dogwifhat sellers exhausted – Is WIF ready for a breakout?

- WIF’s Stochastic RSI has dropped to 11 showing that the meme coin is oversold.

- The number of WIF short sellers has increased to a monthly high, increasing the likelihood of a short squeeze.

dogwifhat [WIF] traded at $2.57 at press time after a 4.7% gain in 24 hours. WIF, the largest meme coin on Solana [SOL], has been under bearish pressure as it was down by 2.5% in the last seven days.

WIF’s recent gains come amid a recovery across the Solana meme coin ecosystem. Data from CoinGecko shows that the market capitalization for SOL-based meme coins has surged by nearly 7% in 24 hours.

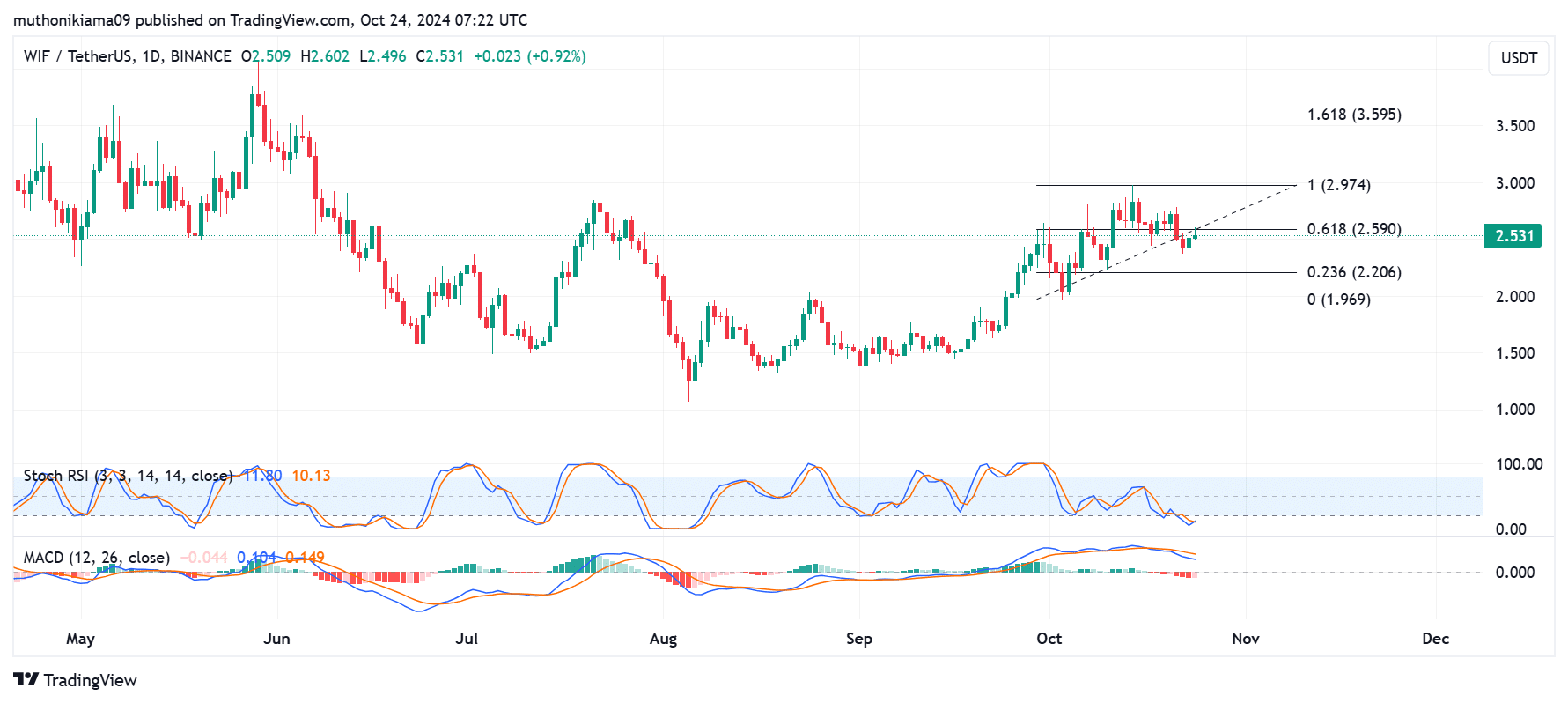

Following these gains, WIF is now showing signs of a reversal from the bearish trend. On the one-day chart, WIF’s Stochastic Relative Strength Index (RSI) had dropped to the oversold level of 11.

This suggests that WIF’s bearish trends were because of selling activity as traders minimized their losses. The Stoch RSI has also converged with the signal line from below suggesting that a reversal could be underway.

However, the Moving Average Convergence Divergence (MACD) shows a bearish outlook as it is below the signal line while the histogram bars are negative. This shows that bears are attempting to gain control of the price action.

If WIF succumbs to the bearish trends, it could drop to find support at the 0.236 Fibonacci level ($2.2).

