ENS: Will low user activity pose a problem in the long run?

- New data suggested a decline in monthly registrations on the ENS network.

- Traders turn pessimistic as on-chain metrics had a cynical outlook.

Based on data provided by Dune Analytics, despite the high number of users on the ENS protocol, the overall activity of the users wasn’t very high. Reportedly, 80% of users have one ENS domain name registered under their name.

This decline in activity from users could cause problems for the protocol.

Just created "ENS new users" @DuneAnalytics dashboard at https://t.co/c7PzXzRDnT (thanks to @hildobby_ for CEX spell books). pic.twitter.com/k3jK4o5NhZ

— matoken.eth (@makoto_inoue) February 27, 2023

ENS has had a difficult time acquiring new users. Since November 2022, the monthly registrations on the network declined significantly. Due to this, the number of new addresses on the network fell as well.

Based on data provided by Dune Analytics, the number of new addresses on the network decreased from 38,134 to 19,366 over the past few months.

This decline in interest from networks impacted the performance of the token as well.

ENS token activity falls

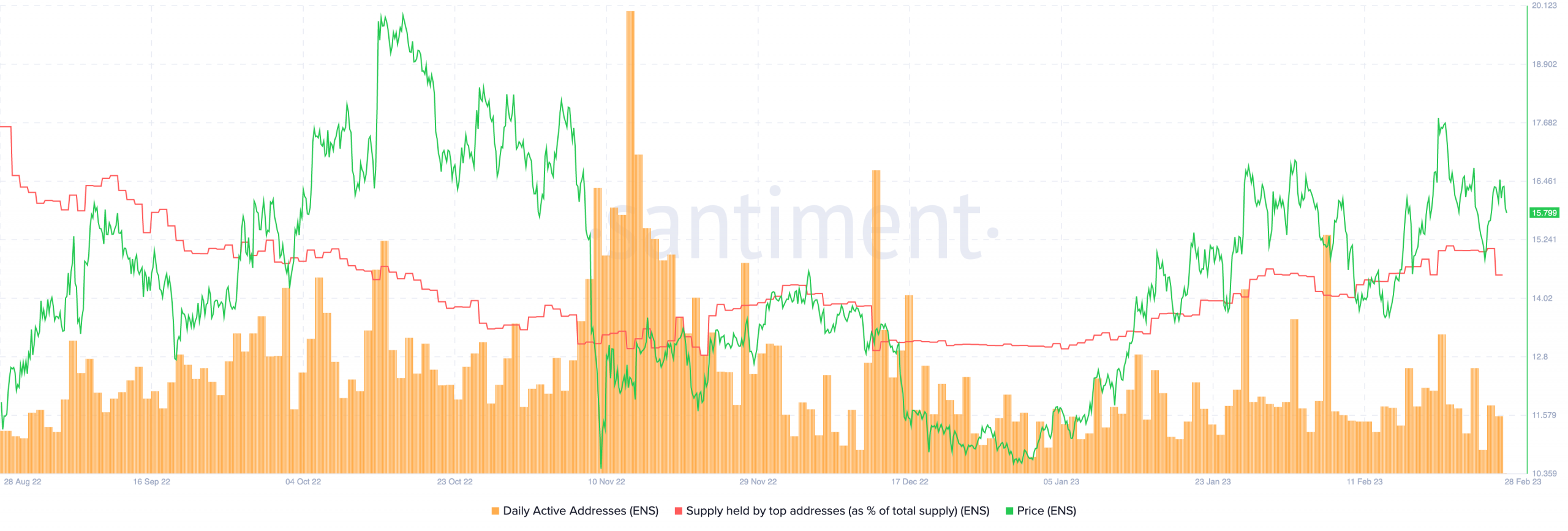

According to Santiment’s data, the overall activity of the token declined materially. This was implied by the decrease in daily active addresses transferring ENS. The network’s velocity also decreased during this period, suggesting that the frequency with which ENS was being transferred had fallen.

However, despite the bleak on-chain metrics of ENS, whales continued to show interest in the token. This was showcased by the increasing percentage of large addresses accumulating ENS tokens. The interest from whales could be why prices surged despite the low activity.

At press time, the price of ENS increased from $13.69 to $15.80 over the last week. However, if whales decide to pull out of their positions, it could impact the price of ENS significantly.

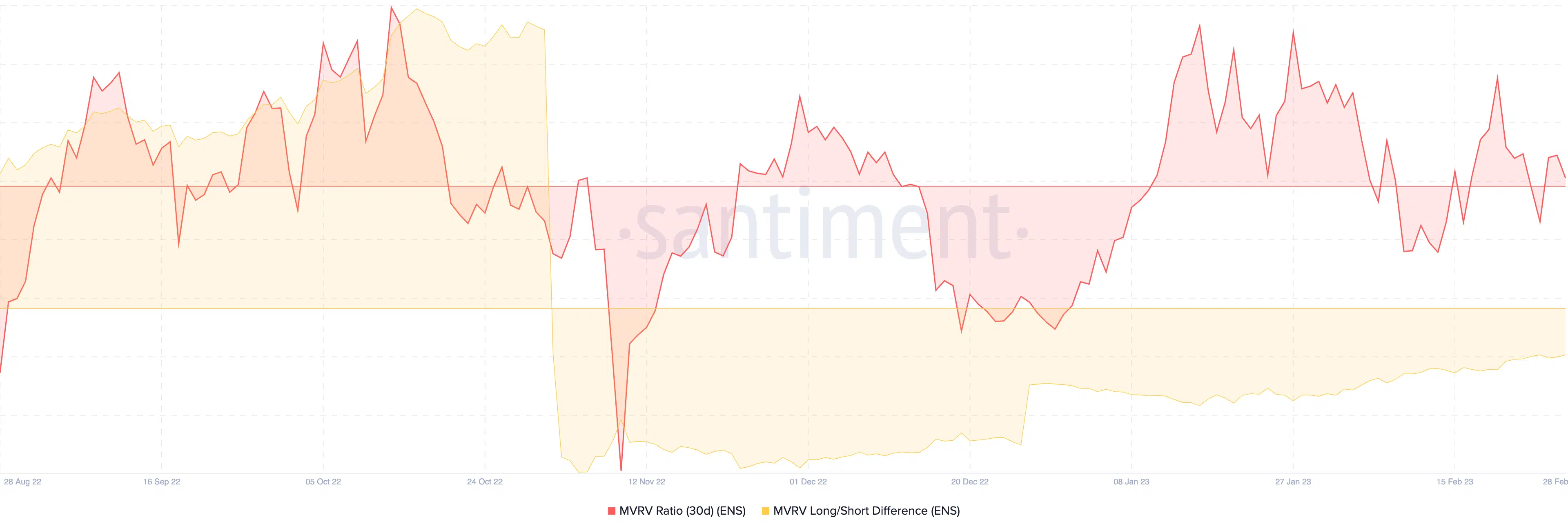

However, the selloff may not be coming soon, as the MVRV ratio wasn’t very high, implying that addresses would not end up with profits if they sold at press time.

Traders turn pessimistic

However, traders were seemingly expecting a drop in prices, as indicated by the increasing number of short positions on the network. According to Coinglass’ data, the number of short positions was 52.78%.

Only time will tell whether the traders turn out to be right about ENS.