EIGEN struggles amid whale activity: Is a recovery still possible?

- Whale deposits signaled concern as EIGEN faced a significant loss.

- On-chain data and liquidation heatmap suggested bearish sentiment, signaling more price drops.

A recent whale deposit of 2 million Eigenlayer [EIGEN], valued at $3.18 million, into Binance has raised eyebrows in the crypto community.

The whale had previously withdrawn the same amount of EIGEN for $9.07 million just two months ago, but with the price now dropping drastically, this investor faces a staggering loss of $5.89 million.

The price of the altcoin has decreased from $4.53 to $1.59, leaving many wondering if this is a warning or a sign of an eventual recovery.

What’s behind the current EIGEN price action?

At press time, EIGEN was trading at $1.61, showing a sharp 9.77% decrease within the last 24 hours. The price has seen a steady decline from the peak of $5.659, and it’s now below critical resistance levels.

Key resistance levels were at $2.20, $3.03, and $3.47, indicating where the price may face difficulty breaking through.

Support was also looking weak, with the $1.60 level showing potential for further support if the price doesn’t drop lower.

Based on the current market trend, a brief consolidation near the $1.60 range could be expected.

However, with the current downtrend, the likelihood of a potential further decrease towards the $1.42 mark looms unless market conditions change soon.

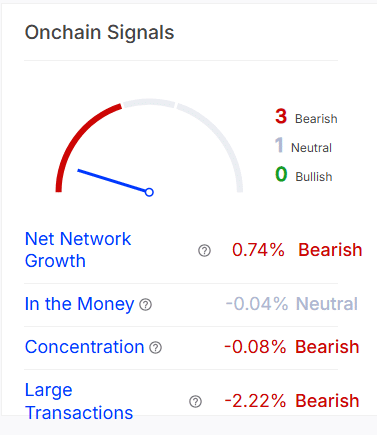

On-chain activity and market sentiment

The on-chain signals for EIGEN remained bearish at the moment. Net network growth stood at 0.74%, which pointed to limited growth.

The concentration of assets and large transactions were also showing negative trends with -0.08% and -2.22%, respectively.

These signs reflected decreasing interest in EIGEN, potentially exacerbating the current downturn.

Moreover, the token’s position “in the money” showed slight neutral sentiment at -0.04%, further underlining the current uncertainty in the market.

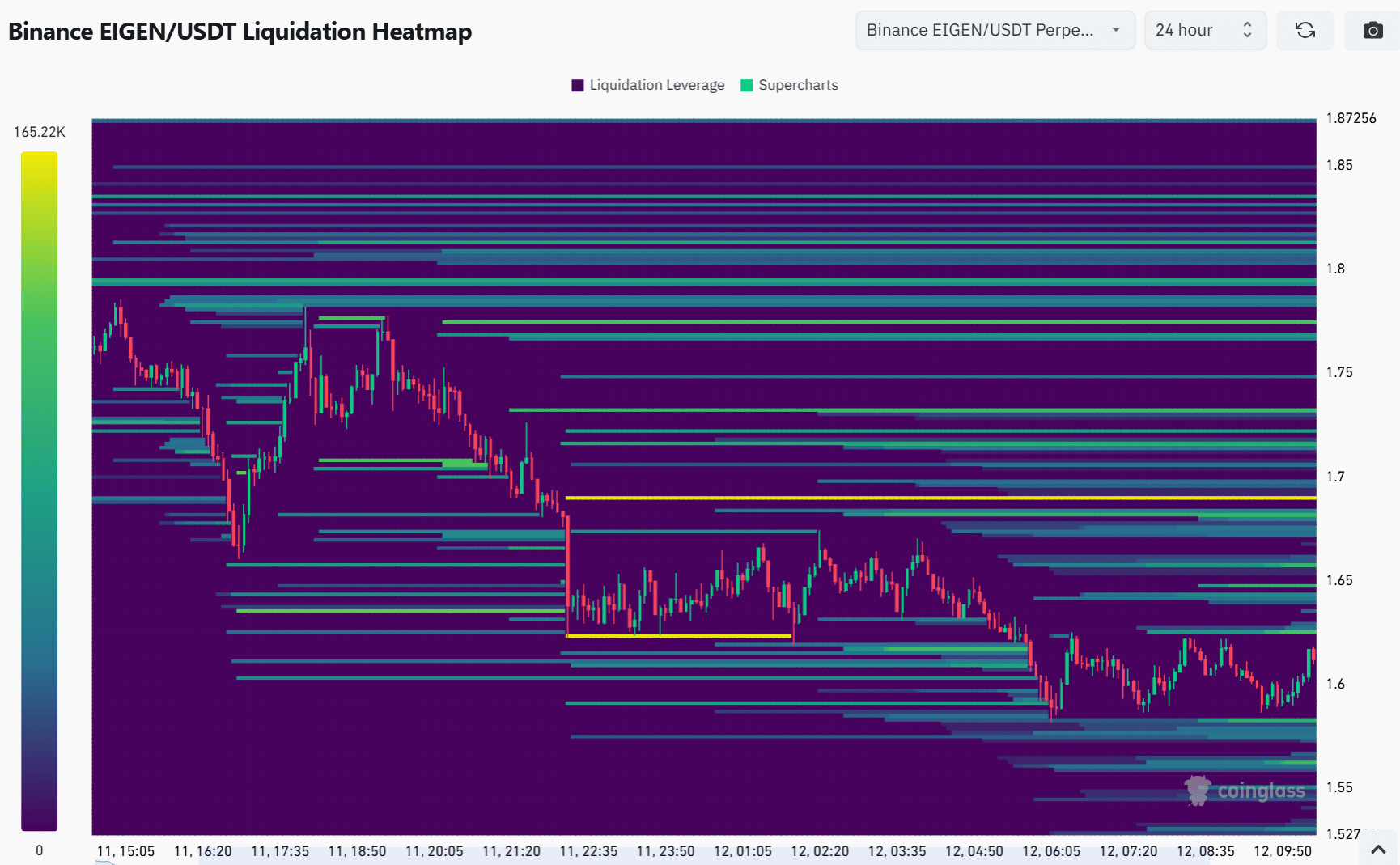

Assessing future price movements

The liquidation heatmap for EIGEN revealed a critical point of interest at the $1.60 price range, where there is significant leverage.

If the price remains near or falls to this level, further liquidations could trigger downward pressure.

The map also shows some support zones around $1.55 and $1.60, where buying activity may step in.

The large amount of liquidation leverage around this level could lead to an eventual bounce if buying interest picks up.

Will Eigenlayer recover or continue its decline?

The whale’s significant loss, coupled with the bearish price action and on-chain data, suggests that EIGEN may continue facing downward pressure.

However, support at $1.60 may hold in the short term, potentially offering a rebound opportunity.

Without substantial changes in market sentiment, though, a sustained recovery seems unlikely in the near future.

The crypto community will need to watch key levels carefully to determine if the token can regain its footing or if the downward trend will persist.