Is Solana’s 50% drop a sign of it badly missing memecoin mania?

- Solana has seen a decline in user activity over the past two weeks

- Network fees and revenue have dropped owing to this

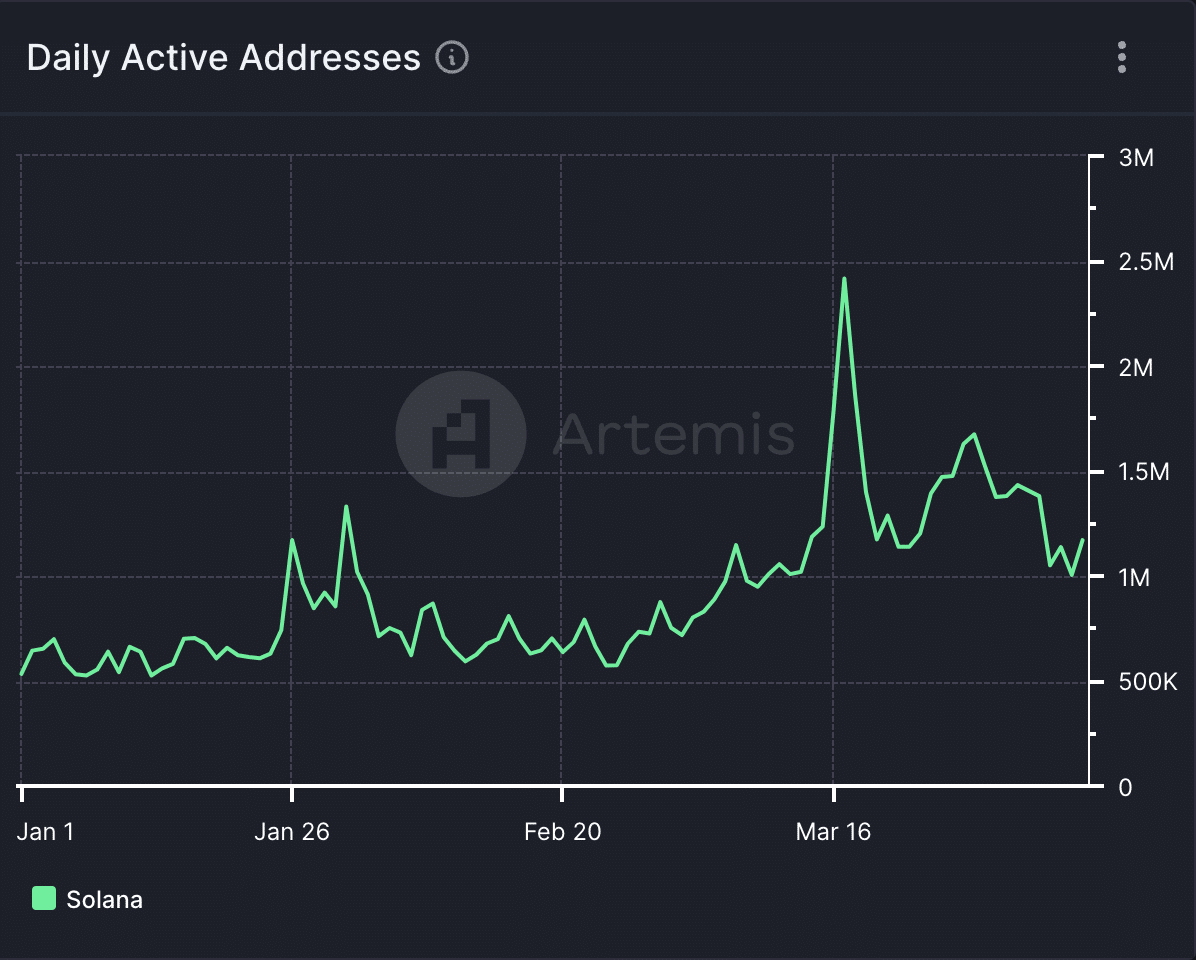

Solana’s [SOL] user activity declined as memecoin mania began to settle on the charts, according to data from Artemis. In fact, information retrieved from the on-chain data provider revealed that Solana’s network has seen a fall in demand since 17 March, resulting in a decline in its daily active addresses, network fees, and revenue derived from them.

According to Artemis, the daily count of unique addresses that have completed at least a single transaction on Solana has dropped by 50% since 17 March. On that day, 2.4 million addresses were active on the chain.

For context, this marked the year-to-date (YTD) high in the number of daily active addresses on Solana. By 8 April, this had fallen by more than half to 1.2 million.

Due to the decline in Solana’s user activity, daily fees received from network transactions have also plummeted. AMBCrypto found that after Solana’s network fees climbed to a YTD high of $5 million on 18 March, it initiated a downtrend and it has since fallen by 40%.

As a result, revenue derived from fees has seen a corresponding decline. As of 8 April, Solana’s network revenue from fees totaled $1.3 million. This represented a 48% drop from the $3 million recorded in revenue on 18 March.

DEX volume, network TVL, and NFT sales: A tale of many declines

Assessing Solana’s decentralized finance (DeFi) and non-fungible token (NFT) sectors offers a clearer view of how the decline in user activity has impacted the network.

AMBCrypto found that when Solana’s daily active address count began to drop on 17 March, the value of the total volume transacted on decentralized exchanges (DEXs) housed within the network also started to fall.

Realistic or not, here’s SOL’s market cap in BTC’s terms

With a trading volume of $1.2 billion recorded on 8 April, Solana’s DEX trading volume has cratered by 70% since 17 March. On that day, DEX trading volume on the network totalled $4 billion, according to on-chain data.

Also, the month so far has witnessed a pullback in Solana’s total value locked (TVL). With a reading of $4.4 billion at press time, this has fallen by 8% since 1 April, DefiLlama’s data revealed.

Regarding the network’s NFT vertical, sales volume has depreciated by double digits over the past month. According to CryptoSlam, this has fallen by 15% in the last 30 days.

Finally, so far this month, NFT sales volume on Solana has totalled $59 million.