ENA’s +$500M surge – Is a recovery on the TVL front next?

- ENA showed proof of life across the Ethena network, thanks to its recent volume surge

- Worth assessing the potential impact of volume uptick on its TVL and ENA’s recovery

The Ethena DeFi platform is experiencing a resurgence in ENA on-chain volume after months of slow activity. But could this spell the start of a positive pivot for the network, especially its TVL?

ENA kicked off trading in April this year, initially characterized by robust daily on-chain volumes soaring over $1 billion during some of its early days. However, the volumes quickly slowed and dropped below $100 million on most days between July and September 2024.

Now, recent observations have demonstrated a strong uptick in ENA’s daily on-chain volume. To put things into perspective, it has averaged over $500 million in the last 2 days alone. While this may not be as high as it was in its early days, it seemed to confirm that the coin might be recording more trading volume and demand lately.

Renewed ENA demand may indicate a potential pivot into positive growth for Ethena after months of decline. In fact, its TVL performance seemed to underscore this decline.

While the total value locked in the network soared to $3.612 billion towards the start of July, it has tanked considerably since. In fact, Ethena’s TVL was down to $2.43 billion on 16 October.

The surge in ENA volumes may have a positive impact on Ethena’s TVL if demand for the token is sustained long enough. This may be the case, especially if the protocol continues to enjoy more utility too.

ENA attempts to escape its bottom range

ENA has resumed its bullish momentum over the past week or so. And, it has seemingly been attempting to push further away from its September lows. This is in line with the resurgence of bullish activity across the market.

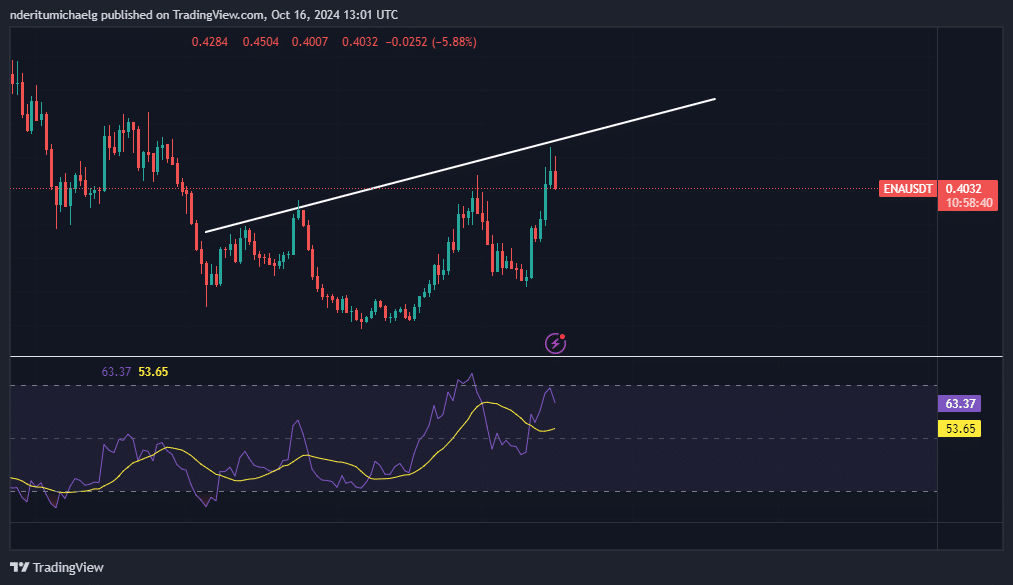

The cryptocurrency pulled off a 78% upside in the last 7 days, peaking at $0.46. ENA’s rally appears to be restricted to an ascending resistance line though, which it retested during Tuesday’s trading session. It soon pulled back by over 5% to its $0.40 press time price.

Although ENA attempted a decent recovery, it is still a long way off from its historic high of $1.52. The real question now is whether the token can sustain the latest recovery for more upside. Well, a bearish divergence indicated the possibility that the bulls may struggle a bit in the short term.

ENA’s price action demonstrated healthy recovery over the last 2 months – A sign that it is still an attractive token in the market. This may play out in its favor in the long term.