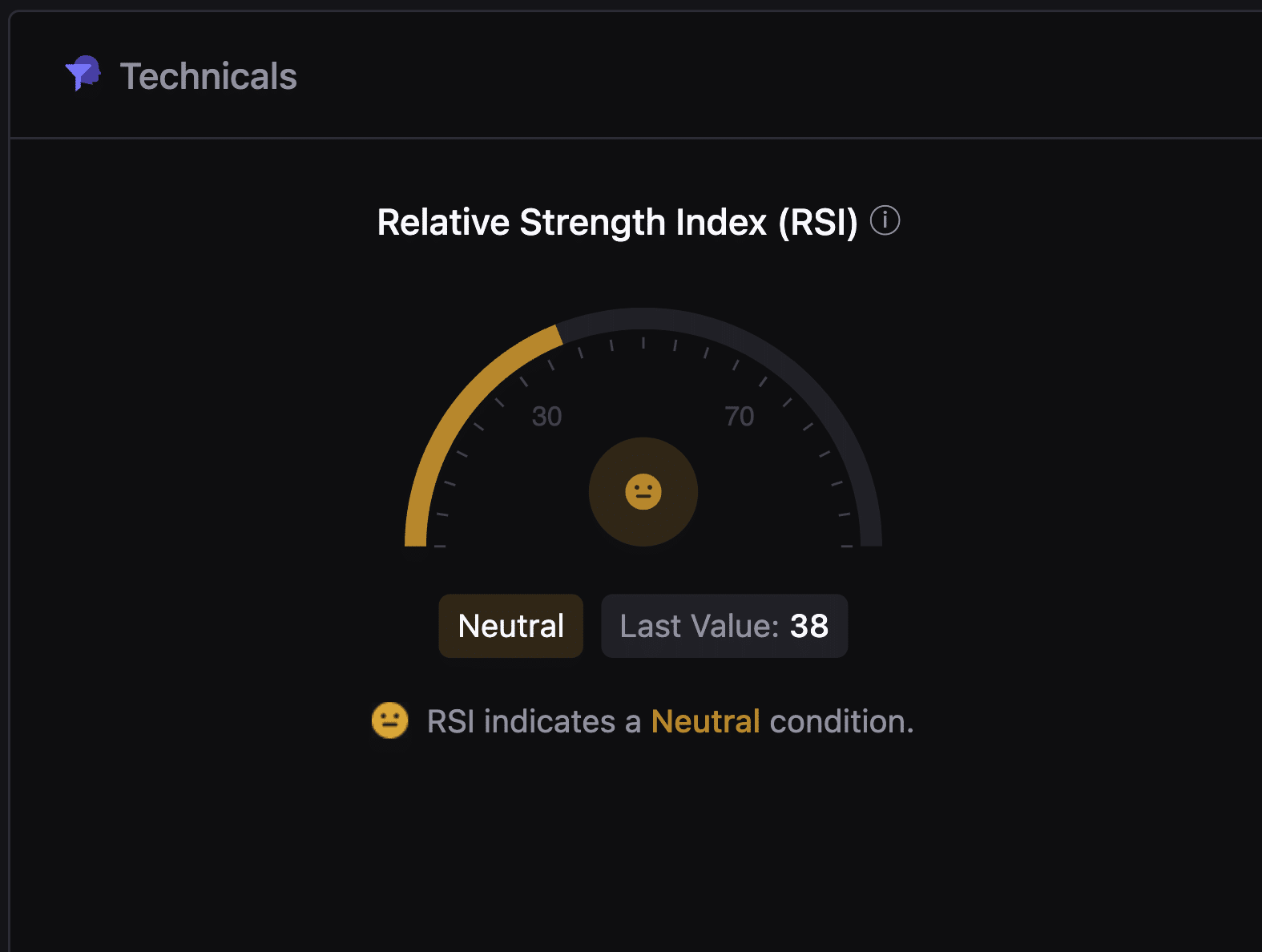

One of the critical indicators to watch is the Relative Strength Index (RSI), which measures the speed and change of price movements.

