DOT’s warranted celebration may not have metrics in attendance because…

- Weighted sentiment towards DOT wasn’t at its best at the time of writing.

- However, DOT managed to stay in the green at press time and surged by 6% over the last seven days.

Polkadot [DOT] Network’s official Twitter account published a latest roundup of all the events and updates the team had to share with its community. The tweet published on 17 April had a number of exciting developments that have been the latest on the ecosystem.

One of the updates was that the peaq network on Polkadot unveiled its integration with the Fetch.ai. The integration aimed to power peer-to-peer applications with automation and AI.

4/ @peaqnetwork has unveiled an integration with @Fetch_ai, a platform powering peer-to-peer applications with automation and AI. With integration already live on Peaq’s testnet, this will pave the way to wider AI use within the Polkadot ecosystem. https://t.co/5yLXQMT8oe

— Polkadot (@Polkadot) April 17, 2023

Read Polkadot’s [DOT] Price Prediction 2023-24

Another significant development that made it to the Polkadot roundup was about Polkadot’s NFT marketplace Raresama. As per the update shared by Polkadot, Raresama witnessed significant growth over the last year. Additionally, the number of NFTs on the marketplace also witnessed a significant growth since January 2023.

7/ @RaresamaNFT – an NFT marketplace governed and curated by the @MoonsamaNFT and @ExosamaNFT community – has grown rapidly this year. Learn more about the project and check the collections on Raresama: https://t.co/6L5b7w9wIm https://t.co/0ji83TL6VR

— Polkadot (@Polkadot) April 17, 2023

Are congratulations in order for DOT?

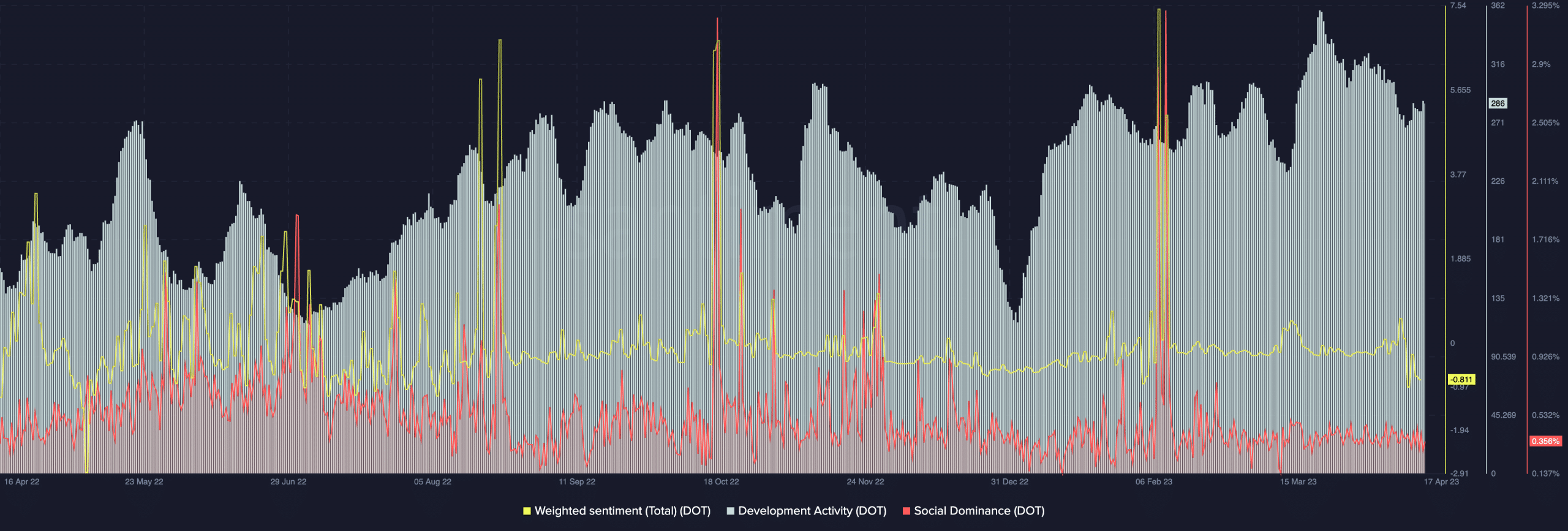

As per data from Santiment, DOT’s social dominance wasn’t near its highs of February. Additionally, at press time, DOT’s social dominance wasn’t in its best state. This indicated that there wasn’t much chatter about DOT on the social front. Furthermore, DOT’s weighted sentiment also failed to paint a positive picture for the altcoin.

