Analysis

EIGEN jumps 11.8% in 2 hours: Will bullish sentiment remain strong?

The Fibonacci extension levels beyond $4.04 presented traders with short-term targets.

- The strong demand behind EIGEN’s rally promised further gains.

- There is a potential for a short-term price dip in case of a bearish divergence.

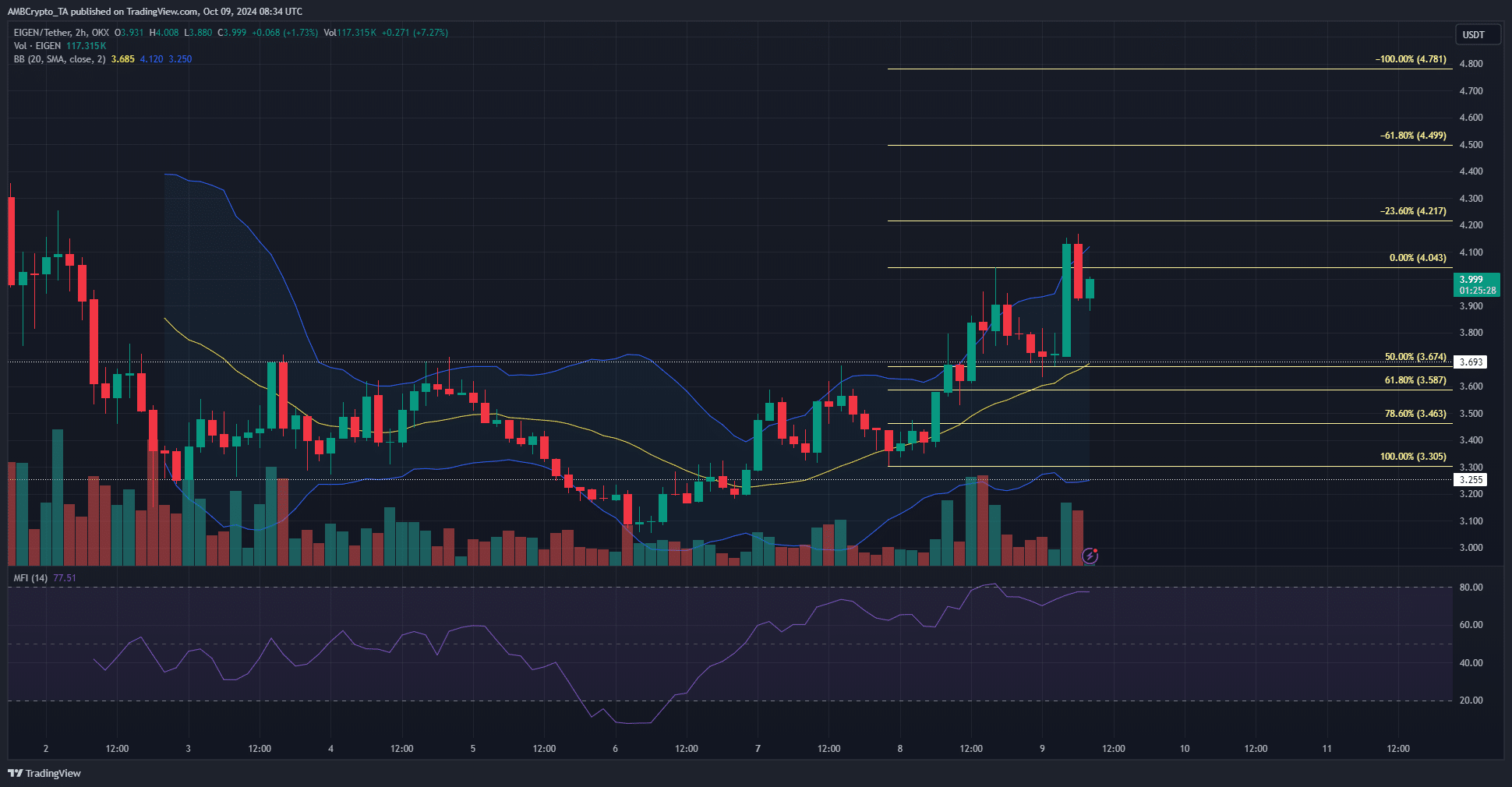

EigenLayer [EIGEN] was trading just below the $4 level at press time. A few hours earlier, it emphatically climbed from $3.71 to $4.13, an 11.8% jump within two hours.

Since Monday’s low at $3.28, the EigenLayer token is up by 28.58% at the time of writing. This short-term rally has also broken a resistance level at $3.7 that had been in place last week.

Extension levels give traders bullish targets

From the 3rd to the 7th of October, EIGEN had traded between $3.255 and $3.7. There was a drop to $3.1 on the 6th of October that bulls managed a recovery from later in the day.

The trading volume has been steadily high during the move higher this week. The Money Flow Index also showed strong buying pressure, but traders should watch out for a potential bearish divergence.

The price was in the upper half of the Bollinger bands. The width of the bands showcased the high volatility of the past two days. It is expected that the 20-period SMA would serve as support in case of a price dip.

The Fibonacci extension levels beyond $4.04 presented traders with short-term targets. These levels were plotted using the impulse move higher that breached the $3.7 resistance.

Firm bullish belief remains

Source: Coinalyze

In the past three days, the Open Interest has trended higher alongside the price of EIGEN.

Realistic or not, here’s EIGEN’s market cap in BTC’s terms

This showed strong bullish sentiment in the futures market and willingness to go long, even though Bitcoin [BTC]

struggled to scale the $63k resistance zone.The spot CVD has been flat in recent days but has begun to shift that trend upward in the past 24 hours. The high funding rate pointed to the prevalence of long positions.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion