News

End to the FTX saga? Bankrupt firm reaches $12.7B settlement with CFTC

A U.S court orders the bankrupt crypto exchange FTX to pay $12.7 billion to customers.

- FTX and CFTC have reached a $12.7 Billion settlement.

- The crypto exchange will pay $8.7 Billion in restitution and $4 Billion to customers.

After almost two years of legal battle between crypto exchange FTX and CFTC, they finally reached a settlement.

FTX collapsed in 2022 after risky investments with customer deposits, leading to bankruptcy and legal battles with U.S. authorities.

FTX’s $12.7B settlement with CTFC

Based on the settlement, the litigation is resolved, as FTX will pay $8.7 Billion in restitution and $4 Billion to customers whose deposits were locked after the collapse.

In CFTC’s statement, Chairman Rostin Behnam stated,

“FTX drew customers with an illusion it was a safe and secure place to access crypto markets, then misappropriated their customer deposits to make risky investments.”

Therefore, the court order will implement a final settlement between the CFTC and the crypto exchange.

The crypto exchange has already committed to bankruptcy liquidation, thus paving the way for repayments for customers whose deposits remain with the exchange.

Lookonchain took to X (formerly Twitter) to clarify the financial position of FTX and Alameda, stating that,

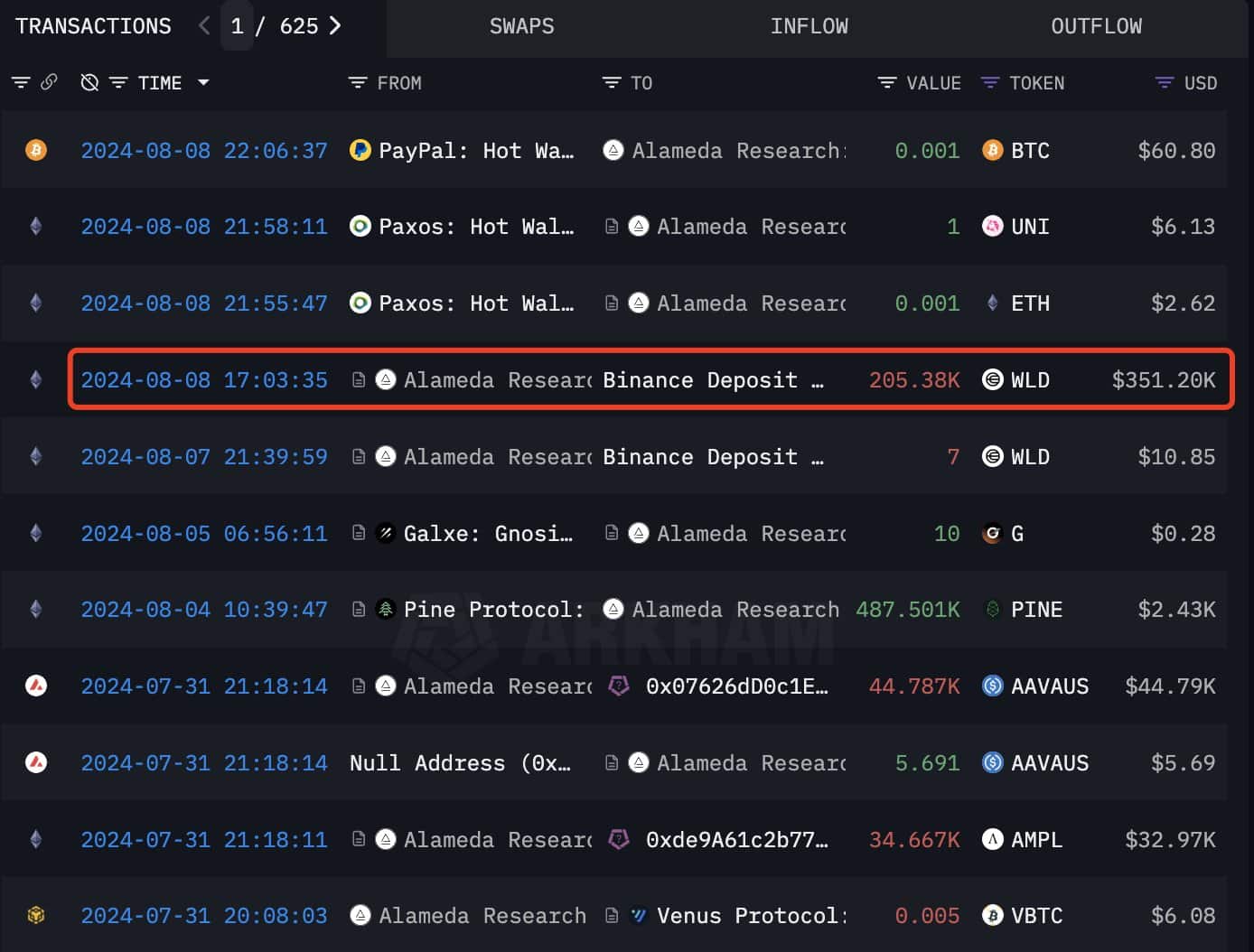

“On Aug 8, #Alameda deposited 205,380 $WLD($351K) into #Binance. #FTX and #Alameda currently hold $630M assets including; 266.85M $FTT($344.24M), 105.47M $BIT($113.26M), 24.8M $WLD($43.64M),104M $STG($32.6M) and 145.97M $BOBA($29.83M).”

According to FTX, all customers will receive 100% of their claims based on the 2022 accounts value.

Importantly, CFTC will not seek any payment from the company until all customers are fully repaid with interest.

FTX collapse and bankruptcy

In November 2022, FTX filed for Chapter 11 bankruptcy protection in the U.S. After the bankruptcy filing, the company’s CEO, Bankman Fried, stepped down.

According to the bankruptcy filing, the firm had more than 100,000 creditors, assets ranging from $10 billion to $50 billion, and liabilities.

The crypto exchange was worth $32 billion, with a million users at the height of its power. However, it all collapsed after the revelation that most of its assets were held by Alameda Research, a sister company.

With the revelation, investors tried to withdraw their funds, which later resulted in the realization that the company had mismanaged $8 billion in customer investments.

These events caused the company to crumble, thus becoming bankrupt overnight.