DOGS token’s rapid ascent: What the holder count tells us

- DOGS ranked third in holder count.

- Market indicators show the token is set for recovery.

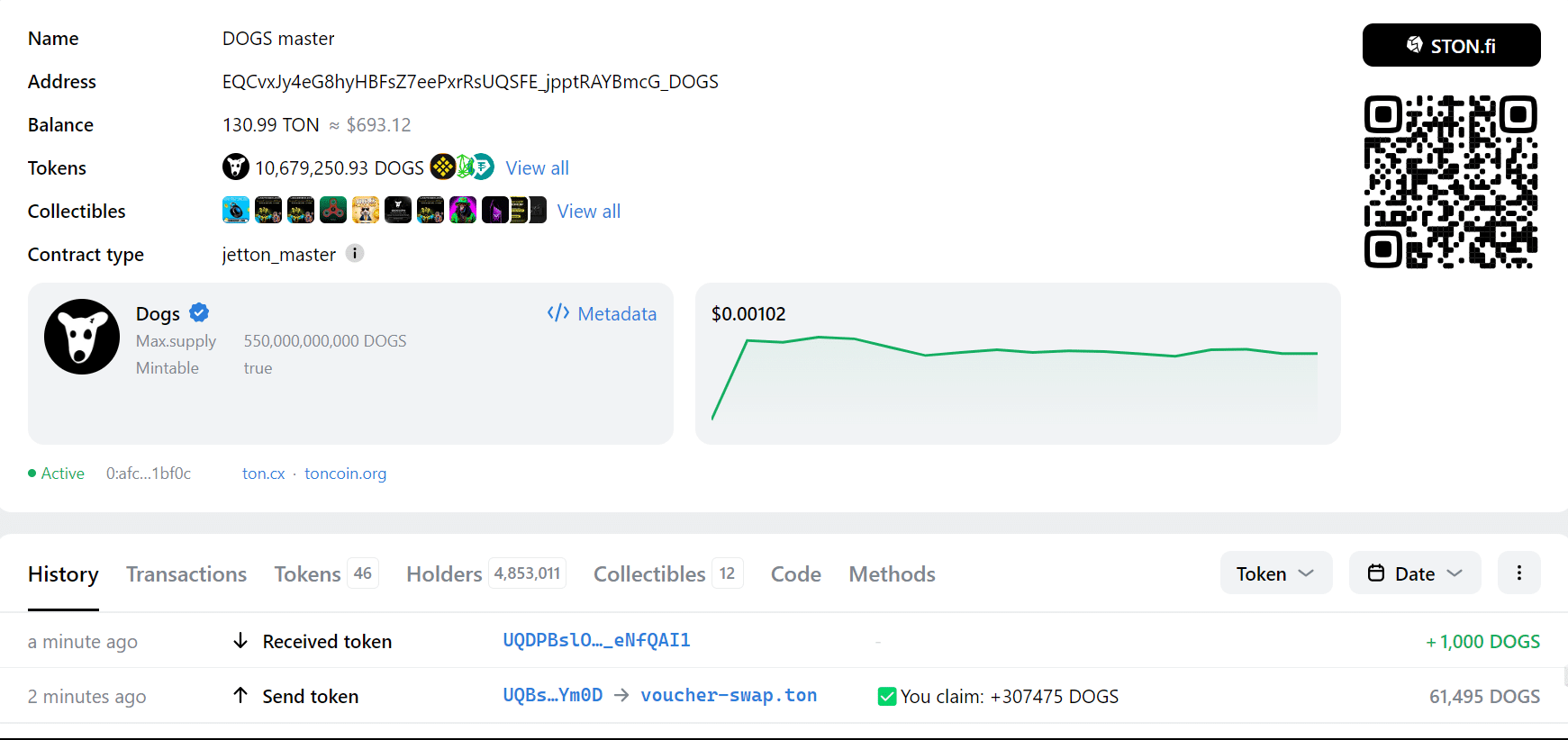

Dogs [DOGS] token is rapidly gaining popularity, now ranked third in holder count, trailing behind only USDT and ETH.

