Memecoins

Dogwifhat’s sharp decline: Why WIF could fall below $1

Amidst crypto market volatility, dogwifhat has been hit had. WIF has declined by 35% on weekly charts leaving analyst eyeing a further drop to $1 or below.

- WIF declines by 35% on weekly charts amidst declining open interest.

- Analysts predict a further decline to $1.

The cryptocurrency market has experienced extreme volatility over the past months. Over the last seven days, the market has seen all cryptocurrencies experience a massive decline.

For starters, Bitcoin

has declined 9.84% to $60,780. BTC’s decline has pushed altcoins to massive sell-off, with Ethereum declining by 9.36% on weekly charts and Solana dropping by 21.09% to $141.This volatility has hit dogwifhat [WIF] the most, declining by 36% on weekly charts.

Dogwifhat’s market sentiment

Amid the WIF’s decline, the market sentiment is strongly bearish. The analysts have shown their pessimism about the possible reversal, predicting a further decline. For instance, Rehan Rao shared his prediction on X, noting that,

“Dogwifhat (WIF) might drop to $1: Major assets are down, and a whale just sold 14.53M WIF tokens. WIF is currently $1.71 and could fall to $1.40 or $0.90.. Watch for key levels at $1.58 and $1.76.”

According to this analyst, since all major crypto assets are declining, WIF will drop below $1, hitting $0.90. Such a decline would solidify the month-long decline of WIFs.

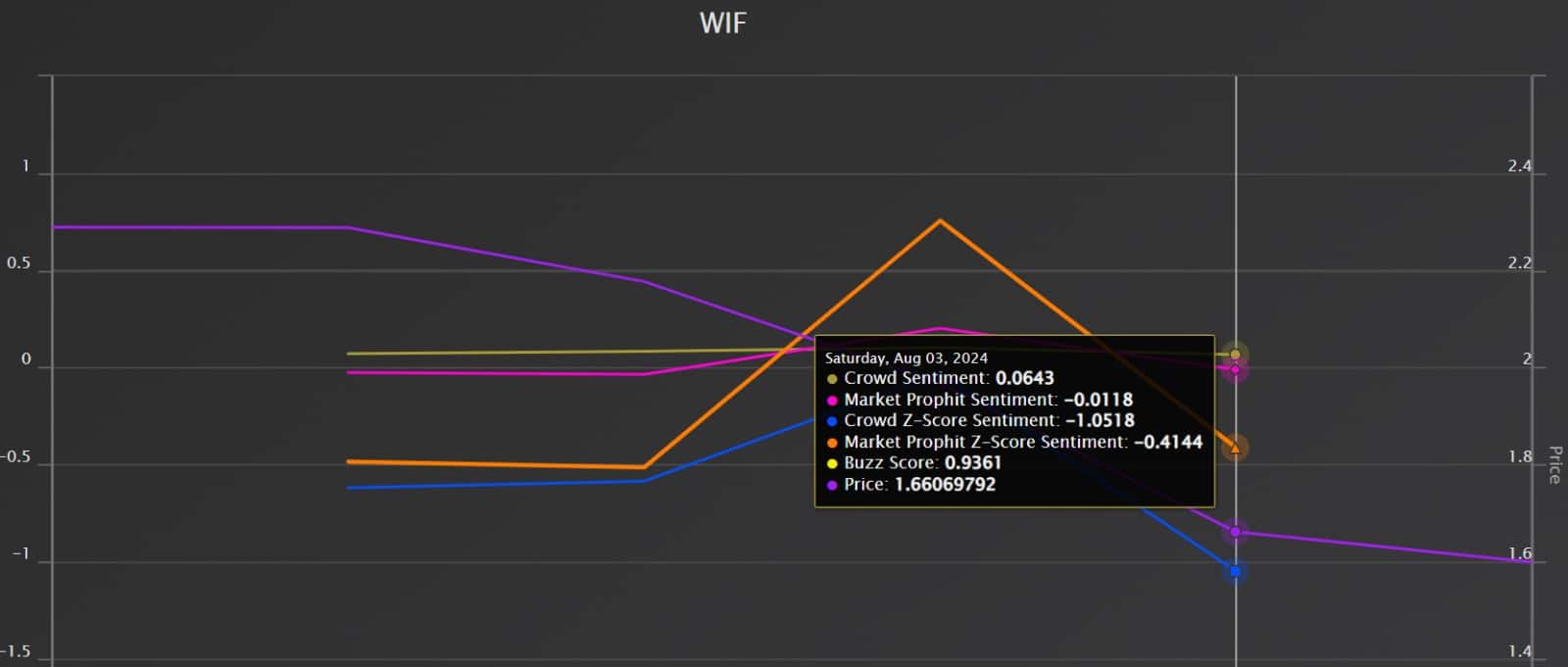

Such analysis shows the prevailing market sentiment, with AMBCrypto’s analysis of Market Prophit showing that the market sentiment is bearish.

According to the market prophit, the Crowd Z Score is below zero at -1.05, and the market prophit sentiment is below zero at -0.0118.

WIF Decline amidst low open interest and higher liquidation

Dofwifhat sustained decline arises from increased liquidation for long positions and declining open interest. AMBCrypto’s analysis of Coinglass shows WIF open interest has declined over the past 7 days.

According to Coinglass, WIF’s open interest has declined from $385.98M to $239.2M over the past week. This decline shows investors are closing their positions without opening new ones.

LookonChain reported such an incident with a whale selling WIF after 8 months. They reported that,

“5 wallets(may belong to the same person) sold 14.53M $WIF($24M) .”

Additionally, WIF has experienced massive liquidation for long positions, according to Coinglass. Over the past week, long position liquidation has surged from a low of $176k to $2.85M.

When long position liquidation soars, investors are forced out of their positions, thus selling at a loss as they lack the conviction to pay premiums and hold their positions.

What price charts indicate

As of this writing, WIF was trading at $1.55 after an 8.84% decline on daily charts. Amidst the price drop, WIF’s trading volume has also declined by 32.93% to $353.5 million over the last 24 hours.

Therefore, our analysis shows WIF is experiencing a strong downward momentum. For instance, RVGI is below zero at -0.3794, suggesting that closing prices are lower than the opening process.

This confirms that the market is in a downtrend and sellers are dominating the markets, thus resulting in higher selling pressure.

The Awesome Oscillator (AO) was below zero at -0.244, indicating that short-term momentum is weaker than long-term.

Thus, the market is experiencing a strongly bearish trend, and AO confirms the trend is most likely to continue. Equally, the MACD further proves this as it’s below zero at -0.109.

Will WIF drop below $1?

On monthly charts, WIF has experienced a strong downward momentum. Over the past seven days, the memecoin has declined by 35%, and thus, if these conditions prevail, WIF will decline further.

Realistic or not, here’s WIF’s market cap in BTC’s terms

If WIF daily candlesticks are closely below the critical support level at $0.50, the altcoin will decline to the next support level at $1.0.

However, if it retests this level and bounces back, it will repeat the historical cycle from 12 July, when it retested the same support level and surged to $2.82.