dogwifhat price prediction – Are long traders stalling WIF’s rally?

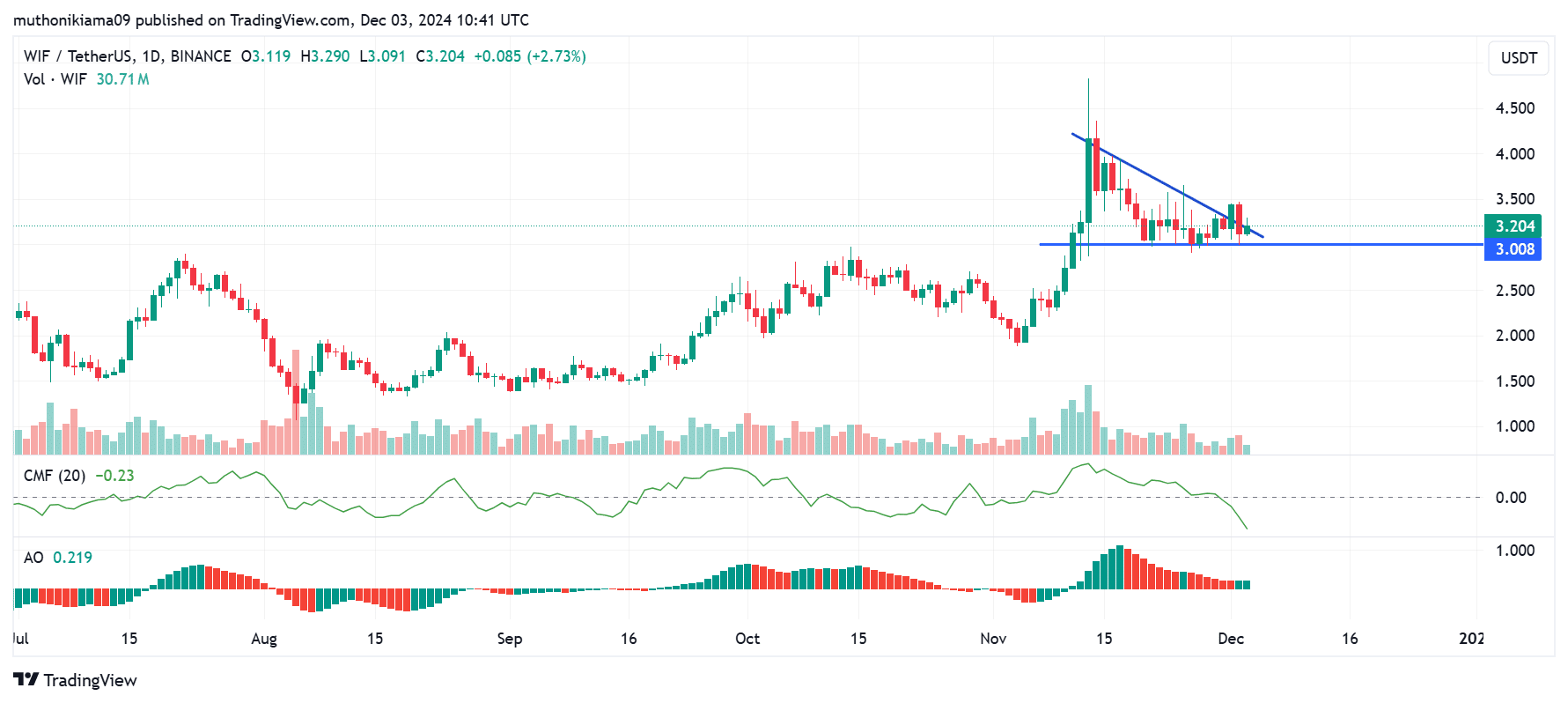

- dogwifhat was trading within a descending triangle channel on its one-day chart, suggesting a bearish reversal.

- The negative CMF showed that despite recent gains, selling activity has outpaced buying activity.

dogwifhat [WIF], at press time, traded at $3.22 after a 5% gain in 24 hours. These gains have brought the memecoin’s monthly gains to 54%, with the uptrend attracting long-term holder distribution.

According to Lookonchain, one trader dubbed “blockgraze” has moved 1.5M WIF tokens, valued at $4.56M, to the Coinbase exchange after holding the tokens for 8 months.

While this trader has clarified that he is yet to sell the coins, the movement of these funds coincides with some bearish signs around WIF on its one-day chart.

A descending triangle pattern was evident, suggesting that dogwifhat could head towards a downturn. The support level at $3 is critical for WIF to avoid this bearish trend.

If WIF rallies to overcome resistance at $4.83 and collects liquidity at this level, it will have invalidated this bearish thesis.

Technical indicators currently show mixed signals on WIF’s future price movements. The Chaikin Money Flow (CMF) has flipped negative, indicating that sell-side pressure is dominant.