However, if sellers are exhausted and buyers step in, WIF could make a strong rebound past $3 to the 1.618 Fib level at $3.50.

dogwifhat short sellers are increasing their positions

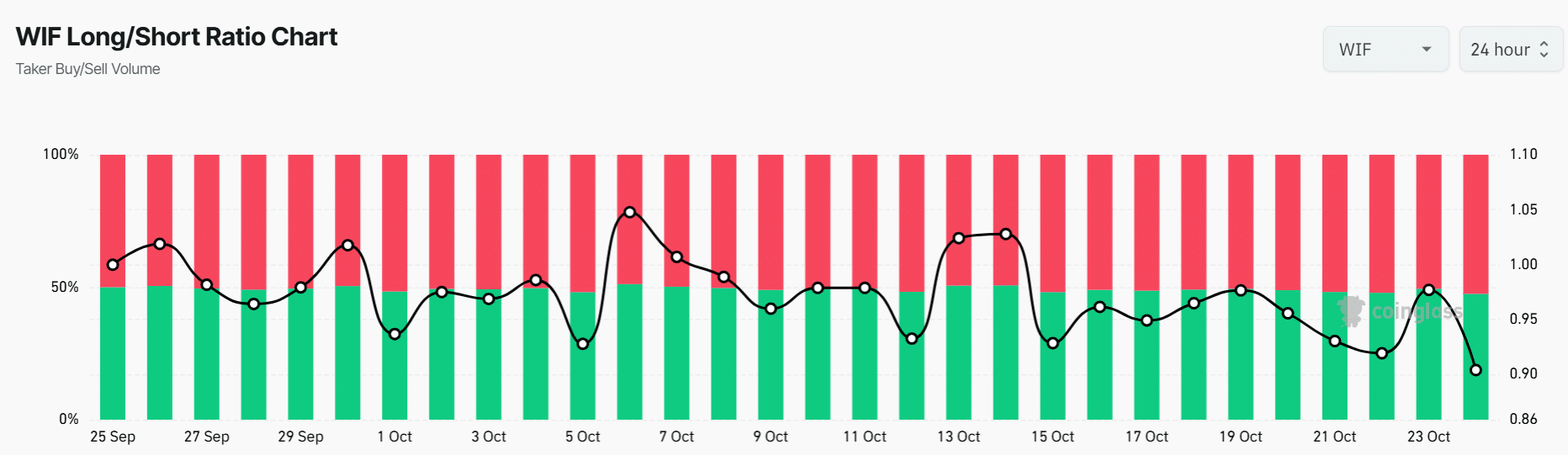

WIF has seen a sudden increase in short positions. This is seen in the long/short ratio that has dropped to 0.90, its lowest level in 30 days. 52% of derivative traders have opened short positions on WIF, while 47% of traders have opened long positions.

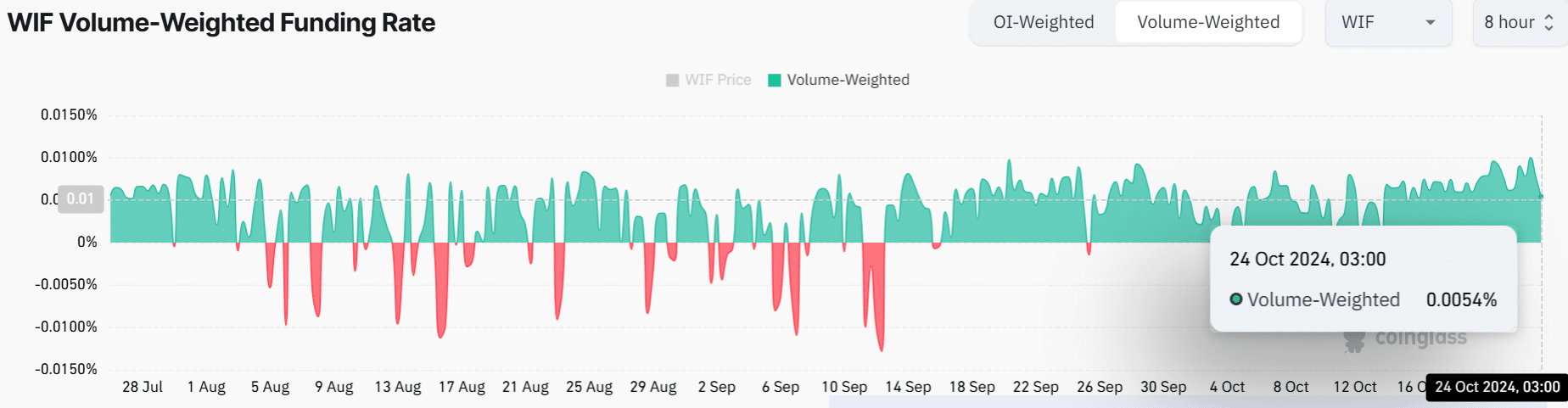

The increase in WIF short sellers is further seen in its funding rate. This metric recently surged to a multi-week high of 0.01% suggesting that long traders were willing to pay a higher fee to maintain their positions.

However, at press time, the funding rate had dropped to 0.0054%, indicating that long traders were closing their positions.

Is your portfolio green? Check the dogwifhat Profit Calculator

A surge in short positions increases the likelihood of a short squeeze. If WIF continues its uptrend, these short sellers could be forced to buy, which will further support an uptrend.

The likelihood of a continued uptrend is also seen in the positive crowd sentiment around WIF per Market Prophit. Positive sentiment could lead to buying activity and the bearish trends could weaken.