Dogecoin

Dogecoin’s surge in retail FOMO: Can a dip fuel DOGE past $1?

Dogecoin saw a surge in retail activity hinting at potential manipulation.

- Retail investors FOMOing Dogecoin suggested the possibility of another dip before rally continuation.

- Dogecoin RSI has been bouncing up from the oversold zone on 4-hour chart.

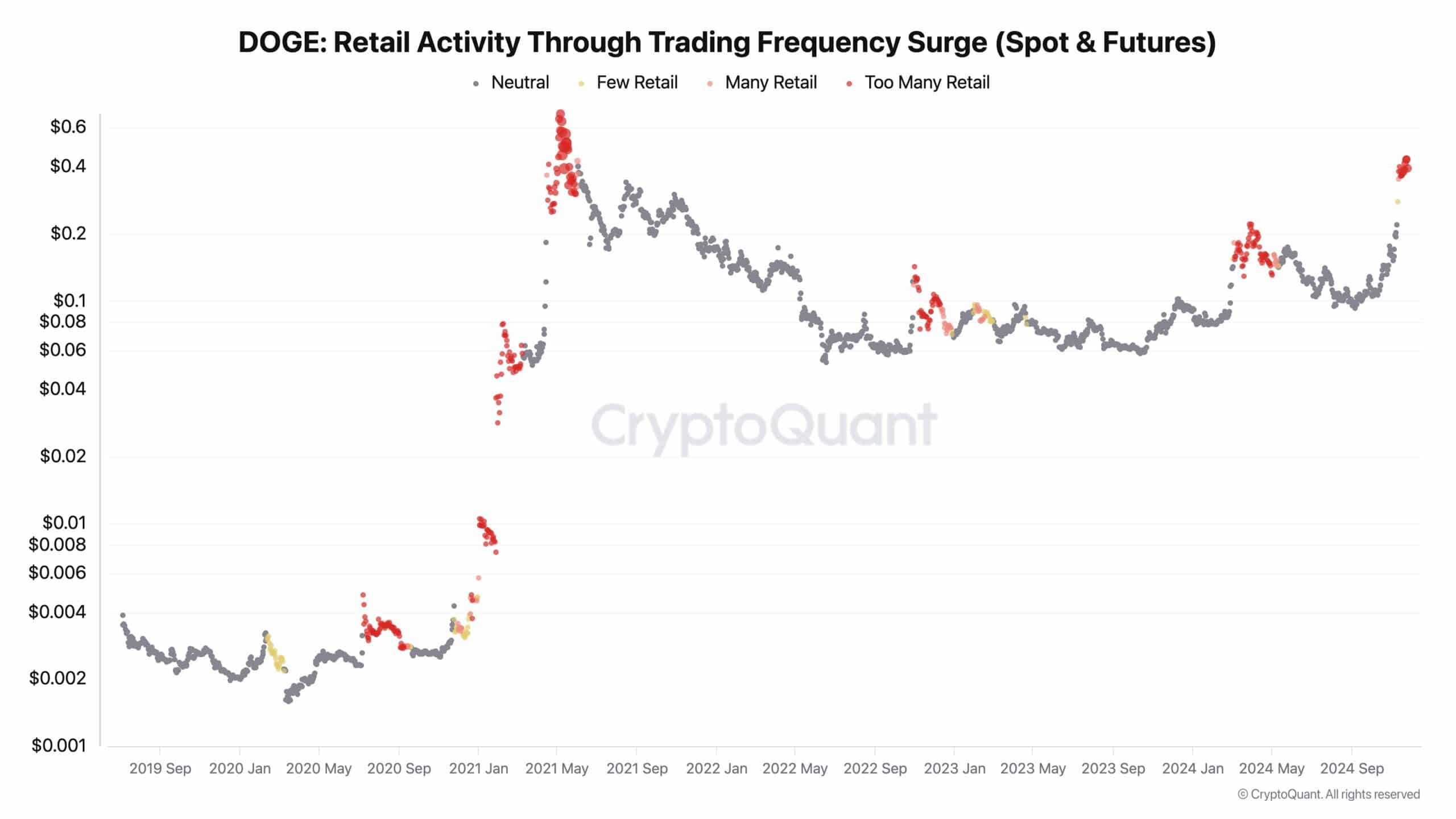

Dogecoin [DOGE] saw a significant surge in retail activity, marking a phase categorized by intense retail participation, as evidenced in the recent analysis.

This period, identified as having “Too Many Retail” traders, historically suggested that Dogecoin could face another price dip soon, as was in May 2024, January 2023 and May 2021.

Market analysts interpret this spike in activity as FOMO (Fear of Missing Out), which could lead to a sharp sell-off, manipulation, to eliminate late market entrants.

However, this potential dip could set the stage for a major rally, possibly propelling DOGE to new ATHs.

Analysts noted that such cycles were common in highly volatile meme-driven markets, where emotional trading can lead to rapid price changes.

The current retail frenzy indicated robust interest in Dogecoin, setting it up for significant market moves in the near future.

Number of trades on all exchanges

Dogecoin also set a new record in terms of the total number of trades across all exchanges, achieving an all-time high in November 2024.

The surge in trading activity reflected a growing interest in the meme cryptocurrency, surpassing previous peaks observed in early 2021 and mid-2023.

This spike in trades aligned with a period of heightened price movements, suggesting an increase engagement. As the trading frequency soared, DOGE’s price also showed significant volatility.

This trend was particularly notable during November, where trade counts on both spot and futures markets escalated dramatically, underlining robust engagement from traders worldwide.

This landmark trading activity for Dogecoin suggested a renewed enthusiasm in the crypto community, potentially positioning DOGE for further attention and investment.

The cryptocurrency continues to attract a diverse audience, driven by its underlying community support and widespread media coverage, contributing to its volatile yet intriguing market performance.

DOGE price prediction

With retail investors FOMO on DOGE suggesting the possibility of another dip to take out the traders entering now, a rally could unfold leading to hitting of new ATHs.

DOGE on the four-hour timeframe highlighted significant price movements and corresponding trading volumes. Notably, the chart marked two prominent rallies where DOGE surged with anticipation of another soon.

The first rally showed an increase from approximately $0.125 to $0.175, marking a 40.42% gain.

Similarly, the second highlighted surge reaches up to $0.43, indicating another 208.59% increase and its projected to surge another 208.58% blasting past $1.

These spikes coincided with the RSI (Relative Strength Index) dipping into the “oversold zone,” signaling potential buying opportunities that traders might have capitalized on.

Is your portfolio green? Check out the Dogecoin Profit Calculator

After each dip into the oversold area, substantial price increases followed, suggesting a pattern of strong buying pressure after significant sell-offs.

As of press time, the RSI was around the oversold territory, which hinted at another potential uptrend if past patterns hold true.