ENS coin tops the charts with a 30% gain in a single day

- ENS has seen consecutive price increases in the last 24 hours.

- More traders are betting on a continued price rise.

The Ethereum Name Service [ENS] coin has emerged as a standout in the cryptocurrency market, particularly in the last 24 hours. It has drawn significant attention due to its positive price trends.

This surge in interest has not only impacted spot markets but has also resonated strongly within the derivatives sector. This heightened activity is evident in some derivative metrics reaching new highs.

ENS coin leads 24-hour gain

According to the latest data from CoinMarketCap, the ENS coin was the highest gainer in the past 24 hours. At the time of writing, ENS has registered a gain of over 24%, with its peak rise reaching above 30% earlier in the day.

This substantial price increase has led to a notable surge in its market capitalization, which has grown by over 23%.

ENS’s market cap has now surpassed the $1 billion threshold, marking a significant milestone since it’s the first time in a while it has reached this level.

Additionally, ENS’s trading volume has dramatically increased, rising by over 80% in the last 24 hours. As of this writing, the volume was over $293 million.

This spike in trading volume reflects heightened market activity and liquidity, suggesting that more traders are engaging with ENS.

ENS makes a strong price push

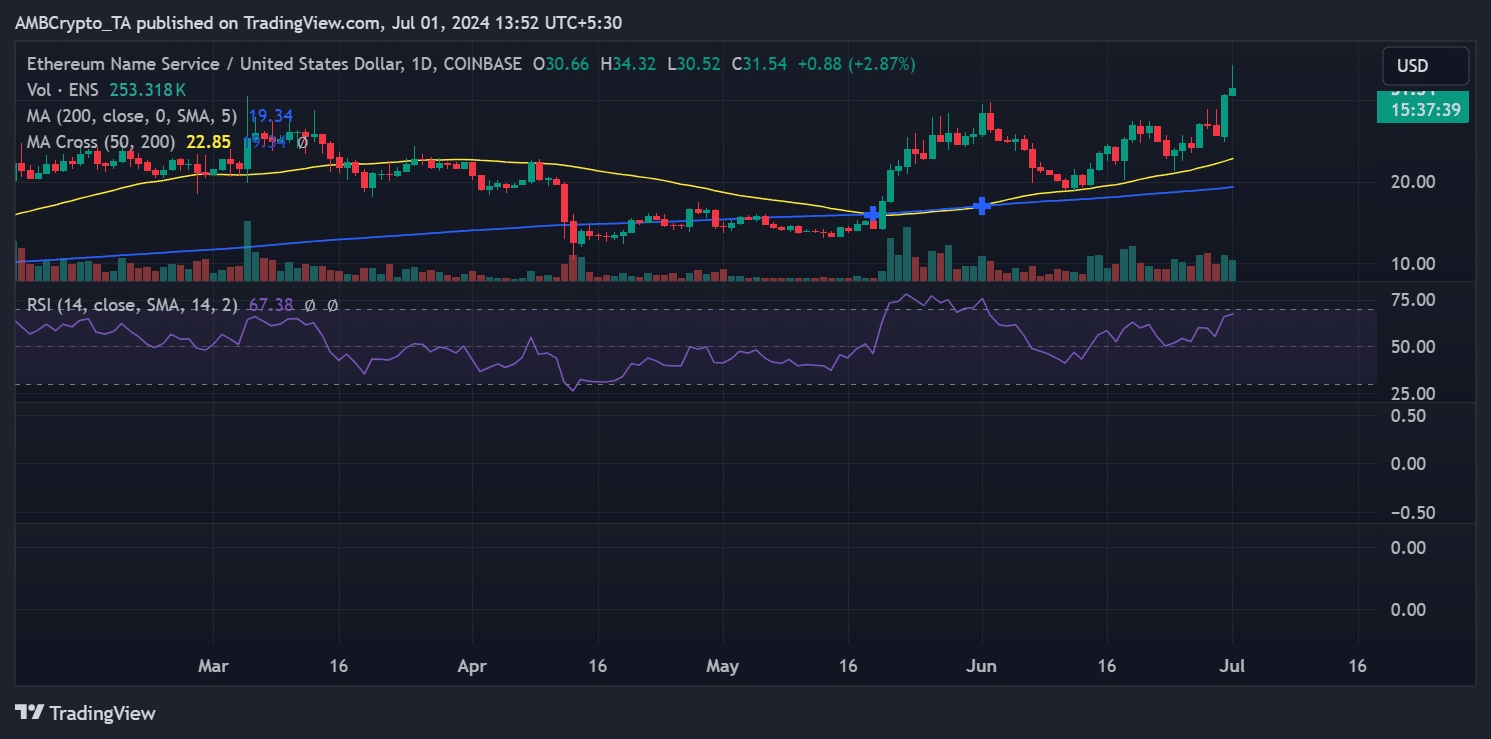

The recent analysis of Ethereum Name Service (ENS) on a daily timeframe revealed mixed trends in the last few days. However, there was a significant price spike at the close of trade on 30th June.