Since its launch on Telegram’s TON blockchain, DOGS has seen remarkable growth, with over 17 million token claims and 4.5 million unique wallets holding the token.

This memecoin, inspired by Pavel Durov’s dog drawing, has quickly become one of the most widely held tokens in crypto history.

With daily active users hitting 1.1 million and single-day transactions peaking at 14.4 million, DOGS has set records in user engagement.

Source: TonViewer

As September progresses, TON expects even larger token generation events (TGEs), potentially bringing millions of new users.

While this rapid growth may create technical challenges, the focus remains on scaling and addressing any issues to support mass adoption.

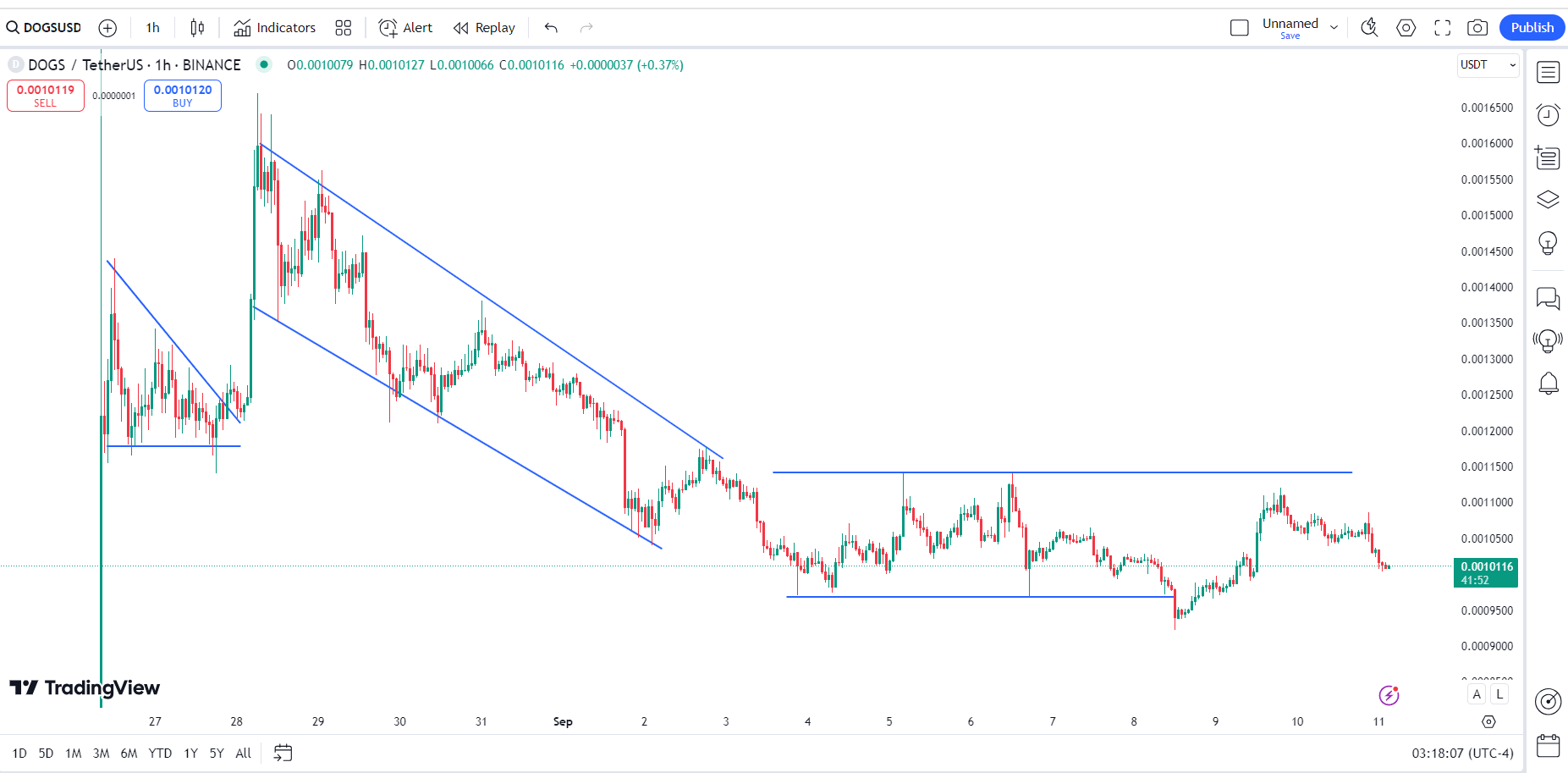

Price action of token in range

Looking at DOGS’ price action, its DOGS/USDT pair currently shows a bearish trend since the token’s launch.

After an initial surge, followed by consolidation and another spike, the token has seen a downward trend, finding a low at $0.0009233.