However, the Awesome Oscillator (AO) bars have flipped green, which shows a bullish divergence. As bulls and bears struggle for control, the derivatives market shows that liquidations could determine WIF’s next move.

WIF long liquidations surge

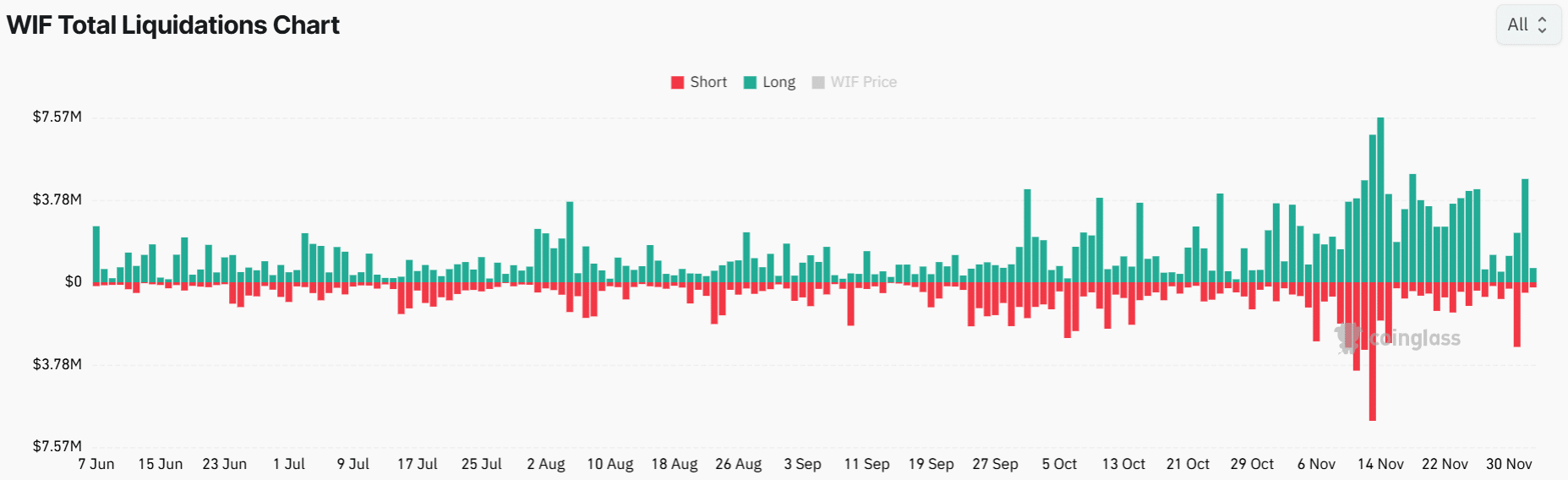

Data from Coinglass shows that a surge in long liquidations might be suppressing WIF’s rally.

In just two days, more than $5M worth of WIF long positions have been liquidated, adding to the dominance of these liquidations in the last two weeks.

When long positions are liquidated, traders are forced to close their positions by selling the token. The forced selling may have outpaced the buying activity, causing the rally to stall.

