Down 70% in 2 months, WIF memecoin may be heading to the $1-level next!

- WIF has fallen below its November lows

- Down by nearly 70% in two months, dogwifhat is likely to touch $1 soon

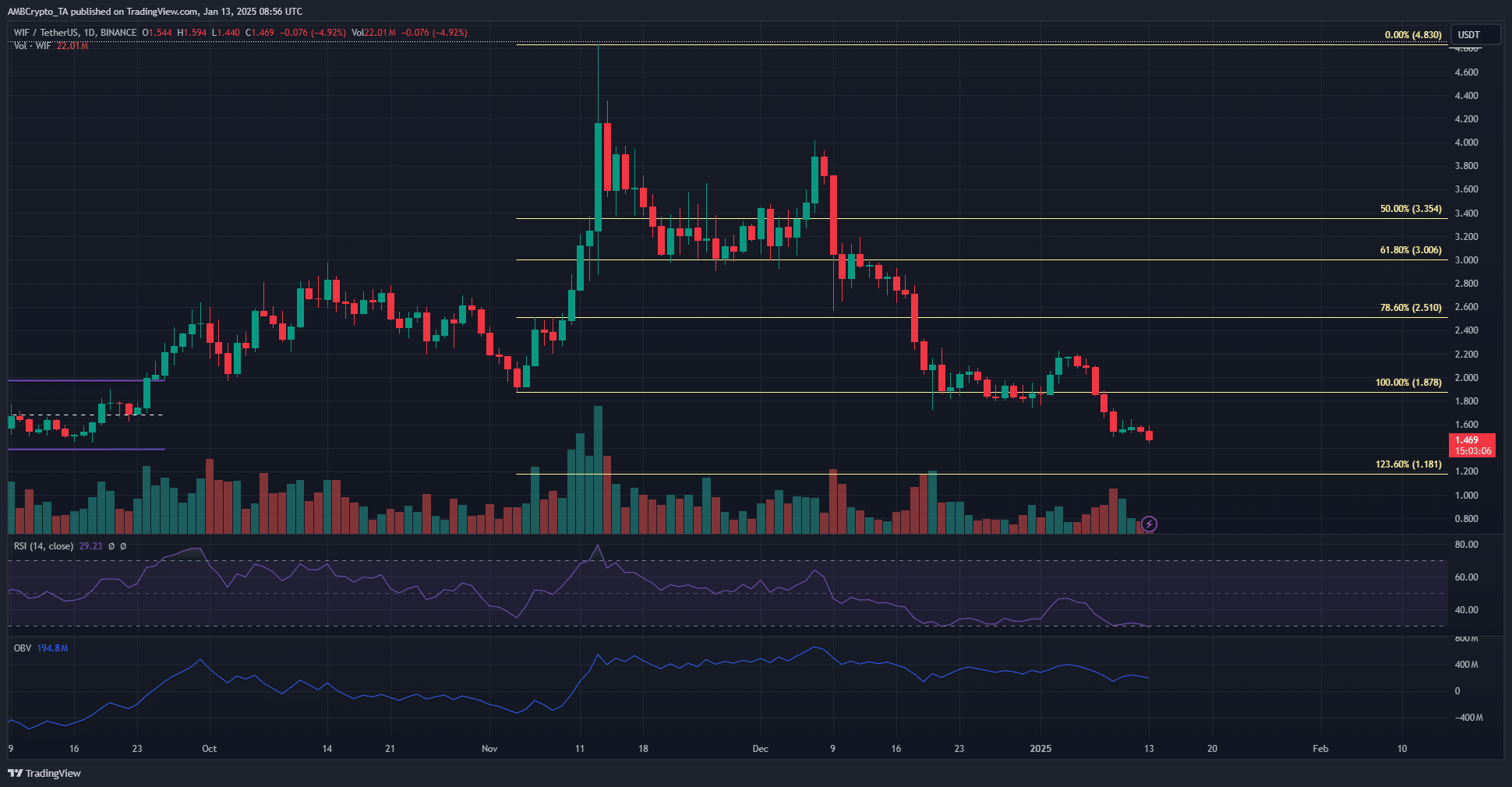

Popular memecoin dogwifhat [WIF] is continuing its downtrend. It has been on this bearish trajectory since 10 December. The buyers’ failure to defend the $2.51-level turned the deep retracement into a full-blown sell-off, showcasing the waning confidence among buyers.