Throughout September, it has traded within a sideways range, suggesting that the bottom may have been found.

Source: TradingView

If the token maintains its position above $0.0009233, the price is set to rise, potentially reaching its previous high of $0.00166, representing a 72% gain.

However, if the price falls below this key support level, a reassessment of the situation will be needed to determine the next price target.

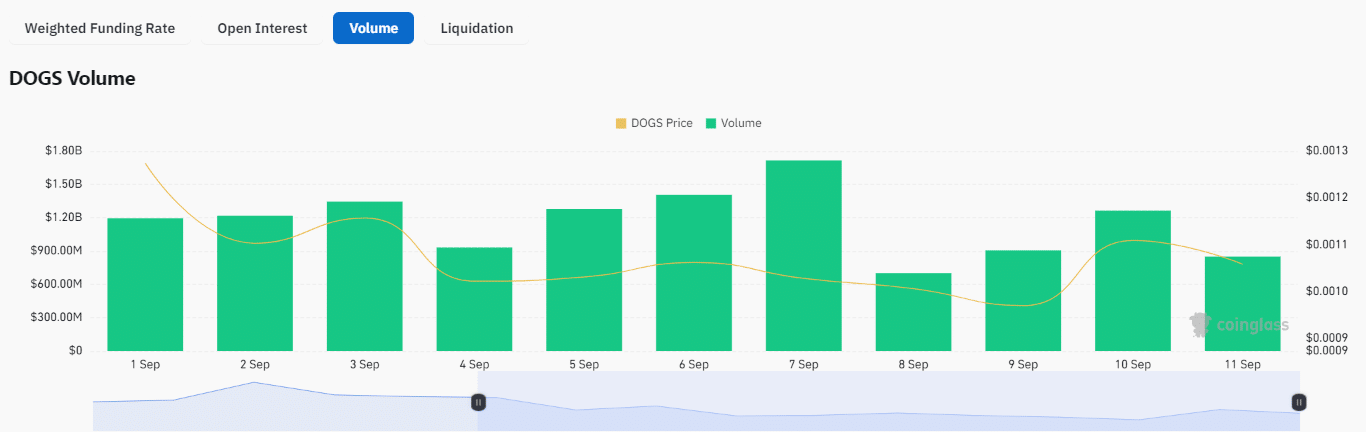

Trading volume and OI-funding rate

DOGS’ trading volume and open interest (OI) also provide positive signs. As of September, the trading volume has been robust, with today’s volume at $859.24 million at a price of $0.0011.

The current open interest stands at $124.57 million, indicating growing interest in the token, especially after many traders sold their tokens following the airdrop.

The OI-weighted funding rate is currently at 0.0069%, signaling that holders are paying traders who are liquidating their positions. This dynamic suggests a balance between long-term holders and short-term traders.

