dogwifhat’s rally fizzles: Will WIF bulls regain momentum soon?

- The market structure of WIF was bullish.

- Traders can expect sideways and slightly higher instead of a breakout and rally.

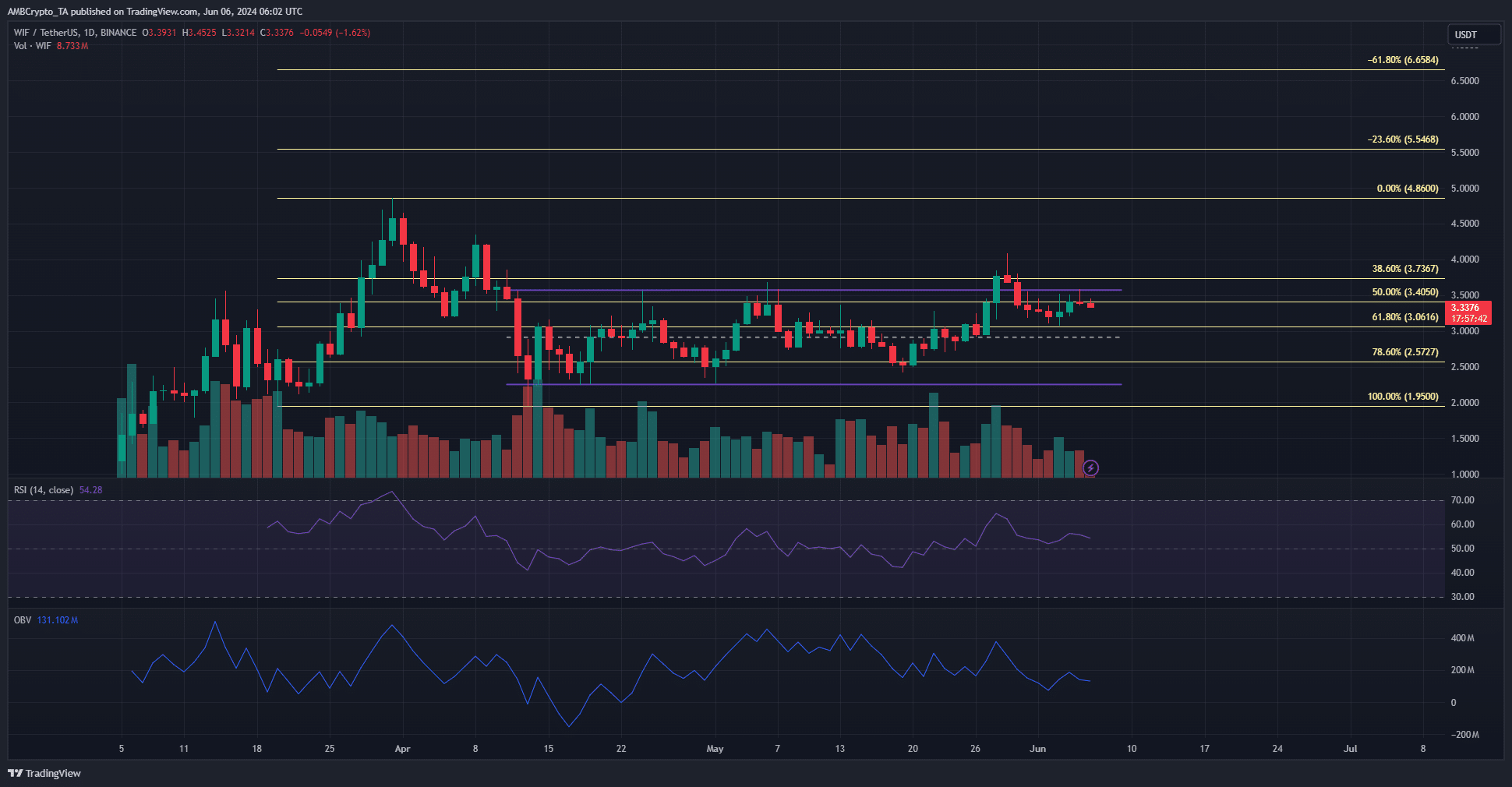

dogwifhat [WIF] was trading below the range highs once again as the late-May breakout failed to stick. The trading volume slumped over the past ten days, which could be a clue about the market intentions.

While the memecoin has been in a consolidation phase since April, it has also slowly trudged higher up the price charts. This was remarkable considering the volatility of Bitcoin [BTC] in the past two months.

Will the rejection see WIF post more losses?

WIF made a local high of $4.08 on the 29th of May. Since then it has shed 18.5%. At press time it was trading below the $3.4 resistance level which was also the 50% Fibonacci retracement level.

