ENS Coin is a surprising top monthly gainer – Will the rise continue?

- ENS was one of the monthly best performers despite broader sell-offs in the market.

- However, ENS hit a key 2024 supply zone that could damp further bullish swings.

Despite the overall market retracement in May and June, there were top outliers that posted double-digit gains. One of these outliers was the Ethereum Name Service [ENS].

As of press time, the altcoin was up +30% on a monthly basis, per CoinMarketCap data.

Did the SEC boost ENS?

Interestingly, a substantial part of the monthly gains happened this week amidst easing regulatory pressure on the Ethereum [ETH] ecosystem.

The US SEC dropped its investigation on the second-largest blockchain ecosystem earlier in the week.

With the increased regulatory clarity, the ENS coin posted more gains this week. It added +11% and 6% in intraday trading sessions on the 18th and 19th of June, respectively.

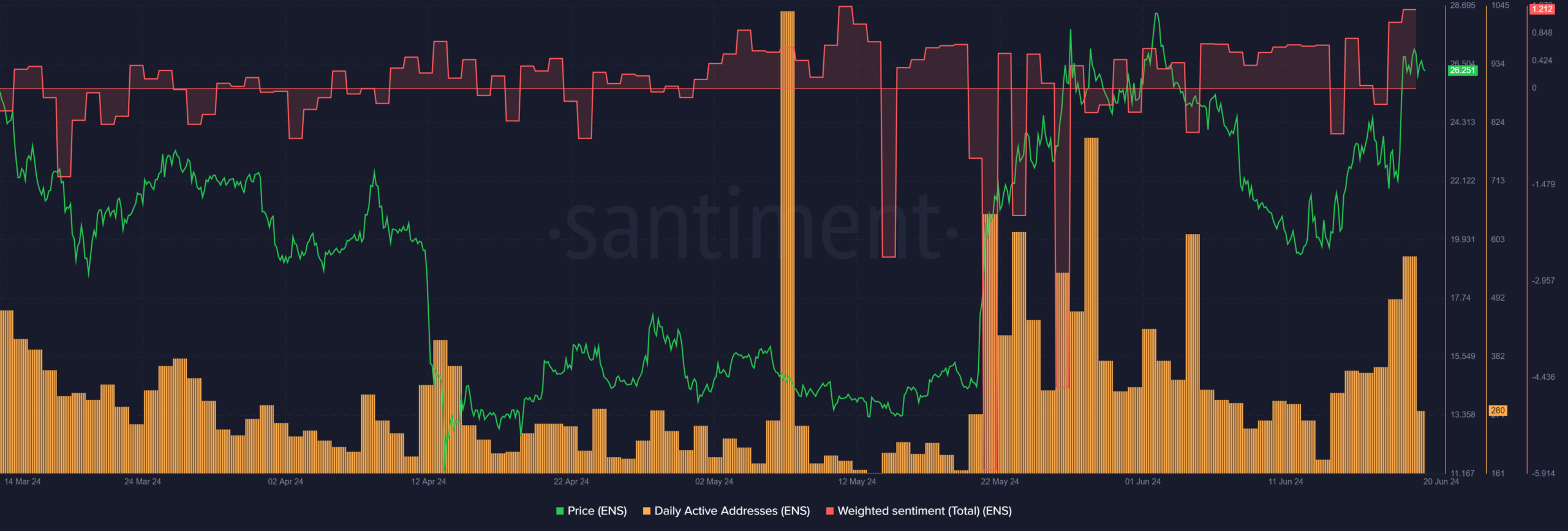

Santiment data revealed that the early pump was also marked by a surge in user activity, as shown by an uptick in daily active addresses.

Additionally, the overall weighted sentiment climbed higher to the positive territory, indicating the market was bullish on the altcoin.

