DOT falls 20% in 30 days: Is Polkadot’s low activity the reason why?

- DOT’s price has fallen by double digits in the last month.

- This is due to the low activity on Polkadot.

Polkadot’s [DOT] value has plummeted by almost 20% in the last month, according to data from CoinMarketCap.

An on-chain assessment of activity on the Proof-of-Stake (NPoS) blockchain network showed that it has experienced a decline in demand since the year began, hence the double-digit decline in DOT’s value.

At press time, DOT exchanged hands at $6.73, a price level last observed in September 2023.

Bears put DOT holders in jeopardy

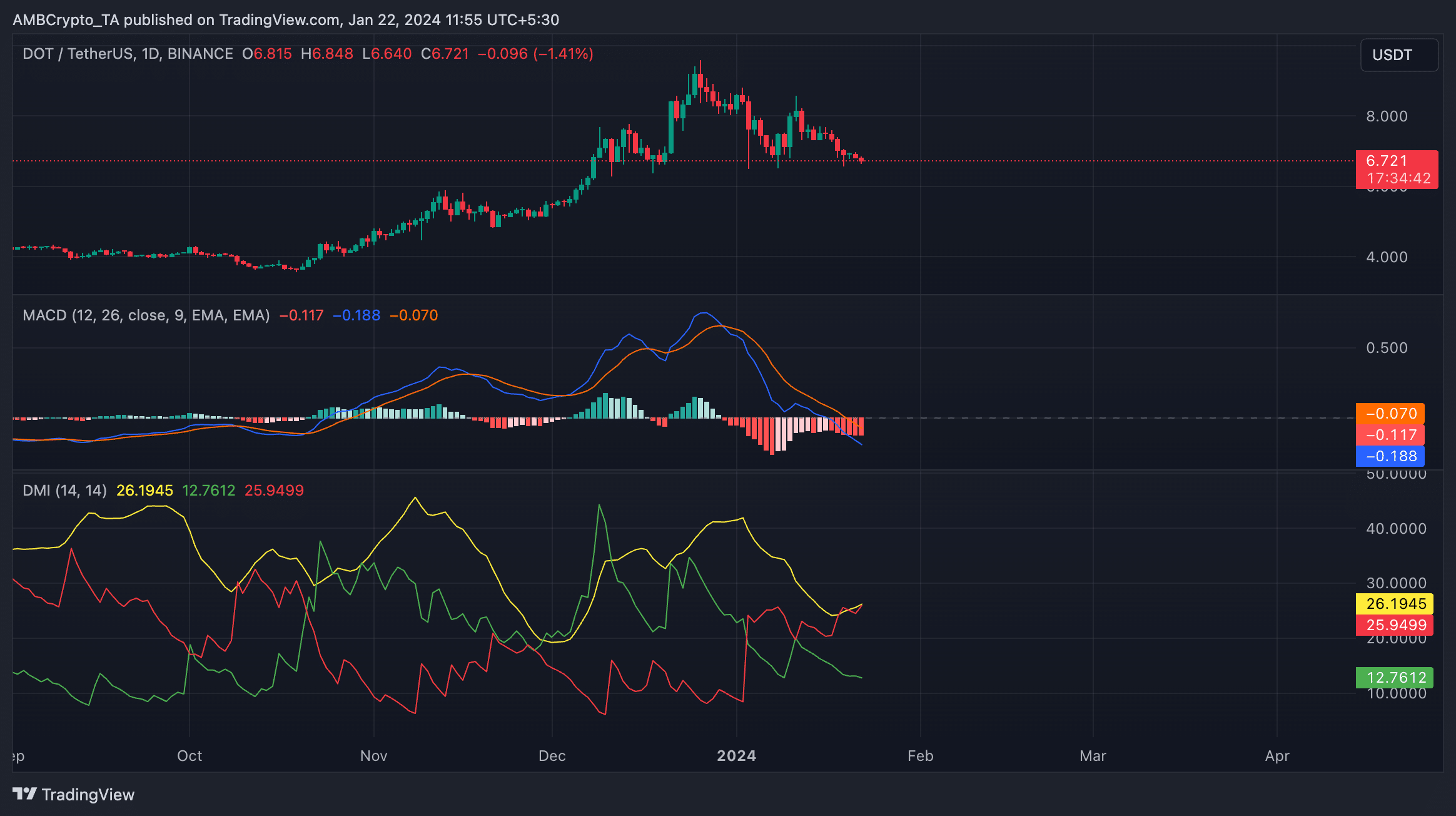

DOT’s price movements observed on a 24-hour chart revealed a significant bear presence.

For example, its Directional Movement Index (DMI) showed its positive directional index (green) at 12.76, resting below its negative directional index (red) at 25.94.

When these lines are so positioned, the downtrend is deemed to be stronger than the uptrend, as selling pressure is of a much higher momentum than accumulation.

Confirming the strength of the downtrend, DOT’s Average Directional Index (yellow) was spotted in a rally at 26.19. When an asset’s ADX is above 25, it signals that the current market trend is strong.

Further, a look at DOT’s Moving Average Convergence Divergence (MACD) showed that the indicator crossed below the trend line on the 31st of December 2023, and has since been so positioned.

This intersection is interpreted as a bearish crossover and a signal for traders to sell. The surge in selling pressure has led to a 20% fall in DOT’s price since the year began.

