Elon Musk hits back at accusations of promoting a Bitcoin pump-and-dump scheme

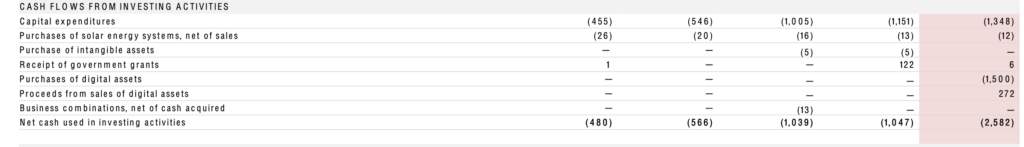

Recently, Tesla reported its Q1 2021 Financial Results on its official website. the report showed that Tesla sold $272 million worth of Bitcoin, thus, securing a profit of $101 million as seen below.

At the time of writing, BTC gained 3% over the past 24 hours and was trading at $53,600, according to CoinGecko.

Source: Tesla’s Shareholder Deck

It’s important to note a few of the statements reported by the company in the Shareholder Deck. The report stated that:

“Year over year, positive impacts from volume growth, regulatory credit revenue growth, gross margin improvement driven by further product cost reductions and sale of Bitcoin ($101M positive impact, net of related impairments, in “Restructuring & Other” line) were mainly offset by a lower ASP, increased SBC, additional supply chain costs, R&D investments, and other items. Model S and Model X changeover costs negatively impacted both gross profit as well as R&D expenses.”

The report also added that

“Quarter-end cash and cash equivalents decreased to $17.1B in Q1, driven mainly by a net cash outflow of $1.2B in cryptocurrency (Bitcoin) purchases, net debt, and finance lease repayments of $1.2B, partially offset by the free cash flow of $293M.”

This sale was an attempt to stabilize liquidity as the cash outflow exceeded that of the cash inflow.

As expected, many in the crypto community expressed their disappointment with Tesla’s for selling its recently acquired Bitcoin. Dave Portnoy, the founder, and president of Barstool Sports, who recently claimed that he had once again become a Bitcoiner, criticized Tesla and Musk for conducting a “pump and dump” operation. Musk was quick to clarify and respond to such allegations.

No, you do not. I have not sold any of my Bitcoin. Tesla sold 10% of its holdings essentially to prove liquidity of Bitcoin as an alternative to holding cash on balance sheet.

— Elon Musk (@elonmusk) April 26, 2021

Larry Cermak, a research analyst at the block too jumped on this bandwagon by expressing concerns.

On the contrary, Meltem Demirors, Chief Strategy Officer at CoinShares posted a juxtaposed view regarding the same. She stated:

“The fact that Tesla could liquidate $270M of bitcoin so quickly and so easily indicates bitcoin market structure and depth is very robust corporate treasurers can tick off “sufficient liquidity” when looking at bitcoin to effectively diversify treasury holdings.”