According to data from CryptoQuant, Dogecoin’s RSI was sitting at a neutral figure of 38 at press time.

This indicates that the asset is neither overbought nor oversold, suggesting that there’s still room for movement in either direction, depending on market sentiment.

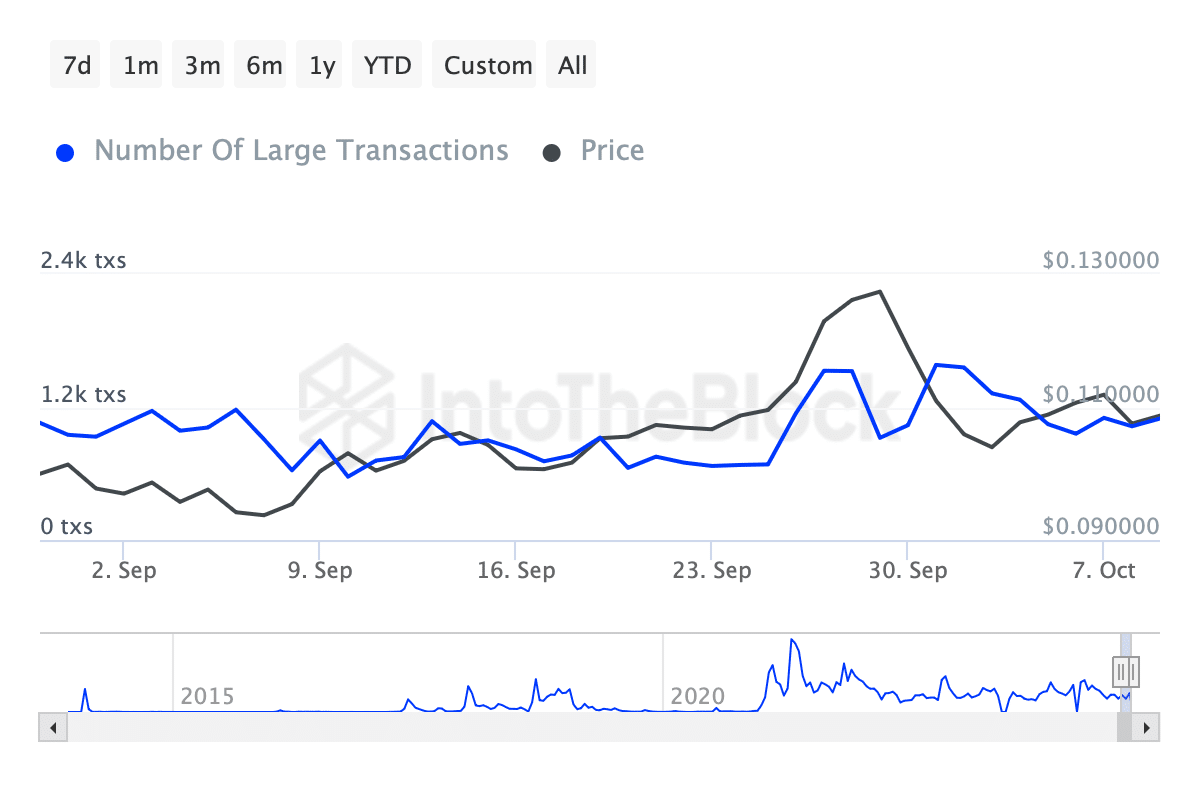

In addition to RSI, whale activity can provide valuable insight into market behavior.

Whale transactions—those involving transfers of over $100,000—are often seen as a barometer of institutional or high-net-worth investor interest.

Read Dogecoin’s [DOGE] Price Prediction 2024–2025

Data from IntoTheBlock showed a significant decline in Dogecoin’s whale transactions this month, with the number dropping from 1.56k to just 1.1k as of press time.

This decrease could signal reduced interest or confidence among large investors, which may dampen the potential for an immediate price surge.