Source: Coinglass

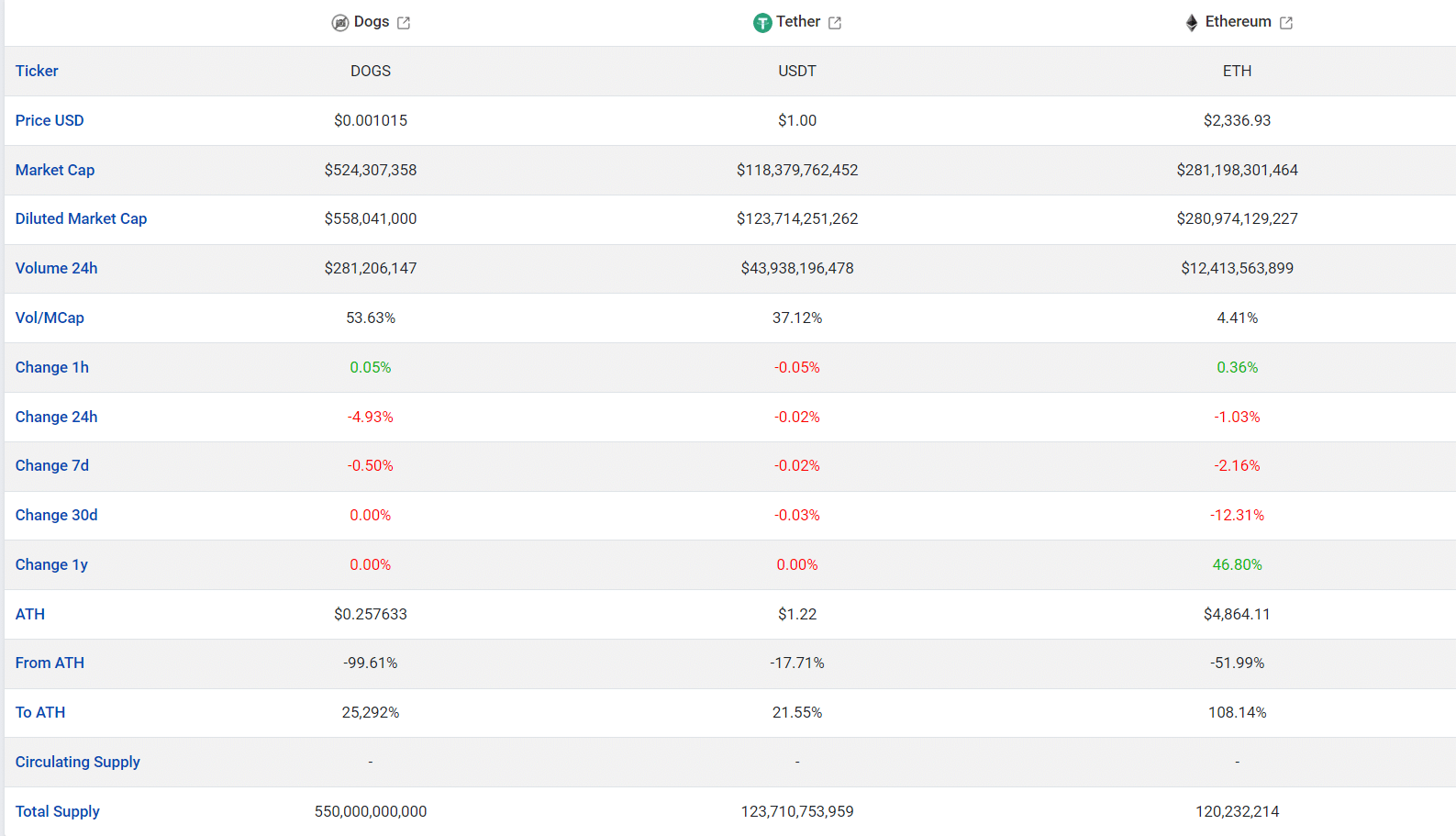

Comparison with USDT & ETH

In comparison to USDT and ETH, DOGS shows strong liquidity. The volume-to-market cap ratio is at 53.63%, suggesting that there is enough liquidity for DOGS to support increased trading activity.

This high ratio typically indicates strong investor interest and can lead to more volatile price movements.

Source: Coinpare

Despite DOGS’ smaller market cap compared to its competitors, the token’s liquidity and growing user base position it for potential price recovery, especially as the initial post-airdrop selling pressure subsides.

DOGS could see higher prices as it continues to gain traction in the market.