At press time, DOT’s weighted sentiment witnessed a drop as compared to its last surge on 11 April. Although development activity did witness a surge as of 17 April, the metric wasn’t at its best since the beginning of April. However, a slight uptick could indicate a positive development environment on the network.

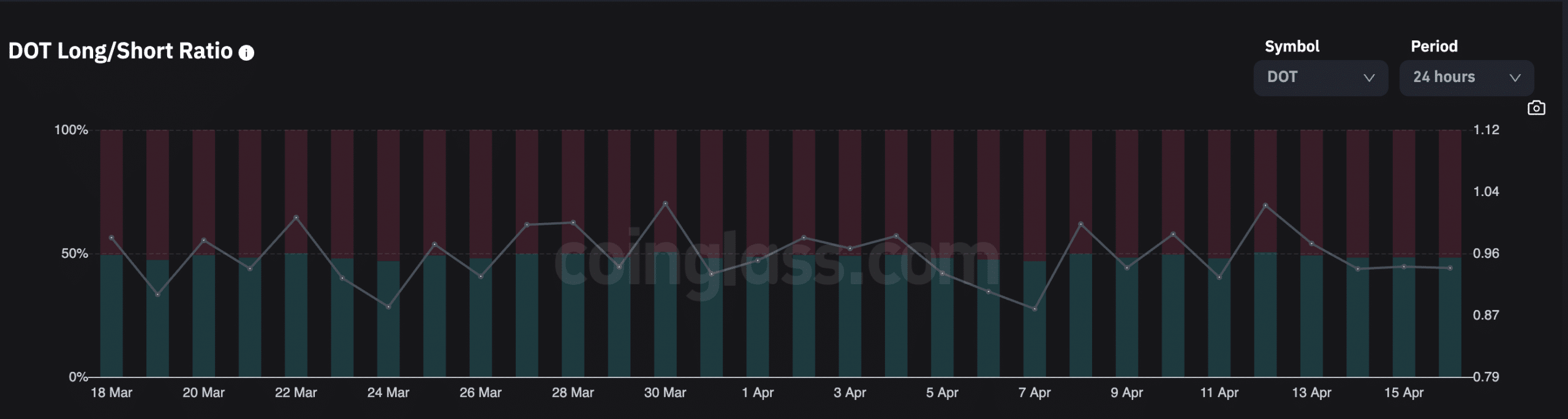

A look at DOT’s long/short ratio indicated that most investors didn’t favor long positions. At press time, DOT’s long/short ratio stood at 0.95 with 51.67% traders in favor of short positions. Thus, traders in the market could be expecting a price correction or fluctuation for DOT in the coming days.

Get in line for a green signal

At press time, DOT was trading at a value of $6.75 and managed to flash green. A look at its Moving Average Convergence Divergence (MACD) also showed the MACD above the signal line. This could be interpreted as a positive indication for the price of DOT.

Furthermore, the Awesome Oscillator (AO) too flashed green ascending bars and managed to stay above the zero line. However, the Relative Strength Index (RSI) indicated that a trend reversal could be in the works. At press time, DOT’s RSI stood at 67 after managing touch the overbought zone.

Realistic or not, here’s DOT’s market cap in BTC terms

At the time of writing, the RSI was seen in a downward position. This could be an indication of a correction over the next few days.

Furthermore, as per data from CoinMarketCap, DOT witnessed a price correction in the last 24 hours and fell by 1.22%. However, its price over the last days surged by a considerable 7.58% giving some hope to investors.

Thus, traders could consider thinking before going all out on DOT especially in light of the contradictory scenarios put forth by DOT’s metrics and its price.