Analysis

DOT stays below $4 — can bulls withstand the heavy selling pressure?

The failure by DOT bulls to reclaim the $4 support level after sellers broke the level saw the altcoin sink further by 5.9% over the past two days.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- DOT continued to trade under $4, as sellers looked to extend their gains.

- Shorts held a significant advantage in the futures market.

The failure by bulls to reclaim the $4 support level on Polkadot [DOT] after sellers broke through saw the altcoin sink by 5.9% over the past 48 hours. This saw price headed toward the weekly support level of $3.6, as of press time.

How much are 1,10,100 DOTs worth today?

The sustained selling pressure could see DOT set another record low for 2023 in the coming days. Meanwhile, Bitcoin [BTC] continued to trade under $27k, as the market experienced a price correction.

As per AMBCrypto’s latest analysis

, DOT posted significant losses since the beginning of October given a heavy bearish pressure. Between 2 and 10 October, DOT lost more than 10% of its value.Bulls unable to withstand heavy selling pressure

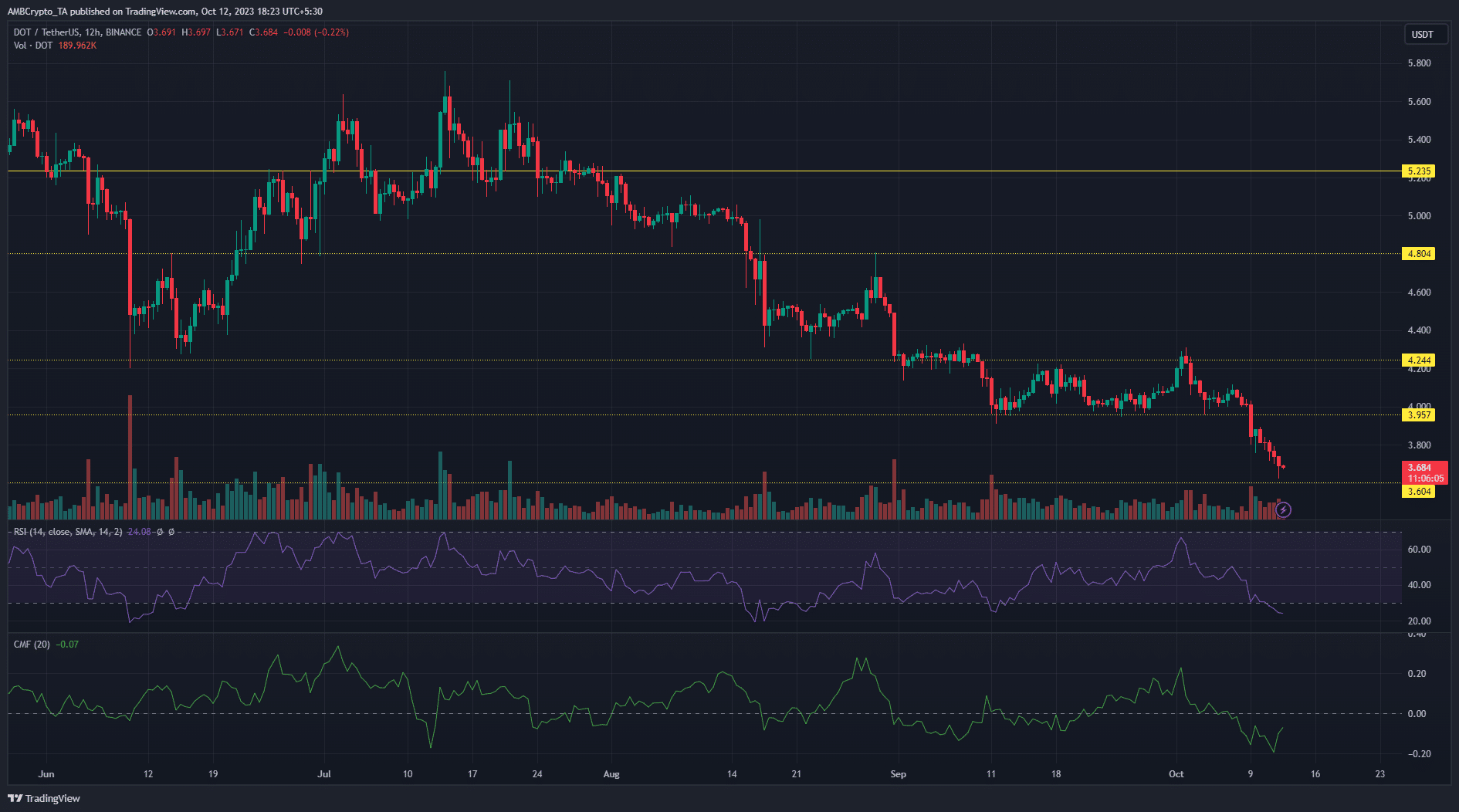

The 12H price chart highlighted the intense selling pressure on DOT. After the break of the bullish defense at the $4 support level on 9 October, sellers went on a spree with DOT recording a series of bearish candles in a row.

The swift descent of price toward the next support level of $3.6 (weekly timeframe) could extend the selling pressure with a bullish rebound looking unlikely in the short term.

Furthermore, a look at the on-chart indicators painted a grim picture for bulls. The On Balance Volume (OBV) remained in perpetual decline while the Relative Strength Index (RSI) slipped into the oversold zone. Both signaled the significant selling impact on DOT’s price.

In addition, the Chaikin Money Flow (CMF) hit -0.20, a dive deep into negative territory which showed the heavy outflow of capital from DOT.

Thus, the decline of BTC below $27k could see sellers extend their gains in the short term.

Sellers held massive leverage in the futures market

Read Polkadot’s [DOT] Price Prediction 2023-2024

The Exchange Long/Short ratio on Coinglass showed that selling positions eclipsed buying positions by over $7 million. This translated to a 52.85% market share for shorts. This hinted that sellers could extend their influence over DOT’s price action, due to the ongoing market correction.