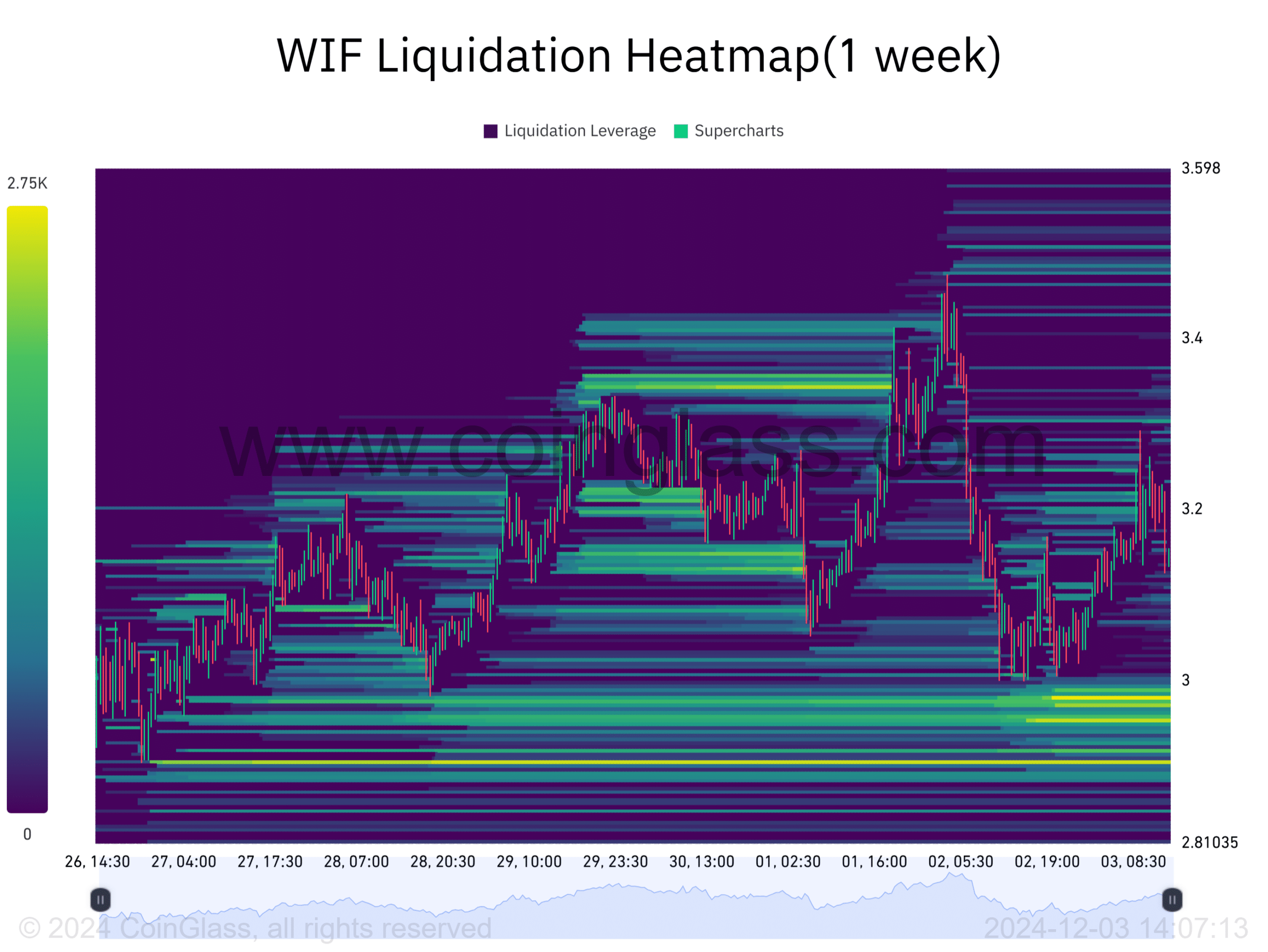

dogwifhat’s liquidation heatmap with a one-week lookback period clearly shows these surging liquidations each time the uptrend failed.

However, there is still a hot liquidation zone below the price. A liquidation cluster tends to act as a magnet zone that could cause WIF’s downtrend. If WIF falls below $3, these liquidations could push the price down further.

WIF Funding Rates hit record highs

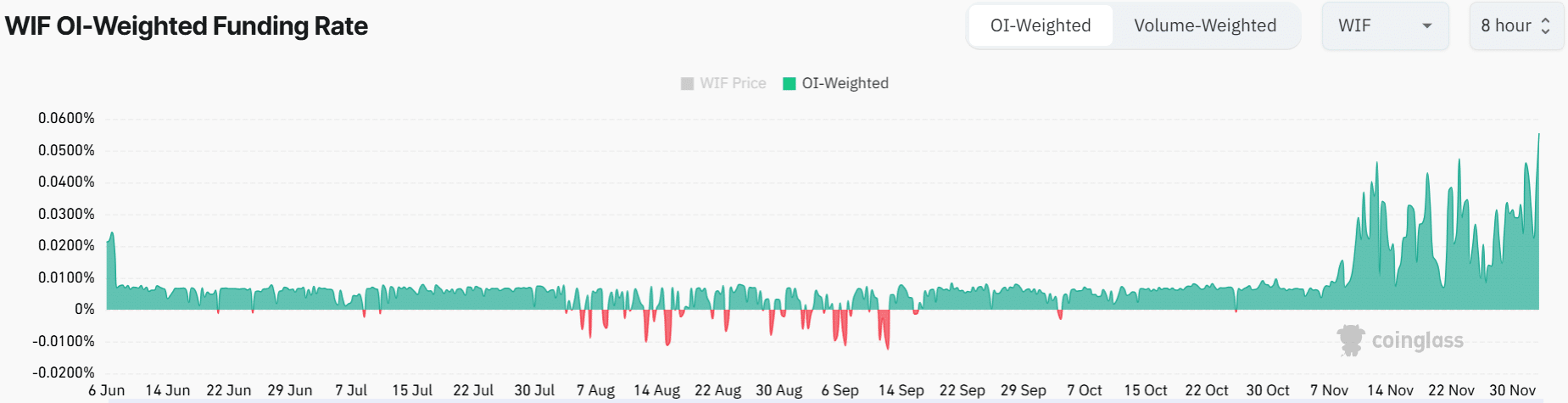

Despite long traders being liquidated, these positions continue to dominate the market, showing an overall bullish sentiment around WIF.

Read dogwifhat’s [WIF] Price Prediction 2024–2025

At press time, WIF’s Funding Rates stood at an all-time high of 0.0555%, suggesting that traders were willing to pay more to maintain their long positions.

However, traders should watch out for a potential long squeeze if WIF records an unexpected price drop because that could cause a surge in liquidations that will fuel the downtrend.