Analysis

dogwifhat gives bullish signals: Why $2.4 resistance is important for WIF

The Stochastic RSI was on the verge of signaling a momentum reversal, what are the chances of a retracement?

- WIF was about to post a bullish structure break on the daily timeframe.

- Buyers at these levels and breakout traders must be wary of a reversal from resistance.

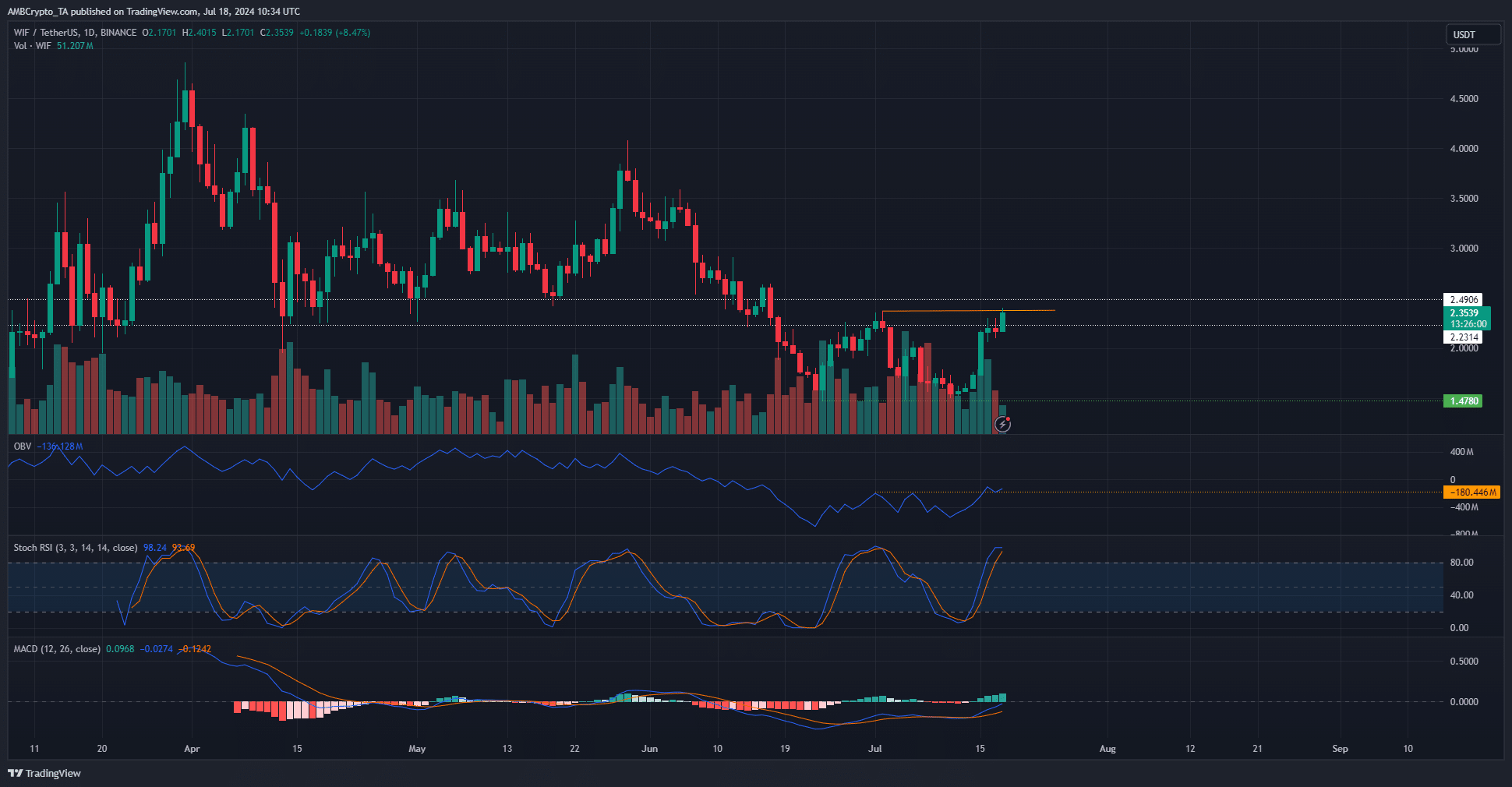

dogwifhat [WIF] made strong gains over the past week. Its 25.1% price surge on the 15th of July set the tone for the week, and at press time the meme coin is close to breaking above a significant local high.

This breakout would flip the structure bullishly. There is also the potential of a range formation under the previous one that was in play from mid-April to mid-June.

The argument for a WIF breakout

The $1.48 support level and $2.4 resistance have been the key levels over the past three weeks.

This meant that the supply zone at $2.4 might be difficult to break in a single attempt unless the bulls are overwhelmingly strong.

The OBV showed that the buying volume was ticking higher but has just broken the local high. Therefore, the early signs were positive for the buyers.

The Stochastic RSI appeared to be on the verge of signaling a momentum reversal. The MACD was also below neutral zero to indicate weak momentum in recent weeks.

The short-term sentiment was keenly bullish

Source: Coinalyze

The Funding Rate has jumped higher over the past ten days, alongside a hefty increase in the Open Interest. The OI rose by$121 million in the past five days. Speculators were eagerly bullish and believed in a breakout.

Realistic or not, here’s WIF’s market cap in BTC’s terms

The spot CVD has recovered from its slump earlier this month but has not crept above the highs from late June.

The relatively weak spot demand might see WIF’s momentum falter around the $2.4-$2.5 resistance region.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.