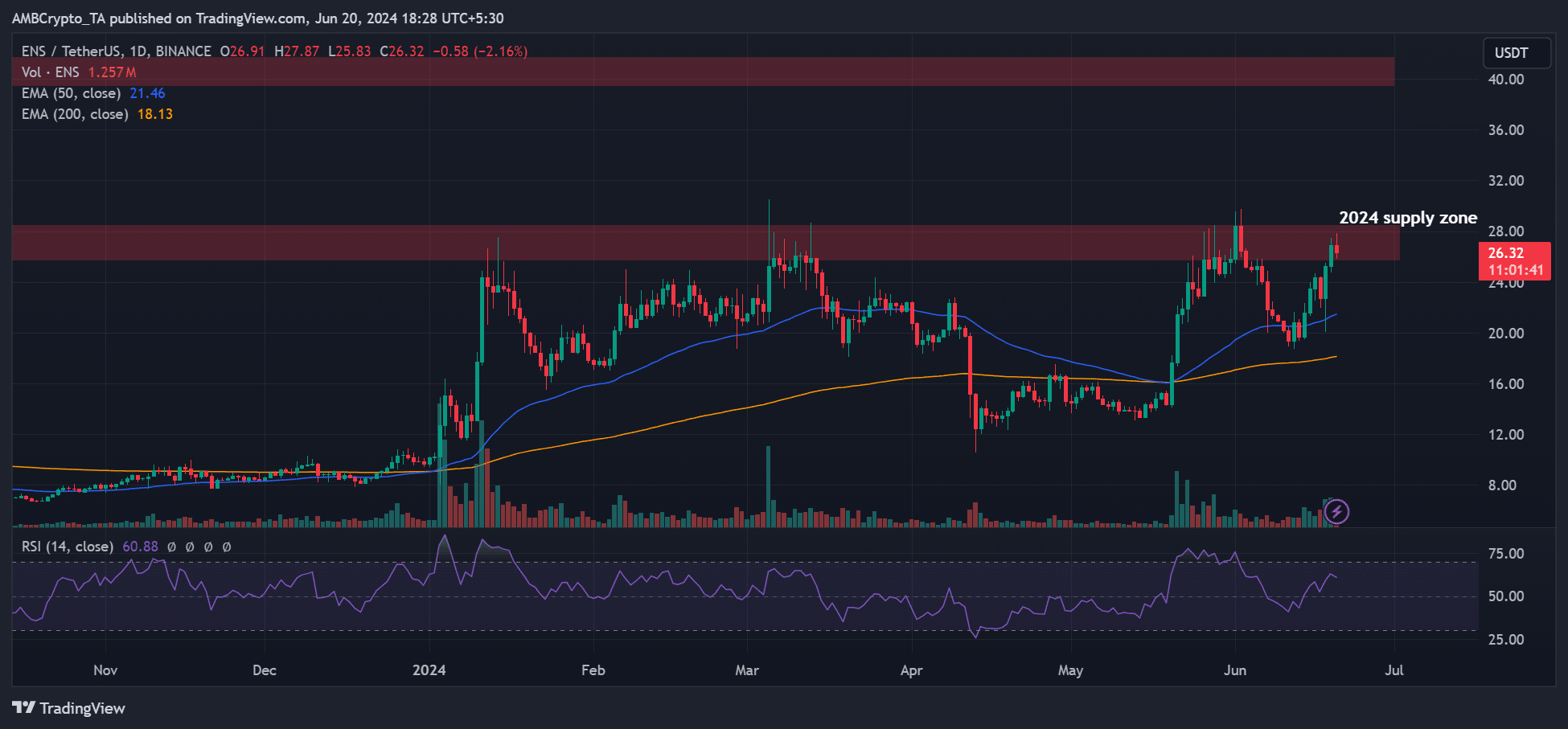

However, the altcoin hit a familiar supply zone on the higher timeframe charts that could delay a further rally, especially if holders with unrealized profits opt to book gains at the $28 supply level.

On the daily chart, ENS hit a supply zone, and a daily bearish order block (OB) formed in early 2022. The supply zone has discouraged ENS from further price upswing above $28 in the first half 2024.

If the 2024 trend repeats, ENS could retrace towards the 50-day EMA (Exponential Moving Average), marked blue.

Realistic or not, here’s ENS’ market cap in BTC’s terms

However, the altcoin still had room for more upside, as the RSI (Relative Strength Index) was yet to hit the overbought zone. But the supply zone must be cleared if ENS bulls are to target the next resistance at $40.

The two possible catalysts to watch for in the ENS case were the upcoming launch of the US spot ETH ETF launch or Bitcoin’s [BTC] extended recovery.