The poor performance of WIF was a trend mirrored across the memecoin sector. Dogecoin [DOGE] the biggest memecoin by market cap, has also been struggling to recover. In the case of dogwifhat, the struggle is not about recovery, but mere survival.

November lows of WIF give way after three weeks of pressure

The price action chart revealed an extremely weak WIF. The bulls were unable to hold on to the gains made in November, when dogwifhat rallied alongside the rest of the market. While Dogecoin, by comparison, was able to stall the sellers at the 50% retracement level, WIF bulls were not strong enough to do so.

The selling pressure has been persistent. The 78.6% retracement level was ceded to the bears just a month after the rally had begun, and over the past month, it has not even been tested as resistance.

The OBV has gradually trended south over the past six weeks and might be poised to make another lower low. The RSI was at 29.2, reflecting oversold conditions. This did not signal a price bounce was imminent.

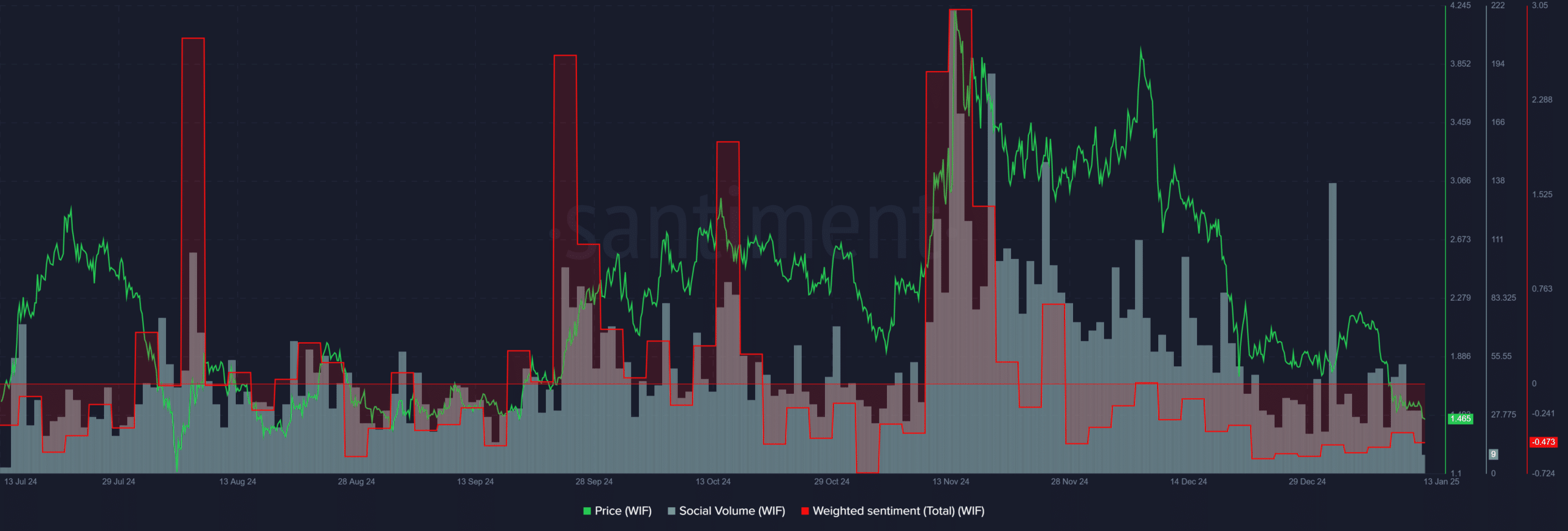

Source: Santiment

Finally, sentiment analysis highlighted predominantly bearish market participants since late November. Moreover, the social volume behind dogwifhat has fallen dramatically too.

Together, they showed that WIF has been receding from the public’s minds, with social media engagement remaining negative too.

Realistic or not, here’s WIF’s market cap in BTC’s terms

The 123.6% extension level to the south at $1.18 would be the next support level to watch. A bounce from there to the $1.55-$1.6 zone, the place where the recent selling pressure renewed, is possible. Traders can look for short trades in the coming days.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion