dogwifhat: How WIF risks deeper correction amidst bullish pattern

- The asset risks losing its current support level within the bullish pattern it is trading in, potentially leading to a deeper correction.

- Metrics reveal active participation from both long and short traders, but with a clear direction.

dogwifhat [WIF] has been predominantly bearish, with a monthly market performance of -43.11%. However, there are signs that the downtrend may pause in the coming trading sessions.

Before any rally materializes, WIF is likely to experience an additional price drop from its current level. The recent 14.69% decline over the past 24 hours may extend further.

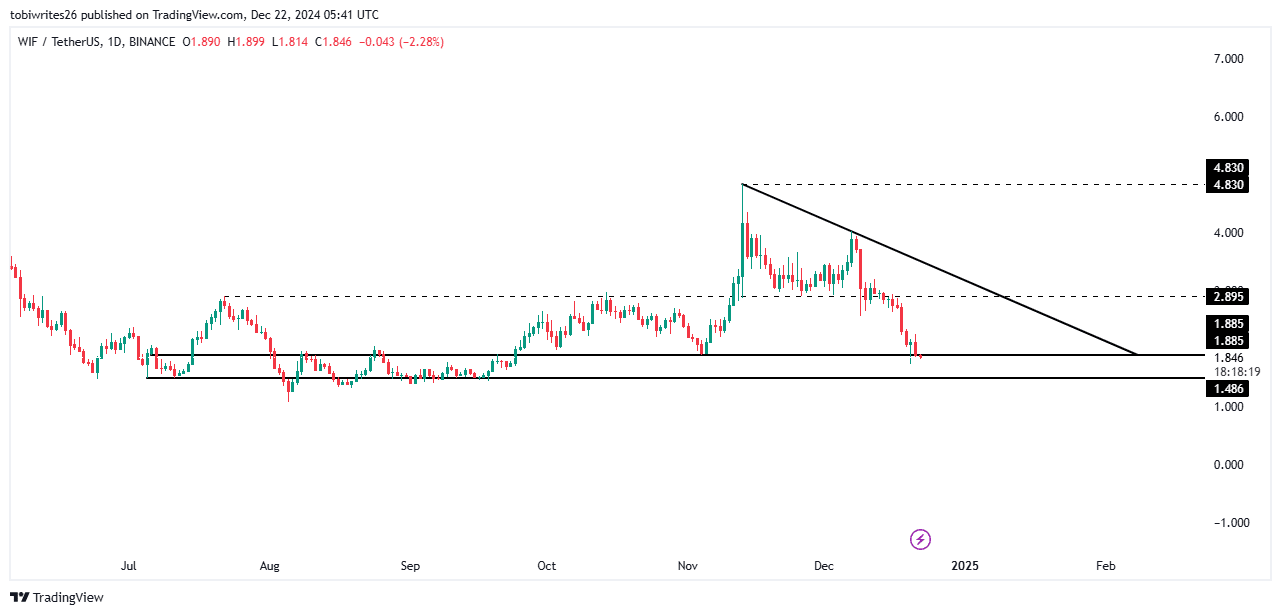

WIF remains bullish but risks a short-term drop

On the chart, WIF has formed a bullish pattern. It has now traded down to the support level of this structure at 1.885, which would typically trigger a bounce. However, significant buying activity at this level has yet to materialize.

If the 1.885 support fails to hold, WIF is likely to lose strength and fall into a range. The next potential support lies at 1.486, where the asset may find the necessary momentum for a bounce.

Once a bounce is initiated, WIF will face two key resistance levels on its path to a rally. The first is at 2.895, followed by the upper boundary of the bullish pattern. Overcoming these hurdles could see WIF establishing its next high at $4.830.

A drop in WIF’s price is imminent

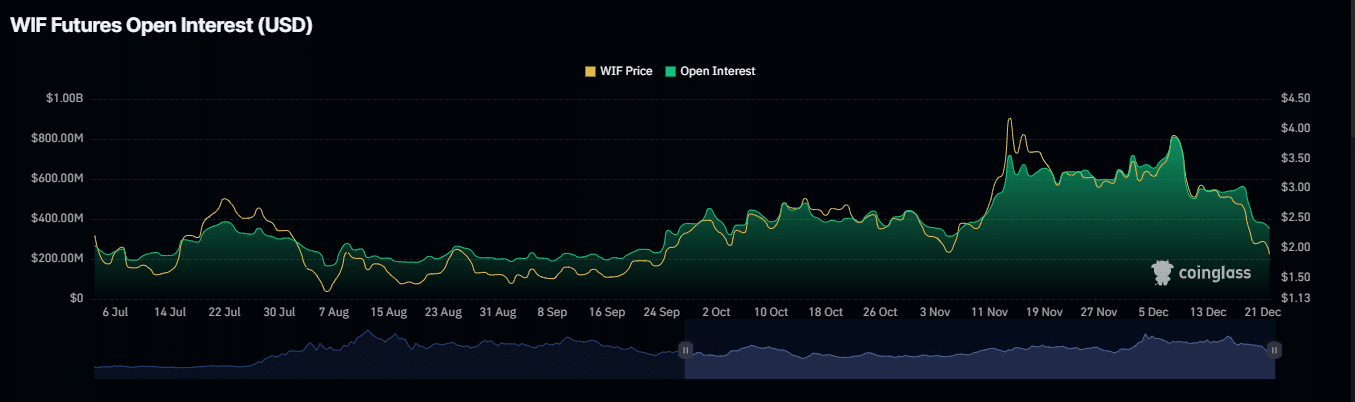

The Open Interest (OI) of WIF has been steadily declining. At the time of writing, OI has fallen to $360.94 million, marking an 11.25% decrease.