The momentum on the daily chart was slightly bullish, with the RSI standing at 54. However, the OBV was in a range, just like the price, and until it can set a new high it is likely WIF would remain rangebound as well.

The OBV’s lack of movement indicated a balance between buyers and sellers, which usually represents consolidation. To the south, the mid-range level at $2.9 is the next support level where the token could see a positive reaction.

Speculators were ready to go long but might not be successful

Source: Coinalyze

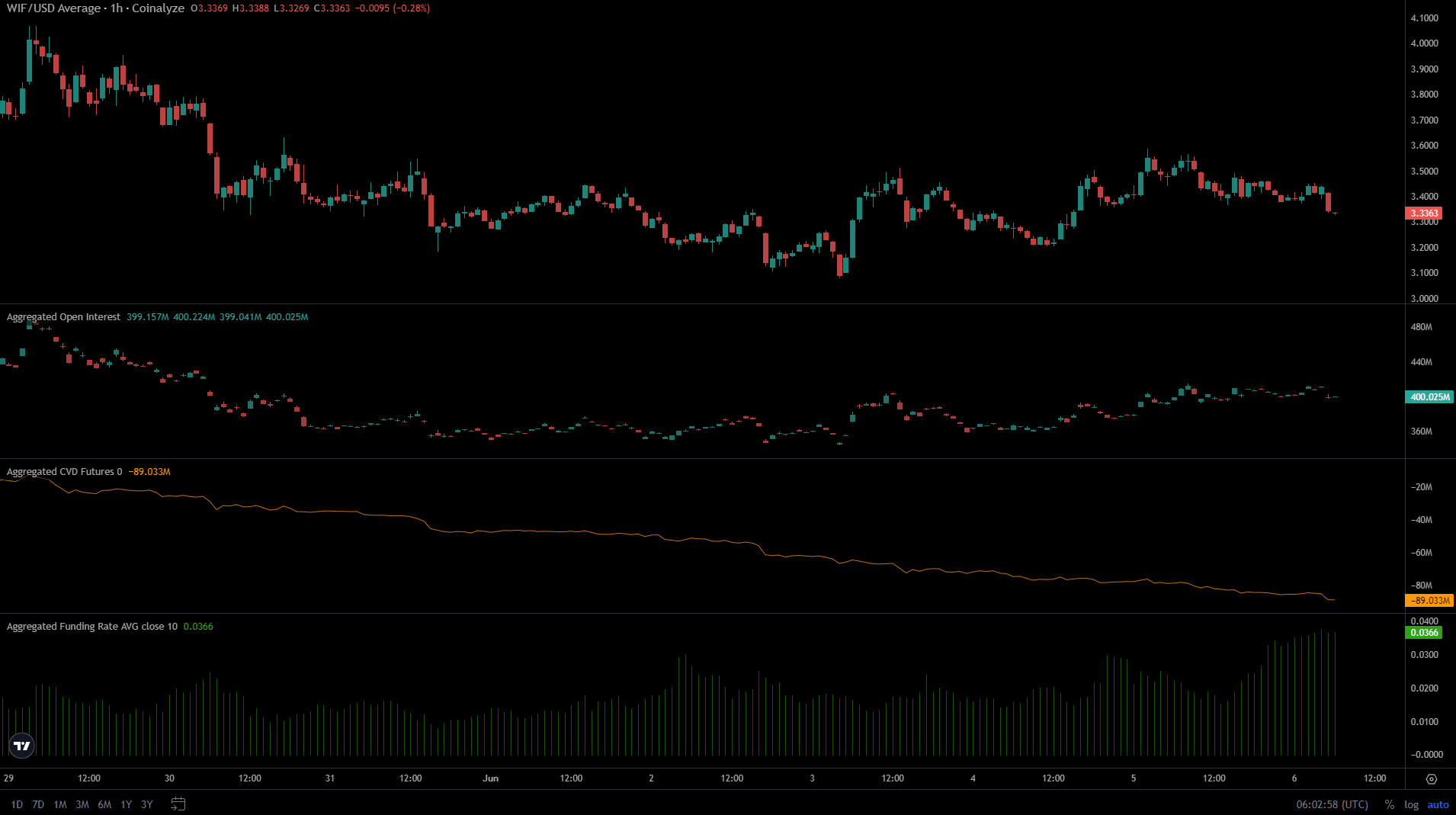

Over the past few days, each time the price of dogwifhat bounced, the Open Interest surged higher.

Is your portfolio green? Check the WIF Profit Calculator

Each short-term price uptick saw a majority of the gains corrected in the past three days, yet the OI was trending higher.

This showed that buyers were willing to go long, an idea reinforced by the climbing funding rates. Yet, genuine demand was missing. The spot CVD was in a downtrend to underline this.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.