dogwifhat rebounds with a 22% hike: Can WIF sustain these gains?

- Dofwifhat experienced a strong downward momentum nearly collapsing to $1.

- However, over the past 24 hours, things changed as WIF surged by 22%.

Over the past month, crypto markets have experienced increased fluctuations. The rise in volatility peaked on 5th July as the market nearly crashed.

During the market dip, Bitcoin reached a two-month low of $49577. With the drop, all altcoins suffered, resulting in $1 billion liquidation and a $300 billion decline in the Crypto market.

Therefore, dogwifhat [WIF], like other altcoins and meme-coins, dropped significantly, continuing a month-long decline.

WIF gains after weeks of decline

Over the past week, WIF has experienced a substantial decline, which went further during the recent market crash. However, in a turn of events, dogwifhat has reported massive gains on daily charts.

As of this writing, WIF was trading at $1.7 following a 22% increase over the last 24 hours. This surge comes after the memecoin experienced a strong downward momentum.

Thus, on daily charts, WIF shows strong upward activities that are sustained and would complete the recovery.

Is WIF safe from the $1 decline scare?

Despite the gains on daily charts, WIF still remains bearish. Over the past seven days, WIF has declined by 26.34 %, with trading volume sinking by 37% on daily charts.

As reported earlier by AMBCryto, dogwifhat’s decline had analysts fearing a further decline below $1. However, with the recent surge on daily charts, the market feels the upward momentum, if maintained, can drive the prices further up.

According to AMBCrypto’s analysis, despite the gains on daily charts, WIF was experiencing a strong bearish trend. Looking at the Directional Movement Index, the downward is strong, with the negative index at 28 sitting above the positive index at 17.

Additionally, the Aroon line further proves the downtrend is strong as Aroon down at 85.71%, sits above the Aroon Up line at 21.43%.

Equally, the RVGI showed that the WIF downtrend is sustained below zero at -0.4355, below the signal line at -0.4339.

Looking further, our analysis of Santiment data shows open interest per exchange has declined over the past week. Open interest per exchange has declined from a high of $146.7 million to $109.1 million at press time.

However, the last 24 hours have witnessed a rise in WIF open interest per exchange. The decline suggests that investors are closing their positions without opening new ones.

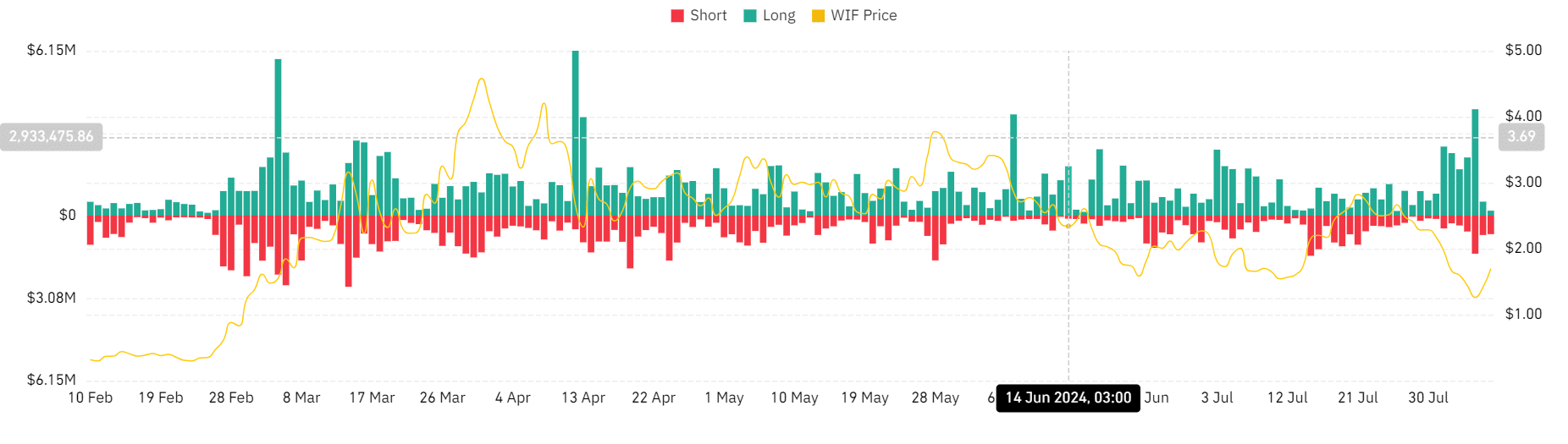

Finally, Coinglass data shows WIF has experienced higher long position liquidation over the past seven days.

Realistic or not, here’s WIF’s market cap in BTC’s terms

The gains on daily charts show that liquidation for short positions increased while long positions remained considerably low.

Therefore, if the gains on daily charts hold, WIF will attempt to reach a significant resistance level of around $2.3. However, if the overall market sentiment persists, dogwifhat is not out of danger of declining to $1.05.