This surge resulted in a substantial 19% increase in value, propelling the price from around $25.6 to over $30. This upward momentum has continued, with ENS recording an additional increase of over 2%, currently trading at above $31.

The Relative Strength Index (RSI) indicated a strong bull trend for ENS. The RSI is presently close to 70, which signifies the asset might become overbought. However, an RSI near this level also reflects strong buying momentum.

This recent performance highlights ENS’s robust market presence. It might attract further attention from retail and institutional investors looking to capitalize on its strong market movements.

Open interest sets record

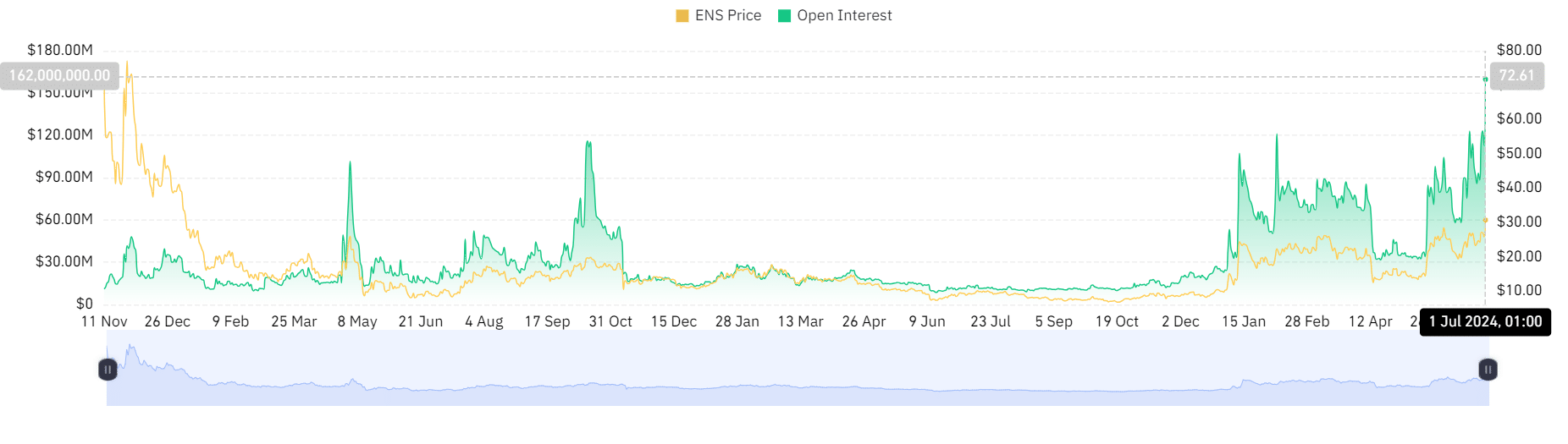

The analysis of the Ethereum Name Service coin’s open interest on derivative exchanges revealed increased market participation and speculative interest.

Over the last two days, there have been notable consecutive spikes in open interest, with figures reaching over $139 million on 30th June.

This upward trend has continued, and as of the latest data, open interest has climbed even higher, nearing $160 million. This level represents the highest volume of open interest observed for ENS recently.

Additionally, the analysis of the funding rate for ENS derivatives further illustrated the current market conditions. The funding rate, which indicates the cost of holding futures positions, has transitioned from negative to positive in the last 24 hours.

Realistic or not, here’s ENS market cap in BTC’s terms

As of this writing, the funding rate was around 0.0107%, suggesting that the demand for long positions has increased. This is usually a bullish market signal.

A positive funding rate implies that long traders are willing to pay short traders to keep their positions open, often reflecting optimism about further price increases.