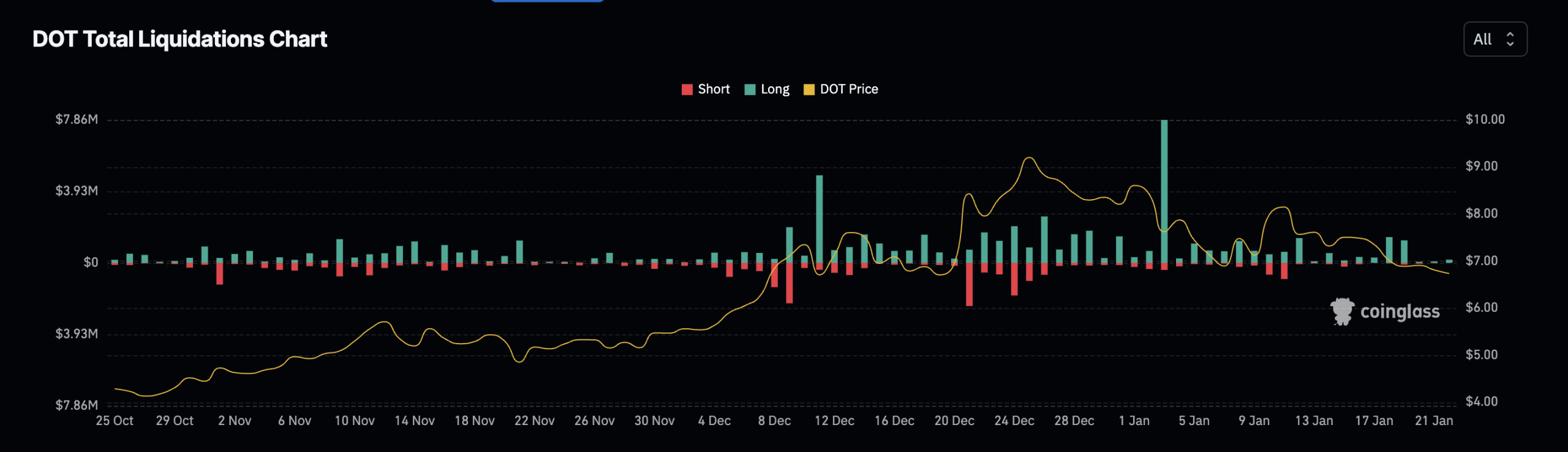

In the coin’s derivatives market, its Futures Open Interest has dropped since the beginning of the year.

According to data from Coinglass, DOT closed the trading session on the 21st of January with an Open Interest of $221 million, marking a 17% decline from the $265 million it recorded on the 1st of January.

Interestingly, despite the falling price and Open Interest, DOT Futures traders have continued to open leveraged positions in favor of a price rally.

Data from Coinglass showed that since the year began, DOT has seen only positive Funding Rates across crypto exchanges.

However, as the altcoin’s price declines further, long traders have faced liquidations, with a year-to-date high of $8 million recorded on the 3rd of January.

Low demand for Polkadot

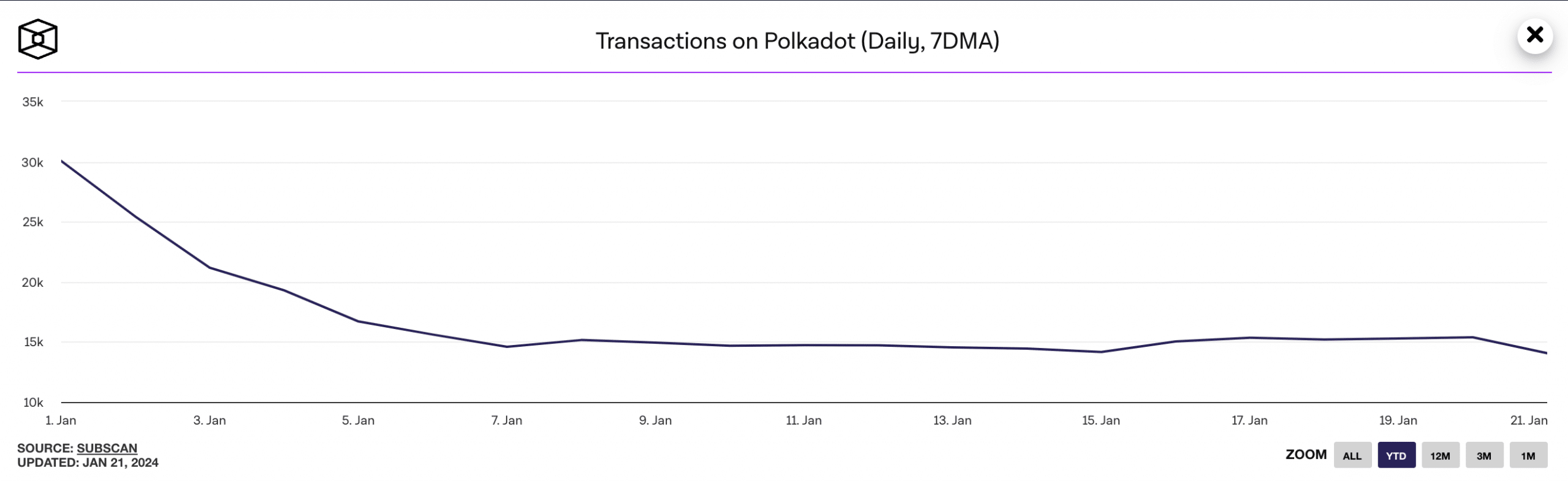

An on-chain assessment of the network activity on Polkadot revealed that it has witnessed a fall in user activity since the year began.

Read Polkadot’s [DOT] Price Prediction 2023-24

As of the 21st of January, it recorded a daily transactions count of 14,100 – the lowest number since 2024 started.

As for the number of new addresses created on the Polkadot network daily, it has also plunged by 20% in the last 21 days, according to The Block’s dashboard.