This decline in OI is driven by derivative traders actively closing their positions as the asset’s price continues to drop. As a result, WIF’s market capitalization has decreased by 14.29% to $1.88 billion, while trading volume has plunged by 44.16% to $496.58 million.

Additionally, there has been a shift in market sentiment, with short contracts outnumbering long contracts. The current long-to-short ratio stands at 0.89, indicating that there are more short positions than long ones.

When this ratio remains below 1, it means bearish dominance in the market.

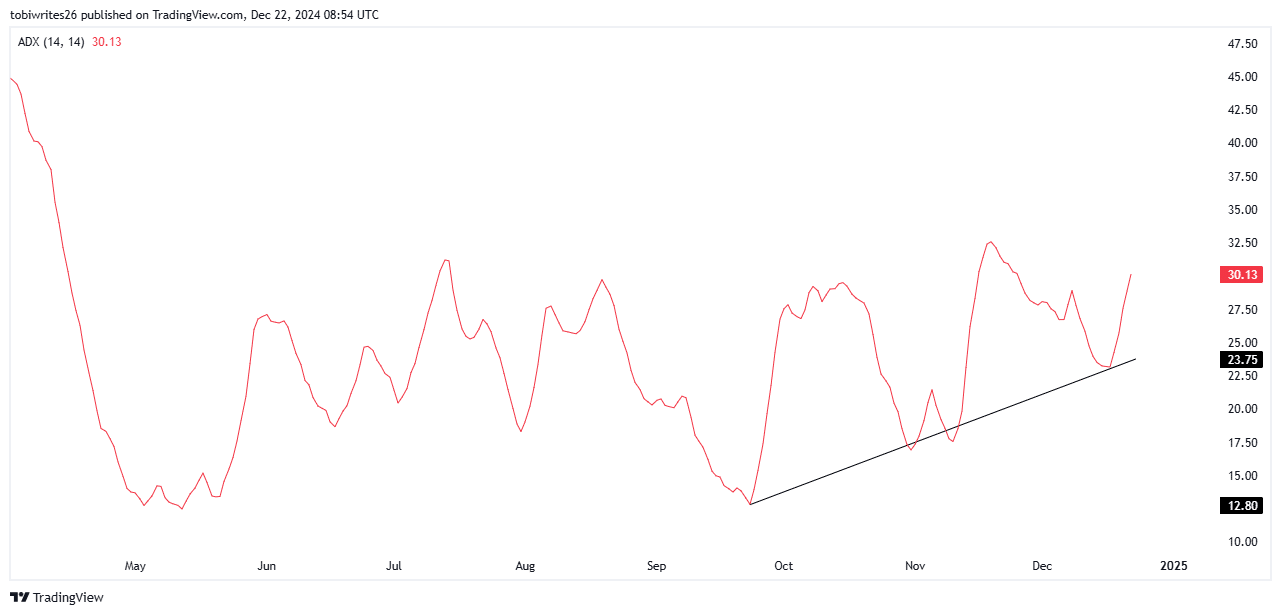

Further supporting the likelihood of a price drop is the Average Directional Index (ADX), which currently reads 30.19, a sign of a strong bearish trend. An increasing ADX during a price decline indicates that the bearish momentum is intensifying.

With these metrics aligning, the asset’s price is expected to fall below its current support level.

Bullish strength remains high despite a minor drop ahead

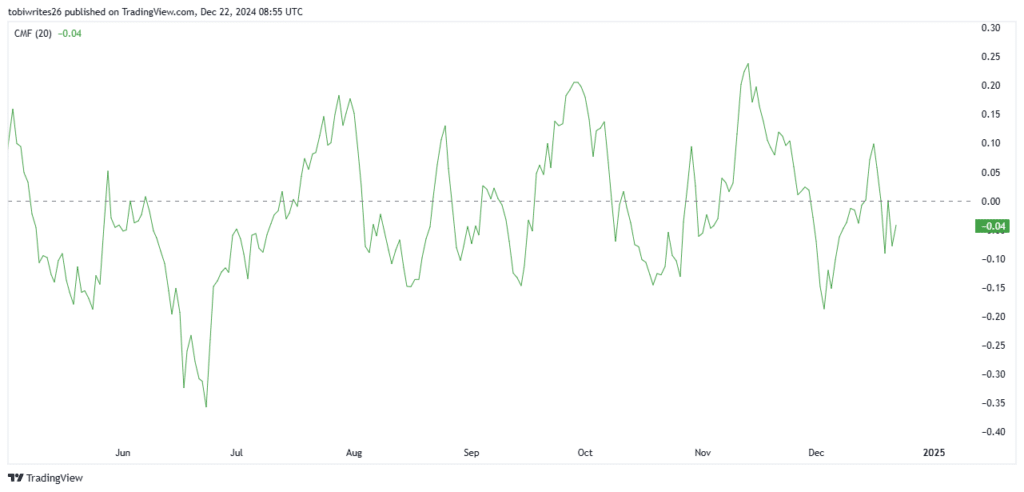

Bullish sentiment persists in the market, supported by the Chaikin Money Flow (CMF), which is trending upward and nearing the zero-line threshold.

When the CMF trends higher, it indicates that buying volume exceeds selling volume, with a potential reversal to the upside being close. If the CMF crosses above the neutral zero line, it could drive the price higher.

The current movement of the CMF suggests ongoing accumulation at the support level. However, this accumulation may temporarily weigh on the price, causing a minor dip before the bullish momentum intensifies.

Read dogwifhat’s [WIF] Price Prediction 2024–2025

In addition, spot traders are increasingly transferring their WIF holdings to private wallets for long-term storage. At present, approximately $5.50 million worth of WIF has been moved in this manner.

While WIF maintains its overall bullish outlook, a slight drop in price remains likely in the short term.